10 Accounting Problem Solving Skills and How To Improve Them

Discover 10 Accounting Problem Solving skills along with some of the best tips to help you improve these abilities.

Accounting is an important skill for anyone who wants to be financially successful. Without a basic understanding of accounting, it can be difficult to make sound financial decisions. However, even if you have a strong understanding of accounting principles, you may still encounter occasional accounting problems.

When these problems arise, it is important to have strong problem solving skills in order to find a resolution. In this guide, we will discuss some tips for solving accounting problems. We will also provide an overview of some common accounting problems so that you can be prepared in the event that one arises.

Financial Statements

Regulatory filings, revenue projections, account reconciliation, general ledger, business knowledge, problem solving.

Financial statements are important because they provide a snapshot of a company’s financial health. They can be used to make decisions about whether or not to invest in a company, and they can also be used to track a company’s performance over time. Financial statements include the balance sheet, income statement, and cash flow statement.

Payroll is an important skill for accountants because it allows them to process and manage employee compensation and benefits. Payroll processing includes calculating gross wages, deductions, and net wages; preparing payroll tax returns; and managing benefits such as health insurance, retirement plans, and paid time off.

Accountants who can effectively manage payroll can help businesses save time and money. They can also help businesses comply with federal and state tax laws and regulations.

Regulatory filings are important because they are required by law. Companies must file certain documents with government agencies in order to operate. These filings include tax returns, annual reports, and shareholder communications. Failure to file these documents can result in penalties or even the closure of a company.

Regulatory filings are important because they provide transparency. By law, companies must file certain documents with government agencies. These filings are public, which means that anyone can access them. This transparency allows investors and other stakeholders to see how a company is operating.

Revenue projections are important for businesses because they help businesses plan for future income. Revenue projections can be used to determine how much money a business will need to operate and grow. Revenue projections can also be used to help businesses raise money from investors.

Revenue projections are important because they help businesses plan for future income. Revenue projections can be used to determine how much money a business will need to operate and grow. Revenue projections can also be used to help businesses raise money from investors.

Account reconciliation is the process of ensuring that all transactions in a company’s books are accurate. This process is important because it helps ensure that the company’s financial statements are accurate and can be relied upon by investors, creditors and other stakeholders.

Account reconciliation involves comparing the company’s books with the records kept by its banks, vendors and other parties with whom it does business. If there are any differences, they need to be investigated and resolved. This process can be time-consuming, but it is important to ensure that the company’s books are accurate.

Compliance is the process of ensuring that you are in compliance with the laws and regulations that apply to your business. It is important for businesses to be compliant because it helps to protect them from penalties and fines. Compliance also helps to build trust with customers and regulators.

To be compliant, businesses need to understand the laws and regulations that apply to them and then take the necessary steps to ensure that they are following the rules. For example, businesses that sell products to consumers need to be aware of the consumer protection laws that apply to them. Businesses that operate in certain industries, such as healthcare, need to be aware of the regulations that apply to them.

General ledger is an important accounting problem solving skill because it is used to track and report financial information for a business. The general ledger is a summary of all of the accounts that make up the financial statements, and it is used to keep track of the money coming in and going out of the business. The general ledger is also used to prepare financial statements, and it is important that the information in the general ledger is accurate and up to date.

Quickbooks is an important skill for anyone in the accounting field. Quickbooks is a software program that helps accountants and business owners keep track of their finances. Quickbooks can help you track invoices, manage payroll, and create financial reports. Quickbooks is a valuable skill because it can save you time and make your job easier.

Business knowledge is important for accounting problem solving because it helps accountants understand the context of the problem they are trying to solve. It also helps them identify the root cause of the problem and develop a solution that will be effective in the real world.

Accounting problem solving often involves looking at a company’s financial statements and trying to identify where the company is spending too much money or where it is making mistakes in its accounting practices. To do this, accountants need to understand the company’s business and the industry in which it operates. They also need to be familiar with the latest accounting standards and best practices.

Problem solving is an important skill for accountants because they often have to solve complex problems. Problem solving requires the ability to identify the problem, gather information, develop a plan and implement the plan. Accountants must be able to think critically and creatively to solve problems.

Problem solving often requires good communication skills. Accountants must be able to explain the problem, gather information and develop a plan with the client. They also need to be able to follow up to make sure the plan is working and to troubleshoot if there are any issues.

How to Improve Your Accounting Problem Solving Skills

1. Understand the basics of accounting If you want to improve your accounting problem solving skills, it is important to have a strong foundation in accounting principles. You should be able to read and understand financial statements, as well as have a working knowledge of payroll, regulatory filings, revenue projections and account reconciliation.

2. Be well-versed in accounting software In order to be an effective problem solver, you need to be well-versed in accounting software. This will allow you to quickly and efficiently find solutions to accounting problems.

3. Stay up-to-date on accounting news and changes It is also important to stay up-to-date on accounting news and changes. This will help you anticipate problems and find solutions more quickly.

4. Be proactive in solving problems When you encounter an accounting problem, it is important to be proactive in solving it. This means taking the time to understand the problem and researching potential solutions.

5. Communicate effectively with your team When you are working on a team, it is important to communicate effectively. This means being clear about what you need from your team members and keeping them updated on your progress.

6. Be organized and efficient When solving accounting problems, it is important to be organized and efficient. This means having a system in place for tracking your progress and keeping your work area tidy.

7. Practice problem solving One of the best ways to improve your accounting problem solving skills is to practice. This can be done by working on practice problems or by taking on small projects in your personal life.

8. Seek out feedback When you are working on solving accounting problems, it is important to seek out feedback. This can be done by asking for feedback from your team members or by seeking out feedback from a mentor.

10 Linguistic Skills and How To Improve Them

10 stakeholder management skills and how to improve them, you may also be interested in..., what does a maintenance director do, what does a market development manager do, what does a wells fargo phone banker do, what does a personal driver do.

INSIGHTS + Info

- All Insights

- By Resource

- Ask the CFO

- eBooks/Guides

- Interactive Tools

- Case Studies

- Infographics

- White Papers

- By Role / Industry

- CFO / Corporate Finance

- Investor / PE Firm

- CPA / Accounting Firm

- Corporate Operations

- By Solution

- General Finance & Accounting

- Accounts Payable

- Accounts Receivable

- Back Office

- Why Outsourced Accounting?

- Data & Automation

- Managing Human Capital

- Accounting Staffing

- Cost Containment

- Streamlining Private Equity

- Personiv's Virtual Accounting Solution

- CFO Weekly Podcast

Problem Solving in Accounting

- Share this Article

Problem-solving in accounting is a critical skill that can always be improved upon. Master problem-solver and CFO at Musselman & Hall Contractors LLC, Adam Porter, shares his insight and experience with us in the latest episode of CFO Weekly.

What Makes a Great Problem-solver?

If you know, you know, right? Adam instinctively knew he was a problem-solver when he was younger. Something as simple as going from point A to point B became an opportunity to experiment with which route got him to his destination quicker. And his quest for discovery hasn't stopped.

“If we don’t understand the ‘why’ behind the actions we take, how do we know if we’re really doing the right thing,” Porter said.

To solve is to correct or optimize, and none of us can do that if we don’t first recognize an opportunity to get involved. Problem-solving goes hand in hand with the willingness to roll up your sleeves and get stuck in, take an active role in, and see through the potential outcome. Adam empowers each of his team members to become (and grow as) problem-solvers, by recognizing them and their contributions to identifying and solving issues.

Involving people in the problem-solving process and connecting the dots for them, showing them how they make the business a better organism, is how you create more great problem-solvers and amplify your ability to tackle problems as they appear.

Accounting Problem-solving in Action

Problem-solving is a term that gets thrown around in interviews and on resumes quite a bit. When the time comes, real problem-solvers like Adam approach things in a specific way.

System Upgrades

If you’ve navigated a system change and survived to tell the tale, some would say you have superpowers. Upgrading something like an ERP system is a mammoth task, even for a seasoned team of executives. During a project like this, you’re reviewing and possibly amending every single organizational process.

You’re also required to identify how everything you do during this project starts to affect other areas of the business: finance, accounting, HR, IT and so on.

Adam’s own experience with one such project led him through a GL restructure. At the end of a six-month series of efforts, with the support of a Controller whom he had brought it to, Adam succeeded and was able to present information back to the business, which could be used to inform business decisions.

The domino effect: once more information became available, and it was clear how it related to each portion of the business, the people in charge of those respective portions became more engaged and more curious and more willing to work with that information.

Problem-solving is just one of those skills where nobody needs to formally identify the need for it. It’s the problem-solvers who are constantly on the lookout for opportunities to apply themselves.

The result is that everybody benefits.

The Problem-solving Process in Accounting

Adam’s very first step in his problem-solving process is to absorb as much information from as many sources as he can. Whether it’s listening to the news every day or speaking with different people inside the business, there’s this ongoing effort to find out more, learn about topical challenges that others might be facing, and use that to drive questions internally about further opportunities to solve problems.

It doesn’t necessarily need to reach the state of being a ‘problem’ to receive attention for optimization. You just need to listen and pay attention to where things might be slower, costing more than usual or requiring manual input from too many people.

Once you have this information, you can gather the right people into the room to start looking at that information, gathering more of it from different sources.

One of the key components of fully resolving any issue is to understand the full scope and depth of its current and future impact: What happens if you leave it alone, or if it gets worse, or if it’s completely resolved? Who gets more time in a day when you resolve something? Whose budget gets some breathing room? Can you reduce the amount of manual input that everybody’s required to give?

Finding the Right People to Solve the Problem in Your Accounting Department

So, once you know what the problem is, you need to get the right people in to solve it.

How do you know who that is? The team behind your solution is critical. As a CFO, you have the responsibility of setting your team up for success when they’re working on solving problems. All execs have this responsibility.

In any organization, cross-functional training is the quickest way to widen perspectives when approaching any problems. If your execs are regularly making time to get down to the operational level, and understand how and why things work a certain way, it becomes so much easier to strategically recommend a resolution when one is needed.

Problem-solving isn’t a one-way road.

Solve the Problem, Not the Symptom

How do you know when you’re solving the right thing? So many times, we see something blatantly creating a bottleneck in an operation and we’ll head right toward that point to clear the blockage. Is that really solving the problem, though?

Most times, it isn’t. Once you clear the blockage, if you don’t look a little deeper or follow it upstream, it’s probably going to reappear not long after you put in all that effort.

Adam explains that sometimes, you already know what the real root cause is, of one or more bottlenecks in the business. Sometimes it’s trial and error. Always, though, it requires you to dig deeper, uncover more detail, more links and connections to other parts of the business operation or the stakeholder network.

Adam goes on to say that getting to the root of the issue can also be achieved by just getting the right people in the room with you. Musselman & Hall Contractors does a great job of this, getting executives together at least once weekly, to just help others on the team evaluate elements, ask more questions, different questions, and gain a different perspective on things that can be missed during the daily routine.

Dealing with Resistance

Resistance is natural. Inertia affects every company in the world to some degree. When problem-solving, it’s likely that this will occur too.

You need to follow the process and listen as much as you convey messages. Cultivate the mindset within your business that someone else learning about your job is a positive thing. Take the time to explain that it’s because a fresh pair of eyes and a fresh mind might ask a different question that can enable you to work faster, reduce manual input, take on more responsibility, and actually achieve a promotion.

The right mindset about problem-solving enables it to benefit everyone on the team. No matter who is working on which problem or when, another major benefit to your business is to thoroughly document your procedures and changes thereto. It enriches the context of every issue that gets identified and resolved now and in the future, creating even greater efficiency for you as time passes.

Overcoming resistance is made possible by including and involving the right people, and enabling regular two-way communication with them through the problem-solving process.

For more interviews from the CFO Weekly podcast, check us out on Apple or Spotify or your favorite podcast player.

Previous Article

Not all accounting tasks are created equal. Before you automate, explore some of the top accounting automat...

Next Article

Uncover the hidden profit drain! Learn the top mistakes plaguing your accounting process and discover prove...

Most Recent Articles

High staff turnover draining your accounting team's budget? Learn how the hidden cost of turnover in accounting impacts your bottom line and discover strategies to reduce recruitment costs today!

Leaders, storytelling isn't a luxury, it's essential! The Chief Storyteller role is booming. Learn why & unlock your leadership potential with the power of narrative.

Real estate agents, the recent NAR settlement brings new challenges. Learn how outsourcing can streamline operations, ensure compliance, and free up your time to focus on clients.

Unlock the power of AI for all! Explore the benefits, learn how to overcome accessibility challenges, and build inclusive AI for everyone. Tune in now.

Overwhelmed by accounting tasks? Outsourcing accounting services can be your secret weapon! Discover 3 unexpected benefits to streamline your finances and free up your time today.

Let's talk about gender imbalance in finance! Join the conversation and learn how we can create a more equitable financial industry.

The key to growth you might be missing! Learn about the power of cross-department collaboration and how to foster a winning team. Click to learn more!

Cut costs, and boost efficiency! Learn the top 5 ways companies leverage outsourcing to significantly reduce accounting expenses and achieve success. Discover how much you can save today!

Unlock the secrets of financial team efficiency! Dive deep into strategies for making finance accessible and achieving streamlined operations within your business.

Learn how machine learning in accounts payable can enhance efficiency and reduce costs. Learn how businesses can do more with less by leveraging innovative technology for smarter financial management.

Understanding the evolving role of the pharma CFO. Discover how the CFO is becoming a crucial partner in driving strategic decision-making for growth and expansion within the pharmaceutical industry.

Become an accounts receivable outsourcing expert! Our in-depth guide walks you through every step of the process, from understanding and developing a strategic AR plan to successful implementation.

Modern CFOs are more than number crunchers! Learn how a CFO navigates the shift from bookkeeping to becoming a strategic partner, aligning financial leadership with organizational goals and more.

The CFO role in early-stage startups: Balancing growth, structure, and financial health. Discover essential skills, get expert insights, and learn strategies for thriving in the early stages.

Explore insights from an expert on cash flow forecasting for CFOs. Discover key strategies to improve cash management, optimize financial planning, and support business growth. Read now!

Explore the key differences between accounts payable outsourcing and AI automation in this in-depth comparison. Discover which approach is best for your business today!

Explore the power of systemized decision-making and how it's transforming business decisions. Discover the benefits and see why many companies are adopting this innovative method to drive success.

Unlock the secrets to scaling your startup! Hear from a leading financial strategist as he shares proven strategies for explosive growth. Propel your startup to success.

Explore the exciting world of technological innovation in finance! We chat with a leading expert about the impact of technological innovation in finance. Discover how these advancements affect you.

Unleash the power of your finance department! Learn how effective communication can transform operations, unlock insights, and drive financial success. Get expert tips now!

This site uses cookies, including third-party cookies, to improve your experience and deliver personalized content.

By continuing to use this website, you agree to our use of all cookies. For more information visit IMA's Cookie Policy .

Change username?

Create a new account, forgot password, sign in to myima.

Multiple Categories

Accountants as Problem Solvers

August 01, 2020

By: Linda McCann , DBA, CMA, CPA ; David Horn , CPA ; Jennifer Dosch , CMA

Managers often complain that accounting graduates aren’t prepared for today’s business environment. The complexity of our global economy and the increasing influence of, and reliance on, technology leads to practitioners and instructors questioning if undergraduate accounting programs focus on the right curriculum to prepare students for careers.

One soft skill that can help prepare accounting students for their careers is problem solving. Management accountants need to be able to work cross-functionally to solve problems and provide meaningful analyses. Many colleges, universities, and accrediting bodies in academia incorporate strategic goals requiring curriculum that facilitates problem-solving skills.

As instructors, we teach technical accounting skills by demonstrating and providing practice with accounting concepts and structured problems, which we assess via homework and exams. Teaching soft skills, such as unstructured problem solving, poses greater challenges that are more difficult to incorporate into the curriculum. How can students learn and approach unstructured problem solving?

A SLOW-THINKING APPROACH

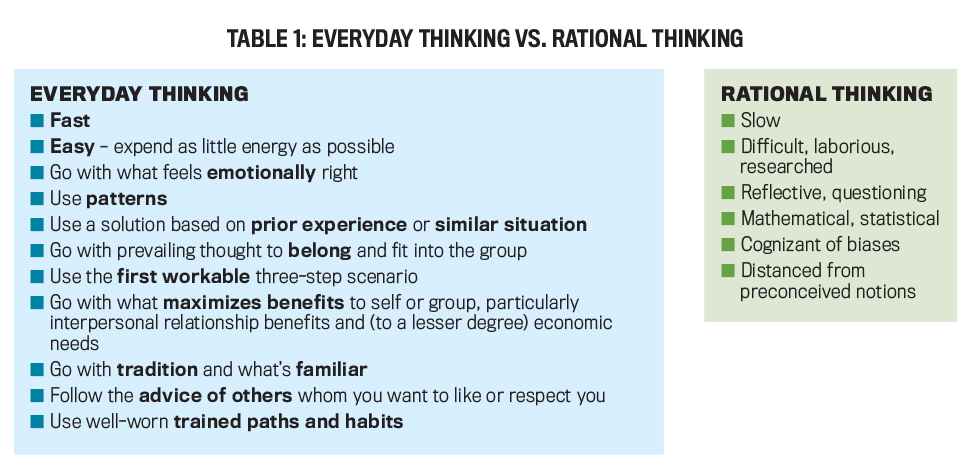

Recent scientific discoveries into the brain reveal that humans employ fast and slow thinking to solve problems. The brain especially prefers making decisions and solving problems quickly based on recognized patterns, visual and verbal cues, prior knowledge, routines, familiar preferences, prejudices, and emotions.

In contrast, decision making and problem solving often require slow thinking to digest new information, hypothesize alternatives, employ quantitative mathematical and statistical analysis, overtly recognize and break free from cognitive biases, challenge preconceived notions, synthesize ideas, and create new knowledge. To support this kind of slow, rational thinking, accountants can learn a methodical process for problem solving (see Table 1).

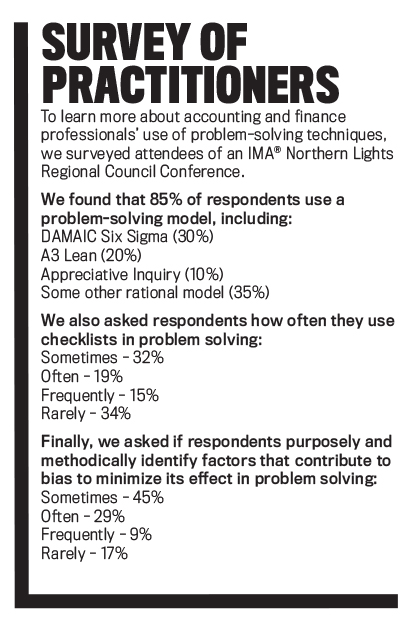

Many common business models—such as Six Sigma, A3 Lean, and Appreciative Inquiry—and the Association of American Colleges and Universities value problem solving, and critical-thinking grading rubrics describe specific steps for rational (i.e., slow thinking) problem solving. Business students, however, learn and apply these models in various courses, typically with no thread that ties them specifically to the accounting profession. Students learn bits and pieces of rational thinking throughout their undergraduate coursework, but instructors often don’t teach a common framework to apply these skills in a relevant and value-added way (see “Survey of Practitioners”).

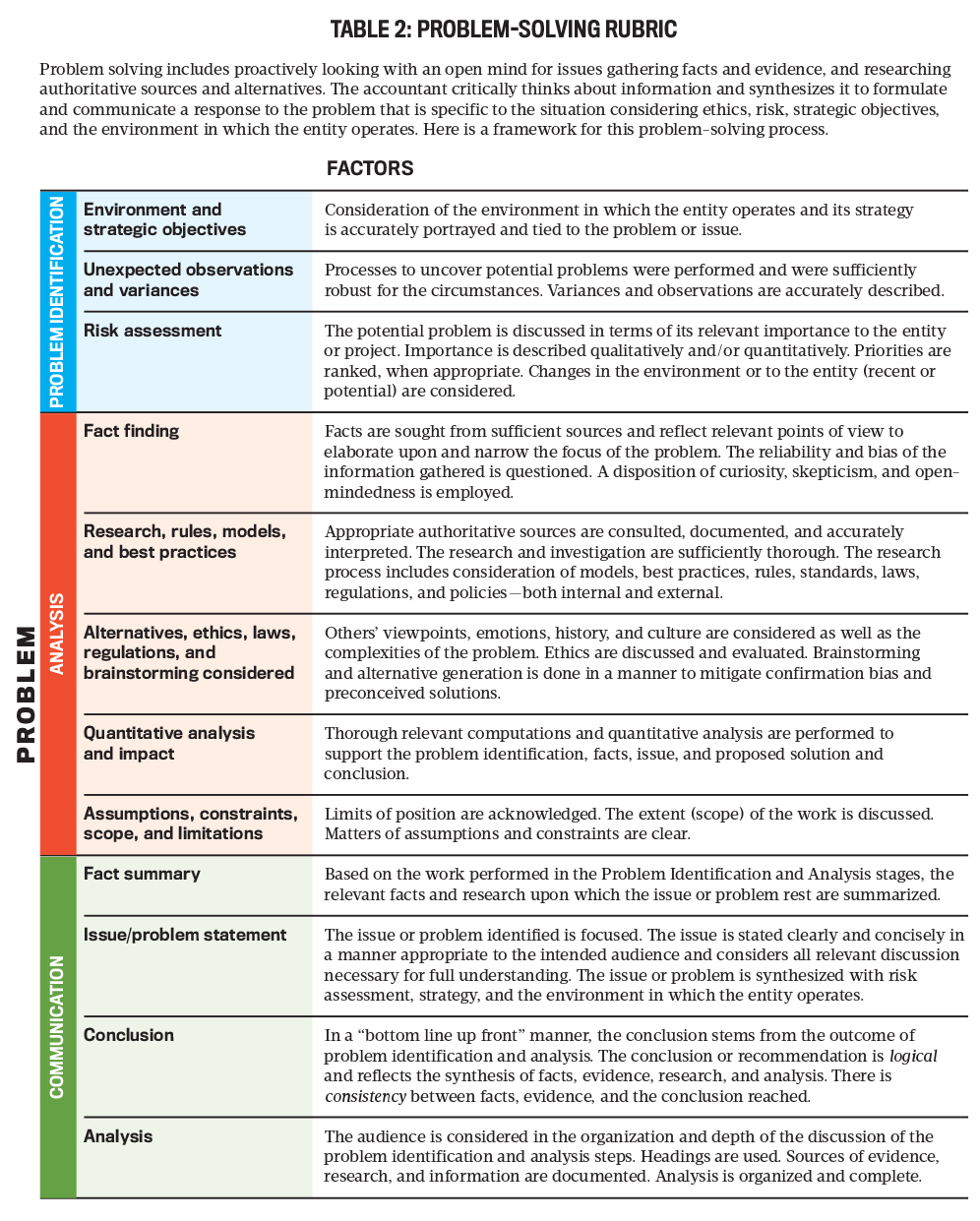

To help address this issue, we developed a problem-solving rubric for accounting students (see Table 2). The three of us are faculty members from Metropolitan State University in Minneapolis/St. Paul, Minn., and represent three different parts of the curriculum (auditing, business taxation, and management accounting), so it was important that it could be used across the entire accounting program.

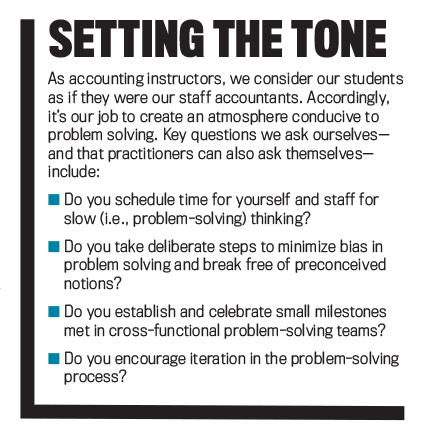

The rubric assesses learning in an organized way, providing a common framework (criteria) for students to consistently approach problem solving. The criteria include problem identification, analysis, and communication of results. It guides students through a series of problem-solving steps using terms and vocabulary specific to the accounting profession. The rubric also reminds us, as instructors, to create a learning environment where problem solving can occur (see “Setting the Tone”).

STEP 1: PROBLEM IDENTIFICATION

The iterative and looping nature of problem solving confounds inexperienced accountants. Where does one begin? Students tell us using a rubric provides a starting point.

To implement the rubric, we assign students projects with unclear goals, incomplete information, and more than one possible solution. Assignment topics vary. It could have students develop a cost-benefit analysis between adding employees or adopting Lean manufacturing techniques, analyze tax outcomes of business decisions, create a risk assessment and audit response for a fictitious client, or some other accounting-related issue.

Students begin by developing one or several hypotheses as to the nature of the problem. To generate ideas, we assist students in their brainstorming discussions. The rubric leads students to consider the environment, strategy, unexpected observations, overall importance, and risk assessment. At this stage, the identified problem may change, but the original hypothesized problem gives direction for next steps. Upon completing the assignment, we assess students on how they identified the problem.

Metropolitan State University’s business taxation course used the rubric in a case study that involves assessing the implication of the Wayfair v. South Dakota U.S. Supreme Court decision on a company’s sales tax collection. Prior to Wayfair , companies operated under a physical presence nexus established in Quill v. North Dakota . The Quill decision required companies to have a physical presence in a taxing jurisdiction in order to require collection and remittance of sales taxes on transactions.

In Wayfair , the U.S. Supreme Court overturned Quill in favor of an economic nexus standard, where companies only needed to have a certain level of economic activity. For example, in South Dakota, the threshold economic activity is 200 transactions or $100,000 in sales. The change from Quill to Wayfair was a major development in how companies operate and collect sales tax. It required companies to assess all jurisdictions in which they operate and evaluate how the change in the nexus standards impact its operations.

To apply this rubric to the change, students learn about a fictitious company that sells inventory to multiple states and collects and remits sales tax under the Quill physical presence nexus standard. We give students a subledger with all sales data for the given year. The rubric leads students to ask about implications of the Wayfair decision on the company, how the ruling impacts the company’s strategic objectives, and risks to the company because of the change in the law. Using the rubric, students are guided to discover the issue at hand, which is whether the company will have a significant number of new sales tax jurisdictions requiring collections and remittance from its customers.

Students tell us that without the rubric, they often feel like they have no road map at the beginning of a project or case study; identifying the problem seems too big and undefined to tackle. Many students initially resist engaging with unstructured problem-solving assignments because they differ from past assignments. Similar to what one might find in cross-functional teams opposed to change, students show their displeasure with crossed arms and distant body language.

Many college courses still rely on testing facts and use formulas and calculations, an approach that doesn’t put the student in the decision-making role but is familiar to them. With a rubric, students see smaller doable steps, where the assignment is heading, and how they can move forward and loop backward, when necessary. The rubric breaks down the initial intimidation students feel with unstructured problems.

STEP 2: ANALYSIS

Next, the rubric guides students through analyzing the problem using accounting-specific skills they’ve acquired in each course. For example, students consider tax laws, financial reporting and audit principles, or cost accounting techniques.

Continuing the sales and use tax example, at this stage, students apply the rubric to perform a complete analysis, enabling them to form a conclusion to communicate. What are the relevant facts to determine Wayfair ’s impact? What facts are irrelevant? What primary and secondary tax authority is needed to conduct research? Are there alternatives and exceptions to applying Wayfair ? Have all states adopted an economic nexus standard? Have all states adopted South Dakota’s transactional thresholds? What’s the quantitative impact to the company? Are there financial accounting implications to the Wayfair decision? What’s the scope of the necessary research, and are there limitations, constraints, and so on? Through the rubric, students formulate and answer questions and perform analysis to solve the problem at hand.

We assess students on their ability to gather and identify relevant facts, research any applicable rules and laws, assess alternatives, and perform any needed qualitative and quantitative analyses. At this stage, students apply theories and best practices learned in specific course fields, such as management accounting, taxation, and auditing.

To encourage elaboration, the rubric uses words such as curious, skeptical, model, assumption, authoritative, best practices, relevant, and sufficient sources. Like many accountants, students want to get their work done quickly, but problem solving takes time and slow thinking. Thanks to the rubric, more students turned in papers with greater depth, less “cut and paste,” and more relevant supporting details.

As in the real world, students often discover their original hypothesis or identified problem is incorrect, incomplete, or irrelevant. They confront the iterative nature of problem solving as they work through the analysis stage and build evidence to support their hypothesis. When evidence doesn’t support an identified problem, students go back and redefine their problem, gather new evidence, explore new alternative solutions, and build a case for their conclusion.

STEP 3: COMMUNICATION

Finally, students present their results in a memorandum to a hypothetical manager or audit partner. The memorandum mirrors common styles, such as IFRAC (issues, facts, rules, analysis, and conclusion) and BLUF (bottom line up front). Students state the problem and include the conclusion (i.e., solution) up front along with a summary of relevant facts and assumptions. Supporting documentation presents additional in-depth analysis.

This format familiarizes students with a presentation style that allows management to quickly understand conclusions while also providing more depth to support the up-front conclusion. We expect students to write and present findings in a clear and concise manner as if in a professional accounting setting. The rubric grading criteria helps students solve problems using rational thinking and delivering a memorandum that directly supports management decision making.

In the Wayfair case study, students draft a memorandum to management addressing the implications of the sales tax nexus precedence change. The facts section should discuss the company’s current sales and use tax policies. Students identify the issue as the change from physical presence nexus to economic nexus. The up-front conclusion should identify new jurisdictions from which the company needs to register and collect sales tax and quantify the volume of sales tax it expects to collect. Finally, the analysis provides an in-depth discussion of the change from Quill to Wayfair . Students should discuss how they determined new jurisdictions, limitations, and further required resources for the company.

PREPARING STUDENTS FOR THEIR CAREERS

We use the rubric format for projects or cases at different stages throughout the accounting curriculum. The problem-solving rubric measures student learning and reinforces rational thinking with each assignment. The projects that use the rubric vary in length, depth, and complexity as students move from management accounting to tax and then finally to audit. We find the rubric flexible enough to adapt to an instructor’s needs, yet it provides consistent core steps—identify the problem, analyze, and communicate—to solve problems.

The rubric helps students organize their communication through the memorandum. Setting up a memorandum so the problem and solution appear “up front” highlights mismatches between the problem, evidence, and conclusion. Further, it encourages students to decide—rather than ramble and include information that isn’t relevant. We find students often get to the communication stage and realize that their analysis doesn’t support their conclusion or identified problem. Fortunately, the rubric allows them to loop back and redefine and reanalyze.

By using the same grading criteria in multiple courses, we provide students with a familiar approach to problem solving that turns fast thinking to slow, rational thinking. The process and steps become routine and less daunting for the student. While each step still requires arduous thinking, the approach itself is a recognized pattern for students.

From our point of view as accounting instructors, the rubric helps provide consistent and fair grading. We provide separate points for milestones in problem identification, analysis, and communication, which further encourages students to go through each step of the process. Metropolitan State University plans to expand the use of this rubric in the accounting curriculum. This common framework provides students with a process to identify problems, research and investigate facts, conduct analyses, and communicate results across all accounting disciplines.

This process reinforces the problem-solving skills that students will need in their professional careers. These capabilities will help them perform their roles in today’s strategic, fast-paced business environment. Solving problems is critical for today’s management accountant. Through implementing the rubric, instructors can help students systematically apply a problem-solving process that they can take with them as they move from student to management accountant.

About the Authors

August 2020

- Strategy, Planning & Performance

- Decision Analysis

- Negotiation

- Metropolitan State University

Publication Highlights

Call for Ethics Papers: Sept. 1 Deadline

Explore more.

Copyright Footer Message

Lorem ipsum dolor sit amet

- Business Partner

- Strategic Partner

- Problem Solving

- Communication

- Strategic Thinking

- Influencing

Problem Solving Skills For Accountants

Problem solving skills for accountants are so valuable because businesses are full of problems that need solving – and almost all business problems have some kind of financial impact.

Therefore accountants with problem solving skills are highly valuable.

As a technically proficient accountant you understand many technical solutions to finance problems and issues.

You know what complies with the rules, what is possible and what is not.

However there comes a time when you are faced with problems that are difficult, eiether because they aren’t well-formed, are ambiguous or complex.

Complex problems

These are problems where there is no right answer and the issues span multiple disciplines and departments.

Developing problem-solving skills will set you apart from your colleagues, as you will be able to help solve these complex problems.

For instance, you will be a vital resource for developing the finance function.

You’ll also become a valued partner to other non-financial managers.

You will be able to propose solutions that work for you and them.

You can also ensure that they work within the financial constraints that you understand well.

Understanding business problems

The first step is to understand the problem thoroughly. To examine it from every relevant angle and understand it in context.

This means understanding the business, what is important and what would be right for the business – not just finance.

Lateral thinking for problem solving

Solving a business problem often requires lateral thinking – coming at things from a new perspective.

With your financial and analytical mind you can bring a valuable perspective that your colleagues may lack.

If you are able to develop lateral thinking skills you can make a significant contribution to the debate. Particularly when you use these alongside and combined with your technical and analytical approach.

Creative ideas

Accountants aren’t always noted for their creative thinking. Therefore being able to suspend judgement and think creatively and imaginatively can give you an edge over others. Because this enables you to bring something unique and different to the discussion.

Learning to think creatively can be liberating and fun. But it can also produce some new insights and innovations.

These can make everyone’s lives more productive and set you apart from your colleagues.

Proposing solutions

Having great ideas is one thing, but arguing the case for them and presenting your proposed solutions to your colleagues and decision-makers is another.

Being able to see – and sell – the benefits of a solution requires an insight into the business, your colleagues and the office politics that inevitably exist.

Why are problem solving skills for accountants so important?

Most business problems have a financial dimension and as accountant you have unrivalled expertise.

An accountant who can proactively solve business problems will be a highly valuable asset for any business..

Being a creative problem-solver may not be your natural strength, but these skills can be learnt and developed.

You have a huge opportunity to become a highly valued member of the team if you can develop your problem solving skills.

How are you developing your problem solving skills?

Do you have sufficient understanding of the business to propose solutions that will be accepted, how adept are you at persuading others of the merits of your solution, which of the other key soft skills for accountants do you need to develop, discover the seven essential soft skills for accountants download the report now.

There are some key soft skills to focus on as your finance career progresses.

Find out which they are by downloading the free report.

Never see this message again.

Mastering Problem Definition: A Beginner’s Guide

Introduction: Problem definition is a crucial step in problem-solving processes across various domains, including accounting and finance. It involves clearly identifying and understanding the nature and scope of the problem at hand. In this guide, we will delve into the concept of problem definition, its importance, and how learners in accounting and finance can effectively apply it in their field.

Key Points:

- Definition of Problem Definition: Problem definition refers to the process of clearly articulating and understanding the problem or challenge that needs to be addressed. It involves defining the scope, boundaries, and objectives of the problem-solving endeavor.

- Clarity: Clearly defining the problem helps in avoiding ambiguity and ensures that all stakeholders have a shared understanding of the issue.

- Focus: A well-defined problem allows individuals to concentrate their efforts and resources on finding relevant solutions, leading to more effective problem-solving outcomes.

- Efficiency: By precisely defining the problem, unnecessary time and resources spent on addressing irrelevant issues can be minimized, leading to increased efficiency.

- Alignment with Goals: Problem definition ensures that the identified problem aligns with the overall goals and objectives of the organization or project.

- Identifying the Problem: The first step involves recognizing the existence of a problem or challenge that needs to be addressed. This may arise from various sources such as financial discrepancies, operational inefficiencies, or strategic concerns.

- Clarifying the Objectives: Once the problem is identified, it is essential to clarify the specific objectives that need to be achieved through problem-solving efforts. These objectives should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Understanding the Context: Understanding the context surrounding the problem, including its causes, stakeholders involved, and potential implications, is vital for effective problem definition.

- Setting Boundaries: Defining the scope and boundaries of the problem helps in focusing efforts on relevant aspects and avoiding unnecessary complexities.

- Identifying the problem: Declining profitability despite consistent sales.

- Clarifying the objectives: Increase profitability by reducing operational costs or increasing revenue streams.

- Understanding the context: Analyzing factors such as increasing raw material costs, inefficient production processes, or changing market dynamics.

- Setting boundaries: Focusing on internal operational factors directly impacting profitability rather than external market fluctuations.

- Kepner, C. H., & Tregoe, B. B. (1981). The New Rational Manager. Princeton Research Press. This book provides insights into structured problem-solving methodologies, including problem definition techniques, with practical examples.

Conclusion: Problem definition is a foundational step in problem-solving processes, enabling individuals to clearly understand and address the challenges they face. By defining the problem accurately, learners in accounting and finance can streamline their problem-solving efforts, leading to more efficient and effective outcomes. Understanding the importance of problem definition and mastering its techniques is essential for success in accounting and finance.

Related Posts

Written-down value (wdv) explained for beginners.

If you’re new to finance and accounting, terms like “Written-Down Value” or WDV might sound…

Activity Sampling (Work Sampling): Unveiling Insights into Work Efficiency

Activity Sampling, also known as Work Sampling, is a method used in various industries to…

- Portal Access

- ADP Employee Access

- ADP Employer Access

- QuickBooks Login

- New Business Client Questionnaire

- New Individual Client Questionnaire

- New York Tax Services

- Where’s My Refund?

- Individuals Refund

- Business Refund

- Accounting Firm Support

- Business Growth & Advisory Strategies

- Cloud Accounting Conversion & Maintenance

- Tax Minimization Strategies & Preparation

- Healthcare Accounting

- Outsourced Virtual CFO New York

- Casualty Loss – Reporting & Prevention

- Cloud Accounting

- Quickbooks Online

- QuickBooks Resources

- Newsletters

- Business Resources

- Business Worksheets & Compliance

- Preparing for Your Tax Appointment

- What is a 1099-Misc Form?

- What Should I Do About My Payroll Tax Withholding?

- Weekly News

- Retention Guides

- Video Library

- Our Company

- Our Philosophy

- How we work

- What our clients say

- Strategic Partners

- Tech-Forward Accounting Solution

- Trusted Accounting Partner in New York

Six ways to solve 80% of your accounting problems

Accounting problems can have serious consequences for your business and are definitely worth avoiding. Here we outline six ways to solve the majority of your accounting issues.

1. Know the difference between profit and cash flow

If you’re a new business owner, it can be easy to spend money on growing your business rather than earning that money back again in profits. You may have a profitable business, but it can still become bankrupt by having all its money tied-up in assets, leaving you unable to pay its expenses.

The problem with growing too quickly is that you can end up in a lot of debt and with very little cash flow, even though your business may be making solid profits. You can only stay afloat using loans, credit cards and lines of credit for so long.

In order to avoid this situation, it’s important to understand the difference between profit and cash flow. Your profit is what you’ll be taxed on at the end of the financial year, whereas your cash flow is what’s actually in your bank (each month) as money comes in and goes out of your business.

It can be easy (particularly for a new business owner) to make a profit but have issues with cash flow. Keep track of what you’re spending and selling. You might have bought too much stock, drawn out too much money, or paid cash for assets that depreciate. Take a thorough look at your books before taking on expansion plans that could put your business at excessive risk.

2. Understand the impact of purchasing assets

If you decide to buy assets like machinery or office equipment with cash, it will reduce your cash reserves. And by doing so, you might be placing your business at risk.

You also won’t be able to claim the whole cost of the asset as an expense. Leasing could be a better option as it spreads the cost over time, meaning your cash lasts longer rather than being spent in one hit.

When you decide to make a major business purchase, such as a new vehicle, also think about taking out a short-term loan.

3. Take your bookkeeping seriously

As a small business owner, it’s vital you record and structure everything correctly when keeping the books.

For your sake, your accountant’s sanity, and to satisfy the tax department, you’ll want to build an accurate and reliable picture of your business’s health. Not only are there laws to be met, but you’ll be able to determine how well (or how poorly) your business performed over a certain period.

The advantages of keeping your books clean and up-to-date include:

- Paying your bills on time and gaining a good credit score.

- Less chance of becoming a victim of fraud – because you’ll be able to keep a close eye on stock levels and help prevent staff theft.

- Saving money – if your accounts are accurate when you meet your accountant at the end of the year.

These days, many small business owners use online accounting software like Receipt Bank to keep an electronic record of their receipts and invoices in the cloud. Take a look at the online accounting options that could enhance your bookkeeping accuracy.

4. Reconcile accounts with your bank feed

To reduce the chance of inaccuracies, it’s important you reconcile your business’s accounts with your bank feed regularly.

As a small business owner, online accounting software can be vitally helpful when it comes to reconciling your accounts. An online banking feed will help you ensure all transactions are accounted for. Reconciling accurately can save your business time and money.

Going through this process on a fairly regular basis will help you track your business’s financial situation. After all, with your mind mainly focused on the day-to-day running of your business, it’s possible that smaller expenses could get forgotten and go unrecorded.

5. Keep up-to-date with your accounting records

Keeping accurate records of all your business’s transactions (even the seemingly insignificant ones) is essential to running a successful business. Assigning a few minutes a day to sorting your invoices and receipts will help you avoid having to untangle a web of neglected records come tax time.

By staying on top of your smaller transactions, it will be a lot easier to manage the larger ones. You’ll be able to consistently manage your books and continue growing your business in confidence as the numbers of transactions increase.

6. Separate your business expenses from your personal ones

One of the most widespread accounting errors involves mixing up personal and business expenses. Keeping all your business finances in one place will make tax time much more bearable.

Ideally, you’ll want to be able to browse your business’s accounts at the end of each month and be sure no personal expenses are included. Some methods you can put in place to achieve this are:

- Using an online invoicing and billing system – where you can access the data from anywhere and record purchases with your phone while on the go.

- Getting a dedicated business credit card – to ensure all relevant purchases can easily be accounted for.

If you do get a business credit card, just remember to only use it for work expenses.

These six tips can go a long way to solving typical accounting problems. Keep on top of your records, reconcile often, and ensure your personal expenses are separate from your business ones.

- Talk to your accountant about how you’re going about record keeping.

- Speak to your bank manager about opening up a business bank account.

Complementary Discovery Session

This is our way for each of us to get to know each other a little bit better so we can map out a strategy that will help you meet your goals

- Phone This field is for validation purposes and should be left unchanged.

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Support for students in Australia and New Zealand

- ACCA Approved Learning Partners Australia and New Zealand

- Campus Ambassador Program

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- About policy and insights at ACCA

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- The joys of problem solving

- Student e-magazine

Many accountants enjoy problem solving more than number crunching. So what typical problems can you look forward to cracking at work? Iwona Tokc-Wilde reports

Problem solving is something that accountants and finance professionals deal with virtually every working day. In fact, a recent survey by Robert Half shows it is this part of working in the profession that they like best: 41% of accountants say solving problems gives them the most job satisfaction, compared to just 22% who prefer working with numbers.

‘Accountants are usually excellent at dealing with detail and spotting patterns, which makes them good at – and enjoy – problem solving,’ comments Andi Lonnen, founder and director of Finance Training Academy.

If you are at the beginning of your journey into the profession and enjoy tackling problems, you have a head start. Problem solving is also a skill that is one of the 10 most sought-after trainee skills globally (see 'Related links').

Why problem-solving skills are so important

‘The role of accountancy and finance has shifted from a pure focus on fiscal control to one where it has an impact on the business,’ says Phil Sheridan, managing director at Robert Half.

‘The requirement for problem-solving skills is part of this transition as, by mining data and analysing trends, accountants are now translating numbers into actionable insights for the business and are increasingly being seen as strategic partners.’ By putting their data skills and their problem-solving skills to work together, they also help uncover potential areas for concern.

It is vital for accountants in practice to correctly identify, analyse and solve problems too.

‘As trusted advisers, it’s our role to look at everything in detail to pick-up anomalies, patterns and correlations in order to advise our clients on how to take things forward,’ says Shahzad Nawaz of AA Accountants. If they fail to pick up and analyse problems correctly, the accounts could be wrong.

‘This means the business owner would be relying on incorrect data, which could have a detrimental effect on the future of the business. And, of course, if external stakeholders are relying on the data, then we could potentially be misleading them too.’

Incorrect accounts could also have other serious knock-on effects.

‘If the accounting figures are incorrect, then the tax payments relating to the company will be incorrect too. Later on, the client could find themselves with additional tax to pay – with interest,’ says Tanya Addy of BHP Chartered Accountants.

‘Inaccurate accounting can also land businesses in serious commercial difficulties especially if, as a result, directors/owners have been taking more salary or dividends from the business than they were entitled to. In the worst case scenario, it could even lead to closure of the business.’

Problem solving at work

There are many areas where trainee and new accountants can practise solving problems, depending on the job you are doing.

‘If it’s accountancy, you’ll be looking at helping a business with cash flow, debtors and improving their record-keeping,’ says Nawaz.

At the nitty-gritty level, you will be reconciling control accounts, trying to understand why an account might not be balancing and investigating and clearing old items on reconciliations.

‘The work to balance an account involves finding out what the problem is and then resolving it, for example identifying and correcting transposition errors,’ says Lodden.

If you work in tax, you’ll be involved in advising a client on how much tax they will need to pay (and how much tax they can save) in a particular year.

‘This will require a review of the information provided by the client, such as bank statements and expenses, analysing which expenses incurred are allowable and disallowable for taxation, quantifying the results and communicating them to the client and to tax authorities,’ explains Carolyn Napier, senior ACCA tutor at London School of Business and Finance.

You will also be dealing with tax implications, and tax cost for both employer and employee, of providing benefits.

‘You will need to ascertain which benefits are taxable and which are tax-free, and then you’ll need to "solve the problem" of which tax or taxes are due and payable, and by what date,’ says Napier.

In industry, you may be given the opportunity to help analyse projects, and communicate your findings to various parts of the business.

‘This is where new and trainee accountants will need to be prepared to utilise their problem-solving skills – noting anomalies and seeking clarification on areas of uncertainly will ensure that a clearer picture can be obtained,’ says Sheridan.

Deborah Adigun-Hameed is an accountant and junior financial analyst at BlueBay Asset Management. By utilising her problem-solving aptitude and skills, she has been involved in major decisions that shape the company she works for.

‘I’ve contributed to key strategic discussions about which market and products are profitable, what we should be selling and how we compare with our competitors,’ says Adigun-Hameed.

‘I may be newly qualified, but my informed opinions and advice are really valued by the management.’

Both in practice and in industry, accountants are also increasingly called upon to help solve technology problems – for example, when a business intends to implement new business software solutions. They help with the evaluation and selection of a solution, and with planning and execution of the implementation process. They also assist in testing the new system and facilitate going live when the system is ready.

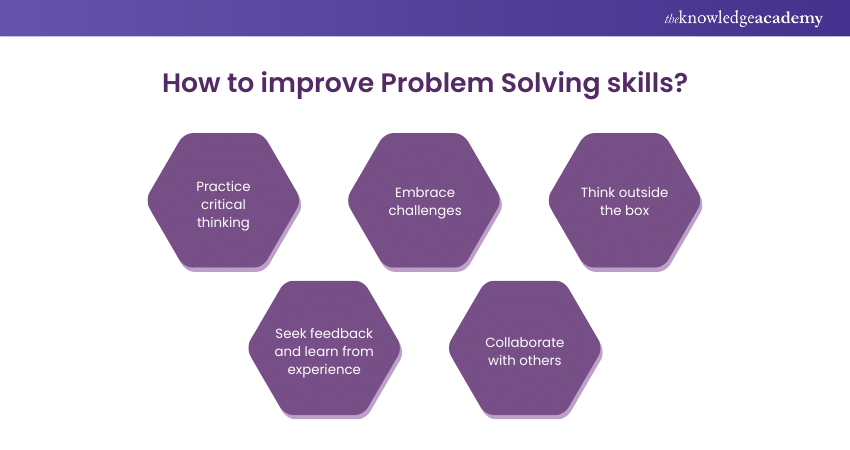

Hone your problem-solving skills

Problem solving is about using logic and your technical expertise to assess a situation and to come up with a workable solution. It is connected to other skills such as level-headedness and resilience, analytical skills and good teamworking skills.

It also requires creativity, which is best learnt through collaboration – brainstorming with others to clarify the problem, generate ideas and create as many potential solutions as possible. When putting forward ideas, be confident in your contributions.

‘Everyone, including those newly-qualified, has something to offer,’ says Adigun-Hameed. ‘Always think outside of the box, as cliché as that may sound. No new idea is insignificant. Innovation can be incremental; change can be small or radical.’

Improving your listening and communication skills will also make you a better problem solver.

‘Learning to communicate well is vital as you need to build rapport with clients. If you have a good rapport with someone, you are confident to ask questions, which is how you can pin down problems and find answers to those problems,’ says Nawaz.

Above all else, getting practical on-the-job experience is how you can get really good at problem solving.

‘The first control account a trainee tends to tackle and perfect is the bank control account; every trainee accountant has had to look for that 1p difference – as painful as that sounds, it certainly helps you learn,’ says Lauren Burt, client manager at EST Accountants and Tax Advisers.

"Everyone, including those newly-qualified, has something to offer. Always think outside of the box, as cliché as that may sound. No new idea is insignificant. Innovation can be incremental; change can be small or radical" Deborah Adigun-Hameed - BlueBay Asset Management

Related Links

- Top 10 global in-demand skills

- Student Accountant hub

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

- User Manager

- Saved for Later

Developing your problem-solving skills

Problem Solving has emerged as one of the key skills that accountants will need in the future. As we are increasingly called upon to help solve problems, both in business and in practice, so it's vital that we hone our skills in this area so that we can continue to add value to our organisations in the future. In this extract from his new course, Problem Solving for Accountants , Alan Nelson describes how we can develop our problem-solving skills.

Before we elaborate on why accountants should be interested in developing their problem-solving skills, let's go back to basics.

The most obvious sign of a problem is that something is not working as well as you would like it to be.

What is a problem?

What are the signs that there is a problem? A downturn in reported sales for the period?

Whether it is a financial reporting issue, a timing issue, a sales issue or a business performance problem, the most obvious sign of a problem is that something is not working as well as you would like it to be.

What are examples of typical accounting problems?

Accountants and finance professionals deal with problems on a daily basis. You might:

- Spot that some creditors are taking longer to pay

- Reconcile accounts

- Notice that an important KPI is off target

- Identify an increase in production costs

- Uncover errors in tax returns

- Foresee a cash shortage before it becomes critical

As accountants, it's vital that you notice the finer details, meaning you are able to spot errors and patterns with figures. Not only do you have the skills to identify these kinds of problems, but you have the technical knowledge to make the numbers right.

How is the nature of problem-solving changing in accounting?

Emerging technologies are causing the accounting industry to change. Computer programmes are starting to rectify the nitty-gritty numbers issues that accountants traditionally dealt with, meaning you will be faced with new problems to solve.

As those of you in practice attempt to move towards becoming trusted business advisers, and those in business towards being finance business partners, rather than being asked to solve problems to do with the accounts, you will be asked to seek out � and provide solutions to � issues in the wider business.

How will I need to develop my problem-solving skills then?

With the rise of automation, accountants of the future will be required to focus less on highlighting these sorts of issues with the numbers, and become much better at thinking up alternative solutions to a range of issues across the organisation.

Your job will be to bring problems to senior management and highlight how they present an opportunity for the business to improve � provide a better service, make better products, satisfy more customers, make more money... the list goes on.

And there are two different sets of skills that you can develop to help you do this.

Traditionally, the strategies used to get to the cause of a problem can be seen as being either creative or analytical. So it's developing your problem-solving skills in these areas that the new course focuses on.

Alan Nelson is an author for accountingcpd. To see his courses, click here .

You need to sign in or register before you can add a contribution.

The Art of Effective Problem Solving: A Step-by-Step Guide

Author: Daniel Croft

Daniel Croft is an experienced continuous improvement manager with a Lean Six Sigma Black Belt and a Bachelor's degree in Business Management. With more than ten years of experience applying his skills across various industries, Daniel specializes in optimizing processes and improving efficiency. His approach combines practical experience with a deep understanding of business fundamentals to drive meaningful change.

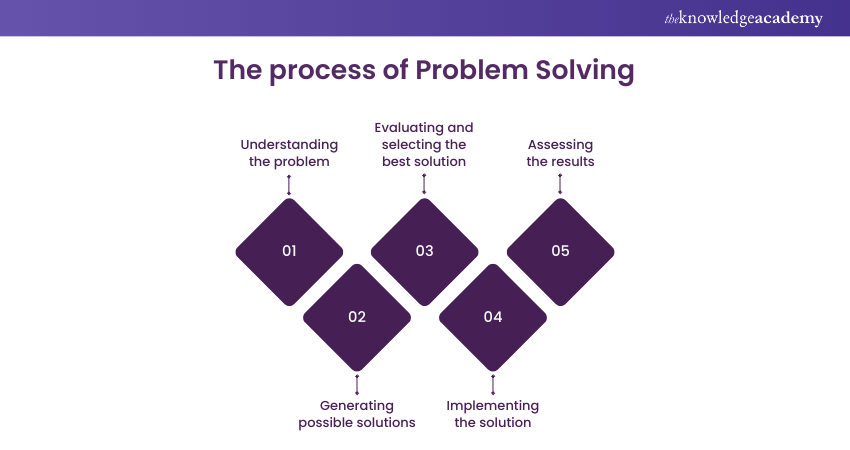

Whether we realise it or not, problem solving skills are an important part of our daily lives. From resolving a minor annoyance at home to tackling complex business challenges at work, our ability to solve problems has a significant impact on our success and happiness. However, not everyone is naturally gifted at problem-solving, and even those who are can always improve their skills. In this blog post, we will go over the art of effective problem-solving step by step.

You will learn how to define a problem, gather information, assess alternatives, and implement a solution, all while honing your critical thinking and creative problem-solving skills. Whether you’re a seasoned problem solver or just getting started, this guide will arm you with the knowledge and tools you need to face any challenge with confidence. So let’s get started!

Problem Solving Methodologies

Individuals and organisations can use a variety of problem-solving methodologies to address complex challenges. 8D and A3 problem solving techniques are two popular methodologies in the Lean Six Sigma framework.

Methodology of 8D (Eight Discipline) Problem Solving:

The 8D problem solving methodology is a systematic, team-based approach to problem solving. It is a method that guides a team through eight distinct steps to solve a problem in a systematic and comprehensive manner.

The 8D process consists of the following steps:

- Form a team: Assemble a group of people who have the necessary expertise to work on the problem.

- Define the issue: Clearly identify and define the problem, including the root cause and the customer impact.

- Create a temporary containment plan: Put in place a plan to lessen the impact of the problem until a permanent solution can be found.

- Identify the root cause: To identify the underlying causes of the problem, use root cause analysis techniques such as Fishbone diagrams and Pareto charts.

- Create and test long-term corrective actions: Create and test a long-term solution to eliminate the root cause of the problem.

- Implement and validate the permanent solution: Implement and validate the permanent solution’s effectiveness.

- Prevent recurrence: Put in place measures to keep the problem from recurring.

- Recognize and reward the team: Recognize and reward the team for its efforts.

Download the 8D Problem Solving Template

A3 Problem Solving Method:

The A3 problem solving technique is a visual, team-based problem-solving approach that is frequently used in Lean Six Sigma projects. The A3 report is a one-page document that clearly and concisely outlines the problem, root cause analysis, and proposed solution.

The A3 problem-solving procedure consists of the following steps:

- Determine the issue: Define the issue clearly, including its impact on the customer.

- Perform root cause analysis: Identify the underlying causes of the problem using root cause analysis techniques.

- Create and implement a solution: Create and implement a solution that addresses the problem’s root cause.

- Monitor and improve the solution: Keep an eye on the solution’s effectiveness and make any necessary changes.

Subsequently, in the Lean Six Sigma framework, the 8D and A3 problem solving methodologies are two popular approaches to problem solving. Both methodologies provide a structured, team-based problem-solving approach that guides individuals through a comprehensive and systematic process of identifying, analysing, and resolving problems in an effective and efficient manner.

Step 1 – Define the Problem

The definition of the problem is the first step in effective problem solving. This may appear to be a simple task, but it is actually quite difficult. This is because problems are frequently complex and multi-layered, making it easy to confuse symptoms with the underlying cause. To avoid this pitfall, it is critical to thoroughly understand the problem.

To begin, ask yourself some clarifying questions:

- What exactly is the issue?

- What are the problem’s symptoms or consequences?

- Who or what is impacted by the issue?

- When and where does the issue arise?

Answering these questions will assist you in determining the scope of the problem. However, simply describing the problem is not always sufficient; you must also identify the root cause. The root cause is the underlying cause of the problem and is usually the key to resolving it permanently.

Try asking “why” questions to find the root cause:

- What causes the problem?

- Why does it continue?

- Why does it have the effects that it does?

By repeatedly asking “ why ,” you’ll eventually get to the bottom of the problem. This is an important step in the problem-solving process because it ensures that you’re dealing with the root cause rather than just the symptoms.

Once you have a firm grasp on the issue, it is time to divide it into smaller, more manageable chunks. This makes tackling the problem easier and reduces the risk of becoming overwhelmed. For example, if you’re attempting to solve a complex business problem, you might divide it into smaller components like market research, product development, and sales strategies.

To summarise step 1, defining the problem is an important first step in effective problem-solving. You will be able to identify the root cause and break it down into manageable parts if you take the time to thoroughly understand the problem. This will prepare you for the next step in the problem-solving process, which is gathering information and brainstorming ideas.

Step 2 – Gather Information and Brainstorm Ideas

Gathering information and brainstorming ideas is the next step in effective problem solving. This entails researching the problem and relevant information, collaborating with others, and coming up with a variety of potential solutions. This increases your chances of finding the best solution to the problem.

Begin by researching the problem and relevant information. This could include reading articles, conducting surveys, or consulting with experts. The goal is to collect as much information as possible in order to better understand the problem and possible solutions.

Next, work with others to gather a variety of perspectives. Brainstorming with others can be an excellent way to come up with new and creative ideas. Encourage everyone to share their thoughts and ideas when working in a group, and make an effort to actively listen to what others have to say. Be open to new and unconventional ideas and resist the urge to dismiss them too quickly.

Finally, use brainstorming to generate a wide range of potential solutions. This is the place where you can let your imagination run wild. At this stage, don’t worry about the feasibility or practicality of the solutions; instead, focus on generating as many ideas as possible. Write down everything that comes to mind, no matter how ridiculous or unusual it may appear. This can be done individually or in groups.

Once you’ve compiled a list of potential solutions, it’s time to assess them and select the best one. This is the next step in the problem-solving process, which we’ll go over in greater detail in the following section.

Step 3 – Evaluate Options and Choose the Best Solution

Once you’ve compiled a list of potential solutions, it’s time to assess them and select the best one. This is the third step in effective problem solving, and it entails weighing the advantages and disadvantages of each solution, considering their feasibility and practicability, and selecting the solution that is most likely to solve the problem effectively.

To begin, weigh the advantages and disadvantages of each solution. This will assist you in determining the potential outcomes of each solution and deciding which is the best option. For example, a quick and easy solution may not be the most effective in the long run, whereas a more complex and time-consuming solution may be more effective in solving the problem in the long run.

Consider each solution’s feasibility and practicability. Consider the following:

- Can the solution be implemented within the available resources, time, and budget?

- What are the possible barriers to implementing the solution?

- Is the solution feasible in today’s political, economic, and social environment?

You’ll be able to tell which solutions are likely to succeed and which aren’t by assessing their feasibility and practicability.

Finally, choose the solution that is most likely to effectively solve the problem. This solution should be based on the criteria you’ve established, such as the advantages and disadvantages of each solution, their feasibility and practicability, and your overall goals.

It is critical to remember that there is no one-size-fits-all solution to problems. What is effective for one person or situation may not be effective for another. This is why it is critical to consider a wide range of solutions and evaluate each one based on its ability to effectively solve the problem.

Step 4 – Implement and Monitor the Solution

When you’ve decided on the best solution, it’s time to put it into action. The fourth and final step in effective problem solving is to put the solution into action, monitor its progress, and make any necessary adjustments.

To begin, implement the solution. This may entail delegating tasks, developing a strategy, and allocating resources. Ascertain that everyone involved understands their role and responsibilities in the solution’s implementation.

Next, keep an eye on the solution’s progress. This may entail scheduling regular check-ins, tracking metrics, and soliciting feedback from others. You will be able to identify any potential roadblocks and make any necessary adjustments in a timely manner if you monitor the progress of the solution.

Finally, make any necessary modifications to the solution. This could entail changing the solution, altering the plan of action, or delegating different tasks. Be willing to make changes if they will improve the solution or help it solve the problem more effectively.

It’s important to remember that problem solving is an iterative process, and there may be times when you need to start from scratch. This is especially true if the initial solution does not effectively solve the problem. In these situations, it’s critical to be adaptable and flexible and to keep trying new solutions until you find the one that works best.

To summarise, effective problem solving is a critical skill that can assist individuals and organisations in overcoming challenges and achieving their objectives. Effective problem solving consists of four key steps: defining the problem, generating potential solutions, evaluating alternatives and selecting the best solution, and implementing the solution.

You can increase your chances of success in problem solving by following these steps and considering factors such as the pros and cons of each solution, their feasibility and practicability, and making any necessary adjustments. Furthermore, keep in mind that problem solving is an iterative process, and there may be times when you need to go back to the beginning and restart. Maintain your adaptability and try new solutions until you find the one that works best for you.

- Novick, L.R. and Bassok, M., 2005. Problem Solving . Cambridge University Press.

Was this helpful?

Daniel Croft

Daniel Croft is a seasoned continuous improvement manager with a Black Belt in Lean Six Sigma. With over 10 years of real-world application experience across diverse sectors, Daniel has a passion for optimizing processes and fostering a culture of efficiency. He's not just a practitioner but also an avid learner, constantly seeking to expand his knowledge. Outside of his professional life, Daniel has a keen Investing, statistics and knowledge-sharing, which led him to create the website www.learnleansigma.com, a platform dedicated to Lean Six Sigma and process improvement insights.

8D (8 Disciplines)

What is the (PDCA) Plan, Do, Check, Act Cycle?

Free lean six sigma templates.

Improve your Lean Six Sigma projects with our free templates. They're designed to make implementation and management easier, helping you achieve better results.

5S Floor Marking Best Practices

In lean manufacturing, the 5S System is a foundational tool, involving the steps: Sort, Set…

How to Measure the ROI of Continuous Improvement Initiatives

When it comes to business, knowing the value you’re getting for your money is crucial,…

8D Problem-Solving: Common Mistakes to Avoid

In today’s competitive business landscape, effective problem-solving is the cornerstone of organizational success. The 8D…

The Evolution of 8D Problem-Solving: From Basics to Excellence

In a world where efficiency and effectiveness are more than just buzzwords, the need for…

8D: Tools and Techniques

Are you grappling with recurring problems in your organization and searching for a structured way…

How to Select the Right Lean Six Sigma Projects: A Comprehensive Guide

Going on a Lean Six Sigma journey is an invigorating experience filled with opportunities for…

- User Roles & Access

- FAQ’s

oboloo Articles

Mastering accounting practice problems: tips and tricks for success, introduction.