A Detailed Case Study on Largest Retail Giant Walmart

Avinash kumar mahato

Walmart is one of the largest retail companies in the world. It was founded in 1962 by Sam Walton. The headquarter of this company is situated in the United States. The main aim of the company is to provide consistent discounts, loyal customer service, and fast friendly service.

Walmart’s targets to expand its business in large cities as well as spread retail stores throughout the world. The retail stores of Walmart are divided into four divisions Walmart Supercenters , Discount Stores, Neighborhood Markets, and Sam’s Clubs warehouses. More than 100 million customers are visiting these Walmart Stores.

It is very uncomfortable for small merchants and communities in America. Walmart reaches their town and provides low-cost offers and the best customer service. It is a very bad condition for small merchants and businessmen in America. To downtown merchants, Walmart just comes and takes over all the small stores.

The purchasing power, aggressive marketing and provide low prices to the customer by Walmart, tend to pull out the business by the small merchants. Gradually the dream of Walmart company to become the largest retailer in the world is full filing day-by-day. But, they increase their business by the wrong actions and do not respect the culture or language of the communities.

Timeline Events Of Walmart company Business Model Of Walmart How Walmart Generates Revenue? Walmart’s Marketing Strategy Walmart’s - Flipkart Acquisition

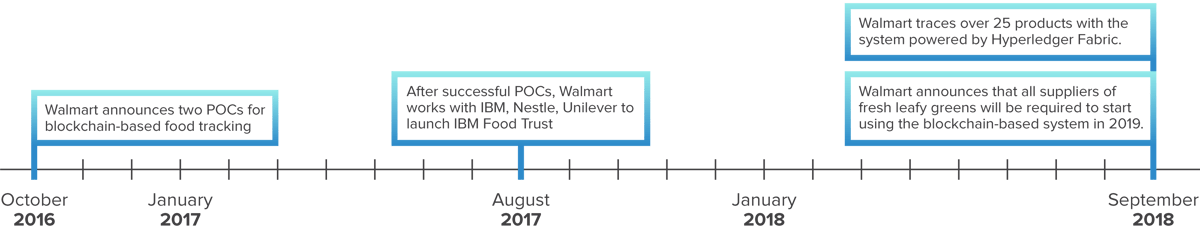

Timeline Events Of Walmart company

The Timeline of events for Walmart company since its inception.

- 1960: Sam Walton opened his first discount store in Rogers, Arkansas.

- 1981: Walmart become the largest company in America .

- 1981: After becoming the largest company in America, they opened their stores in a small Louisiana town.

- 1983: Walmart opened its stores in Pawhuska and Oklahoma.

- 1986: Walmart claims that it can restore more than 4000 jobs to American Communities.

- 1989: They drive a campaign about Environmental awareness that Walmart is aware of land, water, and air.

- 1990: There are some activist groups against the expansion of Walmart’s store.

- 31st December 1990: Walmart’s closed its stores in Louisiana.

- 5th November 1991: Walmart opened up its store in Lowa City.

- 6th October 1998: Walmart’s founder Sam Walton created a family charity named Walton Family Charitable Support Foundation.

- June 1999: Walmart takes over the ASDA Chain (a British supermarket chain), now they have stores and depots across the United States.

- 2001: Walmart becomes the world’s largest retailer, got huge sales of $191 billion.

- July 2003: Walmart opened its stores in Beijing and till now they have 22 stores in China and counting.

- 2006: Walmart closed its stores in Germany.

- July 2007: Walmart is operating more than 2500 retail units in Walmart International and more than 500,000 employers in some countries.

- 2007: By the ending of this year, they got a net $45 billion sales.

- 2008: Walmart’s opened its wholesale facility in India. This is the first step of Walmart's to sell products through its retail outlets in India.

- 2018: Walmart acquired Flipkart for $16 billion and owned 77% stake in India’s largest online retailer brand.

Business Model Of Walmart

There are different business models that are followed by successful companies which vary from time to time. The business model of Walmart is based to eliminate the middleman from the distribution channels. The advantage of removing the middleman is to provide benefit to the consumer by providing products at lower costs. The main motive of Walmart's business strategy company is to enter every segment of the market and dominate the market by providing products at a lower price.

The main marketing strategy of the company is based on leading on price, be competitive, and deliver a great experience by the motto of Everyday Lower price.

Walmart has three important segments.

Walmart U.S

Walmart U.S is operated in the U.S. They provide customers with products and services that are not present physically in stores. They provide their services via the website and mobile application . The website of Walmart company has a special feature that provides a third party to sell products. The company operates its business on various platforms like supermarkets, discount stores, neighborhood markets, and e-commerce websites .

Walmart International

Walmart International is also divided into three sections which are retailers, wholesalers, and other small projects. These sections are also divided into various sections such as supermarkets, warehouses, electronics, apparel stores , drug stores, digital retailers, and many more.

It is the online platform of Walmart’s company i.e., “ samsclub.com ”. This club is consists of memberships of the only warehouse retailer operations. This section includes warehouse clubs in the U.S, as well as samsclub.com.

Want to Work in Top Gobal & Indian Startups or Looking For Remote/Web3 Jobs - Join angel.co

Angel.co is the best Job Searching Platform to find a Job in Your Preferred domain like tech, marketing, HR etc.

How Walmart Generates Revenue?

The Revenue Model of Walmart deals with the principle of buying in bulk in one go. In this system, they got a huge discount from the manufacturers. They sell in small quantities at low prices. By reducing the price they have high sales volume through which they have high earning.

Walmart’s generate its revenue by removing the middleman and selling their product directly to the customers and services to business. The two main sources of revenue are Product revenue and Service revenue .

Walmart's revenue in the fiscal year ending January, 2020 was $524 Billion.

Product Revenue

Walmart has a wide range of products in various categories:-

- In the grocery category, they have products like Daily needs products, dairy products, frozen foods, bakery, baby products, beauty aids, and many more.

- Health and wellness category have products like Pharmacy products and clinical services .

- The entertainment category has products like electronics products, toys, cameras, movies, music, videos, and books.

- Stationary, paints, and hardware, Automotive, sporting goods, crafts, and seasonal merchandise.

- Apparel categories include apparel for men, women, boys, girls, shoes, jewelry, and accessories.

- Home appliances include home furnishing services, home decor, livings, and horticulture.

Service Revenue

Walmart also provide services to generate revenue in various fields:-

- They provide financial services like prepaid cards , money orders, wire transfer, money transfers, bill payments, and so on.

- VUDU movie streaming services: This is a subscription-based OTT platform for buying and renting movies, watching TV shows on demand.

- Clinical Services include primary health care, Physical and Wellness checks, Clinical lab tests.

- Health Insurance services

Walmart’s Marketing Strategy

Walmart's Business Strategy Analysis is one of the most important parts of any business whether it is small or large. It is very important to make an effective marketing plan to survive in the market . Walmart uses the principle of business marketing penetration method which is used to capture the market by offering lower prices and competitive prices to the consumers.

The company follows cost leadership which makes a huge profit for the company. The company provide low prices to the consumer and treated all the customers as king of the market to maintain the relationship between Walmart and the customer.

According to Walmart, there are four factors that drive the customer’s choice of retailer:

- Assortment.

One more reason for the success of Walmart is purchasing products from local manufacturers in a bulk in one go and selling in small quantities. Buying from local manufacturers is the benefit for both. Buying more products from local manufacturers means they are creating more jobs and they reduce the unemployment rate. They should provide good quality products at a lower price to maintain a good relationship with customers and continue to get profits in business.

List of Courses Curated By Top Marketing Professionals in the Industry

These are the courses curated by Top Marketing Professionals in the Industry who have spent 100+ Hours reviewing the Courses available in the market. These courses will help you to get a job or upgrade your skills.

Walmart’s - Flipkart Acquisition

Flipkart is one of the leading Indian e-commerce brands. In 2018, Walmart takes 77% stakes in India’s largest e-commerce company Flipkart and makes the world’s biggest purchase of an e-commerce company.

After this acquisition the future of eCommerce industry in India has become more competitive than ever.

The three main reasons for the acquisition of Flipkart are Flipkart’s leadership in some lucrative sections, its payment platform and the company’s talent pool.

Walmart’s world’s largest company is to continue to expand its business by improving its strategies day-by-day. The main reason for the success of Walmart is the EDLP system i.e., Everyday Low Price. They are working aggressively to maintain profits, market shares, and provide low prices to consumers. There are many business ideas to gain profit from a market. All depends on how you play the cards for a profitable business.

Walmart has made acquisitions of 28 organizations and has 16 sub-organization.

Feel free to reach us and share your understanding and views on the case study of Walmart. We would love to hear from you.

What is the business model of Walmart?

The business model of Walmart is based on eliminating the middleman from the distribution channels. The advantage of removing the middleman is to provide benefit to the consumer by providing products at lower costs.

What is the motive behind Walmart's Business Strategy?

The main motive of the Walmart business strategy company is to enter every segment of the market and dominate the market by providing products at a lower price.

What is Walmart's Market Strategy?

How does walmart generate revenue.

The earning model of Walmart deals with the principle of buying in bulk in one go. In this system, they got a huge discount from the manufacturers. Walmart’s generate its revenue by removing the middleman and selling their product directly to the customers and services to business.

What are the main sources of revenue for Walmart?

The two main sources of revenue are:

- Product revenue

- Service revenue

Is Walmart owned by China?

The Walmart branch in China is majority Chinese-owned. But predominantly it is owned by Sam Walton's many children.

Why is Walmart so cheap?

They sell in small quantities at low prices. By reducing the price they have high sales volume through which they have high earning. Hence, by selling in high volume they can sell it at a cheap price and still gain profit.

What are the sub-organisations under Walmart?

There are 16 sub-organisations of Walmart. Some of them are:

- Walmart Labs

- Seiyu Group

- Walmart Canada

What are the top acquisitions of Walmart?

Walmart has acquired 28 companies. Some top acquisitions are:

Must have tools for startups - Recommended by StartupTalky

- Manage your business smoothly- Google Workspace

Top 5 Leading Telecommunication Companies in India by Their Market Share

Telecommunication companies are entities that facilitate communication and connectivity without the need for physical interaction. Whether it's making phone calls, accessing the internet, or exchanging written messages via emails and SMS, the telecom sector offers comprehensive solutions at our fingertips. Through the use of cables, wires, waves, and wireless technology,

Top Profitable Transport Business Ideas You Can Start Now

Transportation is one of the oldest businesses in the world and is one business that can never go extinct because as long as the world continues, people will always need to move around from place to place. The transport business is also one business in which you can make cool

Koo: The Rise and Shutdown of India's Homegrown Microblogging Platform

Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations. The recent ban in India of 59 Chinese apps has paved the way for many Indian startups and entrepreneurs to create "Made in India" products. The majority of these startups are developing products that

Unveiling Valuable Insights in the Fifth Episode of the Crafting Bharat Podcast Series with Shubhi Agarwal, Co-founder & COO at Locobuzz

Shubhi Agarwal, Co-Founder & COO of Locobuzz, Dives into Entrepreneurship, Funding, and Innovative GenAI Applications. The journey of a startup founder is filled with good times and bad times, successes and failures. Being a female founder in a male-dominated tech industry can be uniquely demanding. As a startup founder, they are

- THE STRATEGY JOURNEY Book

- Videos & Tutorials

- Strategy Journey Analyzer [QUIZ + WORKBOOK]

- COMMUNITY FORUMS

- Transforming Operating Models with Service Design (TOMS) Program

- ABOUT STRATABILITY ACADEMY

Walmart Business Strategy: A Comprehensive Analysis

By Julie Choo

Published: January 5, 2024

Last Update: January 5, 2024

TOPICS: Service Design

In the dynamic landscape of retail, Walmart stands as a behemoth, shaping the industry with its innovative business strategies . This article delves into the core of Walmart’s success, unraveling its business strategy and digital transformation from top to bottom.

Walmart Business Strategy

Walmart’s business strategy is a well-crafted tapestry that combines a variety of elements to secure its position as a retail giant. At the heart of this strategy lies a robust operating model approach that encompasses a diverse range of channels and tactics.

Transition to An OmniChannel Marketplace

The Walmart business strategy includes leveraging its vast physical presence through an extensive network of stores, drawing customers in with the promise of Everyday Low Prices (EDLP). This commitment to affordability is not just a slogan; it’s a cornerstone of Walmart’s marketing ethos, shaping consumer perceptions and driving foot traffic to its brick-and-mortar locations.

Building Strength via its Emerging Digital Operating Model

Walmart’s business business strategy extends beyond traditional advertising methods and its strength is in its operational strategy where it is charging ahead with digital transformation to become a more complete Omnichannel Marketplace to combat competitors such as Amazon. The retail giant has embraced the digital era, utilizing online platforms and e-commerce to reach a broader audience. Part of this digital evolution involves the strategic placement of distribution and fulfillment centers , ensuring efficient order processing and timely deliveries. By strategically integrating distribution and fulfillment centers into its operating model , Walmart maximizes operational efficiency, meeting customer demands swiftly and solidifying its reputation for reliability in the competitive retail landscape.

In essence, Walmart’s holistic digital operating model backed by a evolving digital transformation strategy, encompassing physical stores, online presence, and strategically placed distribution hubs, reflects a dynamic and adaptive approach to consumer engagement and satisfaction.

Walmart’s Existing Business Model Before Digital Transformation

Walmart’s retail business .

Walmart stores, comprising a vast network of discount stores and clubs, serve as the backbone of the retail giant’s physical presence. Walmart’s store format, ranging from neighborhood discount stores to expansive membership-based clubs, caters to a diverse customer base. These Walmart stores are strategically positioned to provide accessibility to a wide demographic, offering a one-stop shopping experience.

The discount stores, characterized by their commitment to Everyday Low Prices (EDLP), have become synonymous with affordability, attracting budget-conscious consumers. Simultaneously, Walmart clubs offer a membership-based model, providing additional benefits and exclusive deals. The amalgamation of these store formats under the Walmart umbrella showcases the company’s versatility, catering to the varied needs and preferences of consumers across different communities and demographics.

Walmart Pricing Strategy

Pricing strategy.

Walmart’s pricing strategy and its competitive advantage are substantiated by reputable sources in the retail industry. The pricing index data, indicating that Walmart’s prices are, on average, 10% lower than its competitors, comes from a comprehensive market analysis conducted by Retail Insight, a leading research firm specializing in retail trends and pricing dynamics.

Everyday Low Prices

Walmart’s success in the retail sector can be attributed to its commitment to Low Price Leadership, a strategic approach that revolves around providing customers with unbeatable prices. Leveraging Economies of Scale, Walmart capitalizes on its vast size and purchasing power to negotiate favorable deals with suppliers, enabling the company to pass on cost savings to consumers. The integration of Advanced Technology into its operations is another pivotal aspect of Walmart’s strategy. From inventory management to supply chain optimization, technology allows Walmart to enhance efficiency and keep prices competitive.

Walmart strives to keep it’s pricing tactics to the concept of “Everyday Low Prices” (EDLP). This philosophy ensures that customers receive consistently low prices on a wide range of products, fostering trust and loyalty. Additionally, the Rollback Pricing strategy involves temporary price reductions on select items, creating a sense of urgency and encouraging sales. Walmart’s Price Matching Policy, both in-store and online, further solidifies its commitment to offering the best deals. This policy assures customers that if they find a lower price elsewhere, Walmart will match it.

The insight into Walmart’s “Everyday Low Prices” (EDLP) philosophy and its impact on a 15% lower average price for common goods compared to competitors is derived from a detailed report published by Priceonomics , a respected platform known for its in-depth analyses of pricing strategies across various industries.

The statistics regarding Walmart’s market share of 22% in the U.S. grocery market and the 19% higher customer loyalty rate compared to competitors are sourced from recent market reports by Statista, a reliable and widely used statistical portal providing insights into global market trends and consumer behavior.

Multiple layers of Discount

Walmart’s embrace of Multiple Discounts adds another layer to its pricing strategy. Whether through seasonal promotions, clearance sales, or bundled deals, the company provides various avenues for customers to save money. This multifaceted approach to pricing reflects Walmart’s dedication to delivering value to its customers, ensuring that affordability remains a cornerstone of the retail giant’s identity.

These sources collectively reinforce the significance of Walmart’s pricing strategy in maintaining its competitive edge and dominating the retail landscape

Walmart’s Servicing Business

Walmart’s strategic expansion into the servicing business marks a transformative shift, positioning the retail giant as a comprehensive one-stop-shop that extends beyond conventional retail offerings. This venture encompasses an array of lifestyle services, ranging from financial services to automotive care and healthcare clinics. Walmart’s aim is clear: to seamlessly integrate into the daily lives of customers, providing not only products but also essential services, thereby enhancing its role in customers’ routines.

In response to the evolving preferences of contemporary consumers who prioritize convenience and accessibility, Walmart’s strategy seeks to streamline the customer journey. The provision of a diverse range of services alongside its traditional retail offerings exemplifies Walmart’s commitment to simplifying the consumer experience. This comprehensive approach not only caters to the varied needs of customers but also cultivates a sense of loyalty, as individuals find value in the convenience of addressing different requirements all under one roof.

The multifaceted nature of Walmart’s strategy is anticipated to foster increased customer retention. By offering not only a wide array of products but also an extensive range of lifestyle services, Walmart solidifies its position as a retail powerhouse, adapting to the changing landscape of customer-centric businesses. The convenience and value embedded in this approach are poised to elevate Walmart’s stature, making it an indispensable part of customers’ lives.

SWOT Analysis of Walmart’s Business strategy

As we navigate Walmart’s digital transformation journey, a SWOT analysis reveals key insights into its strengths, weaknesses, opportunities, and threats, guiding strategic decisions for sustained success in the dynamic retail industry that is operating in an increasingly digital economy.

SWOT Analysis of Walmart:

- Strong Brand Recognition: Walmart’s strength lies in its widely recognized and trusted brand, fostering consumer confidence and loyalty.

- Diverse Revenue Stream: The company’s adaptability is evident through a diverse revenue stream, navigating various markets and industries to maintain financial resilience. Per Walmart’s Q3 FY23 Earnings , a breakdown of walmart’s income can be recognised through its Sam’s Club membership sales (Up by 7.2%), Walmart U.S Comp Sales (Up 4.9%), Walmart U.S. eCommerce (up by 24%), and Walmart International sales (up by 5.4%).

- Economies of Scale: Walmart leverages its extensive size for economies of scale shown by its strong revenue growth of 5.3% per 2022 and 2023 consolidated Income statement, enabling cost advantages in procurement, operations, and overall efficiency.

- Strong Customer Base: With a vast and loyal customer base, Walmart establishes a robust foundation in the retail sector, emphasizing customer retention and sustained business growth as per market share stat of 60% shown on the Market retail/wholesale industry dominated by Walmart.

Weaknesses:

- Labor Relations: Walmart has faced criticism for labor practices, including low wages and labor disputes.

- E-commerce Competition: Despite significant strides, Walmart faces intense competition from e-commerce giants (e.g, amazon, eBay), impacting its online market share.

- Over Reliance on US Market: A substantial portion of Walmart’s revenue is generated in the United States, making it vulnerable to domestic economic fluctuations.

- Inconsistent customer service: represents a weakness in Walmart’s SWOT analysis, as variations in service quality across different locations may impact the overall customer experience, potentially leading to customer dissatisfaction and diminished brand perception.

Opportunities:

- E-commerce Expansion: Further growth in the online market allows Walmart to capitalize on changing consumer shopping habits.

- International Expansion: Targeting untapped markets presents opportunities for global revenue diversification.

- Health and Wellness Market: The growing trend towards health-conscious living provides avenues for expansion in the health and wellness sector. Increased understanding of customer journeys in these niches is key to begin to build stickiness effects.

- Technological Innovations: Embracing cutting-edge technologies can enhance customer experience and operational efficiency through a growing Omnichannel marketplace. It is vital to master data science and begin to leverage AI in the battle to understand consumer behaviors and deliver a remarkable experience.

- Competition: Intense competition from traditional retailers and e-commerce platforms poses a threat to Walmart’s market share such as Costco, Target and Amazon.

- Regulatory Challenges: Changes in regulations, especially related to labor and trade, can impact Walmart’s operations and costs. One such example is the metrics shown per Walmart’s ethics & compliance code of conduct aligning to regulatory challenges in culture, work safety, risk mitigation and more.

- Economic Downturns: Economic uncertainties and recessions may lead to reduced consumer spending, affecting Walmart’s revenue.

- Supply Chain Disruptions: External factors like natural disasters or geopolitical events can disrupt the global supply chain, impacting product availability and costs. Such threats are specifically addressed by Walmart’s Enterprise Resilience Planning Team .

More on Walmart’s Online Competitors

Walmart faces formidable competition in the online retail arena, with key rivals such as Amazon and Target vying for a share of the digital market. Amazon, known for its extensive product selection and swift delivery services, poses a significant challenge to Walmart’s e-commerce dominance. Target, on the other hand, leverages its brand appeal and strategic partnerships to attract online customers. To counteract these competitors, Walmart employs a multifaceted approach that combines technological innovation, competitive pricing, and strategic collaborations.

Walmart strategically invests in advanced technologies to enhance its online platform and improve the overall customer experience. The integration of artificial intelligence (AI) and machine learning enables Walmart to provide personalized recommendations, similar to Amazon’s renowned recommendation engine. Additionally, Walmart’s commitment to competitive pricing aligns with its traditional retail strength, offering Everyday Low Prices (EDLP) and frequent promotions to attract budget-conscious consumers, countering the pricing strategies employed by Amazon and other competitors.

Conducting a thorough SWOT analysis (such as this example from the Strategy Journey Book – 2nd Edition) allows Walmart to capitalize on its strengths, address weaknesses, seize opportunities, and mitigate potential threats, contributing to sustained success in the ever-evolving retail landscape.

Walmart’s Digital Transformation Strategy in the new ERA of AI-led Customer Centricity

Walmart’s online business strategy.

Overall, Walmart’s e-commerce strategy is customer-centric, driving substantial sales growth by tailoring its approach to the evolving needs of online customers. Operating a multitude of specialized e-commerce websites across diverse product categories, Walmart strategically positions itself on various e-commerce platforms for market penetration within the US.

Servicing Relevant Customer Journeys & Sustainable Transformation

Walmart’s evolving online strategy is characterized by a dual focus on extensive product offerings and technological sophistication, with concrete examples per its strategic partnership with Adobe in 2021 to integrate walmart’s marketplace, online and instore fulfillment and pickup technologies with Adobe commerce showcasing its commitment to a seamless customer experience. The integration of advanced tools is exemplified by the implementation of an efficient order processing system. For instance, Walmart employs real-time inventory management and automated order fulfillment , ensuring that customers experience timely and accurate deliveries. Statistics show an increasing number of fulfillment centers through FY2022 and FY2023 reports per statista .

Emerging predictive capabilities supported by Data Science and AI

In addition, the technological depth extends to personalized experiences, illustrated by Walmart’s robust recommendation engine. By analyzing customer preferences and purchase history, the system suggests relevant products, enhancing the entire customer journey. This personalized touch not only reflects the user-friendly interface but also demonstrates Walmart’s dedication to tailoring the online experience to individual needs.

Focus on seamless CX and UX to improve customer stickiness

Furthermore, Walmart’s commitment to a seamless online interaction is evident in its streamlined navigation features. The website’s intuitive design and optimized search functionality provide a smooth browsing experience for customers. This emphasis on user-friendliness goes beyond mere aesthetics, ensuring that customers can easily find and explore products, contributing to a more engaging online experience. Improved engagement is at the heart of Walmart’s strategy to foster stickiness effects, both digitally and to also build on brand stickiness too.

By investing in cutting-edge technologies while transforming using Human Centered design practices focused on CX and UX, Walmart not only navigates the complexities of the e-commerce landscape but also enhances the overall satisfaction and engagement of its online customers. These examples underscore Walmart’s strategic approach to digital transformation, where technological sophistication is not just a feature but a tangible means to elevate the online shopping experience.

Walmart International Business

Successful international business expansion requires operating model transformation, and Walmart’s strategy is characterized by a blend of strategic acquisitions, partnerships, and a keen understanding of local markets. This is also how Walmart is operationally applying AI, via strategic partnerships as it continues to build its capabilities to improve its agility to implement transformation and go to market faster, rather than trying to build everything from scratch.

A Sustainable Diversification strategy that adapts to local markets

Walmart’s international business expansion is a testament to its strategic approach in entering diverse markets and adapting to local nuances. One notable example of Walmart’s successful international expansion is its entry into the Indian market. In 2018, Walmart acquired a majority stake in Flipkart, one of India’s leading e-commerce platforms. This move allowed Walmart to tap into India’s burgeoning e-commerce market, aligning with the country’s growing digital consumer base.

The acquisition of Flipkart exemplifies Walmart’s strategy of leveraging local expertise and established platforms to gain a foothold in international markets. Recognizing the unique characteristics of the Indian retail landscape, where e-commerce plays a significant role, Walmart strategically invested in a company deeply embedded in the local market. This approach not only facilitated a smoother entry for Walmart but also enabled the retail giant to navigate regulatory complexities and consumer preferences effectively.

Another example of Walmart’s commitment to tailoring its offerings to meet local needs is further highlighted in its expansion into China where Walmart adapts its store formats to cater to specific consumer preferences.

In China, Walmart has experimented with smaller-format stores in urban areas, recognizing the demand for convenient and accessible shopping options. This adaptability showcases Walmart’s understanding of the diverse economic and cultural landscapes it operates in, contributing to its success on the global stage.

Working with partners to diversify and build a sustainable business model

Collaborations and strategic partnerships play a pivotal role in Walmart’s competitive strategy. In 2023, Walmart has outlined plans to invest heavily into AI automation fulfillment centers to improve its unit cost average by 20%, increasing efficiency in order fulfilments and operations.

The acquisition of Jet.com in 2016 expanded Walmart’s digital footprint and brought innovative talent into the company. Furthermore, Walmart’s partnerships with various brands (such as Adobe, ShipBob) and retailers enable it to diversify its product offerings, providing a competitive edge against the more specialized approaches of some competitors. As part of Walmart’s strategy in marketing, Walmart has announced partnerships with social media giants such as TikTok, Snapchat, Firework and more further boosting its online digital footprint.

The acquisition of Jet.com in 2016 not only expanded Walmart’s digital footprint but it brought innovative talent into the company. It is clear Walmart sees the need for talent as key to its continued efforts to apply human centered design as part of its digital transformation strategy.

By continuously adapting and evolving its strategies, Walmart is clearly implementing digital transformation sustainably, to support its future operating model as Walmart remains a formidable force in the online retail landscape, navigating the challenges presented by its competitors.

In conclusion, Walmart’s business strategy is that of an growing Omnichannel marketplace, a multifaceted approach that combines physical and digital retail, competitive pricing, supply chain excellence, and a commitment to customer satisfaction. Understanding these elements provides insights into the retail giant’s enduring success in a rapid changing and competitive digital economy as it continues to combat emerging new business disruptions.

Q1: How did Walmart become a retail giant?

Walmart’s ascent to retail dominance can be attributed to a combination of strategic pricing, operational efficiency, and a customer-centric approach.

Q2: What sets Walmart’s supply chain apart?

Walmart’s supply chain is marked by innovation and technological integration, allowing the company to streamline operations and stay ahead in a competitive market.

Q3: How does Walmart balance physical and digital retail?

Walmart seamlessly integrates its brick-and-mortar stores with its online presence, offering customers a comprehensive shopping experience.

Q4: What is Walmart’s philosophy on pricing?

Walmart’s commitment to everyday low prices is a fundamental philosophy that underpins its strategy, ensuring affordability for consumers.

Q5: How has Walmart expanded globally?

Walmart’s global expansion involves adapting its strategy to diverse markets, understanding local dynamics, and leveraging its core strengths.

About the author

Julie Choo is lead author of THE STRATEGY JOURNEY book and the founder of STRATABILITY ACADEMY. She speaks regularly at numerous tech, careers and entrepreneur events globally. Julie continues to consult at large Fortune 500 companies, Global Banks and tech start-ups. As a lover of all things strategic, she is a keen Formula One fan who named her dog, Kimi (after Raikkonnen), and follows football - favourite club changes based on where she calls home.

You might also like

Culture & Careers , Data & AI , Gameplans & Roadmaps , Operating Model , Service Design , Strategy Journey Fundamentals , Transformation

The Impact of Co Creation in Modern Business

Culture & Careers , Data & AI , Gameplans & Roadmaps , Operating Model , Service Design , Transformation

4 steps to create a Winning Game Plan

Service Design

9 Steps to your Winning Customer Journey Strategy

How Walmart Became The Retailer Of The People

Table of contents.

In the world of American retail success stories, it’s impossible to ignore the giant that is Walmart . Just the mention of the name will bring about connotations of scale that are difficult to fathom in our modern context.

Let's take a look at some of Walmart's astounding numbers

- $524 Billion (USD) revenue in 2020, an increase of $9.6 Billion

- Over 2.3 Million employees worldwide, 1.6 Million in the US alone

- 4,743 Walmart stores in the US alone

- 5,184 Walmart international segment stores

- Located in 24 countries

- Global market share of 2.6% in 2021

In this article, we’ll dive deeply into the Walmart story, unpacking the insights that drove them, the circumstances that made them, and pulling as much value as we can from what they’ve been able to accomplish. Whether you’re in retail or not, there are lessons to be learned here about strategic positioning, customer experiences, product development, long-term sustainability, supplier negotiation, and much more.

Let’s dig in.

{{cta('eed3a6a3-0c12-4c96-9964-ac5329a94a27')}}

The Origin Story

The global behemoth started in a very humble way in Arkansas, back in 1962. Mercurial founder Sam Walton had a dream of what a true customer-focused retail experience could be. He believed that you could offer low prices and a great customer experience in parallel. And he set out to prove it.

That first store got off to a roaring success because it did something different from what everyone else provided. Walton’s dedication to leadership through service meant that the store felt like a family-led operation that genuinely cared for those who came through the doors. At this stage, it wasn’t the product range or scale that kept customers coming through the doors; it was the feeling that you actually mattered. You weren’t just a number. You were a valued client whose business was cherished.

Over the next 5 years, Sam Walton and his family expanded this philosophy to open up a further 23 stores, which generated just over $12m in revenue. With each new store they planted, they strived to understand the local community and their needs – delivering the sort of retail experience that they would appreciate. And it was this focus that allowed them to continue growing without losing their spark. Even as they began to scale, the small-town feel remained, and the Walton DNA was sprinkled across every part of the value chain.

In 1969, the company was officially incorporated as Wal-Mart Stores Inc., and just one year later, they were listed as a public company. The vision was to bottle up the magic and take it to a national scale. In a way that had rarely been seen before, the ambition was unbounded. They really did see a future where Walmart stores littered the whole of the USA.

By the time 1980 rolled around, the company crossed the $1bn sales figure, with contributions from 276 stores across the country. In today’s numbers, that’s huge, but back in 1980, it isn’t easy to appreciate just how powerful this empire was. The company had revolutionized modern retail, and on the back of significant improvements in mass production and global supply chains, Walmart continued to accelerate in terms of influence and market share. They were quickly becoming the go-to brand for anything and everything.

Every brand that tried to compete with them struggled to match their low prices, wide variety, and family-friendly ideals that made customers feel at home in the stores. Even though the Waltons couldn’t be everywhere, the culture they had nurtured continued to permeate each location, making it a shopping experience that couldn’t be beaten.

In the ‘90s, the company continued to expand, breezing through $100bn sales in a year and growing its operations into Mexico and other select international locations, most notably China . Thanks to the Walmart supercenters, the company strengthened its brand as the one-stop shop for absolutely everything, providing great value and low costs across everything sold.

As of the time of writing, Walmart now operates over 10,000 stores globally, employing over 2.3m people and maintaining the status of one of the most recognizable brands across the world. The ethos of Sam Walton created an empire that champions low-priced goods delivered at scale in a way that delights customers through and through.

Now that we have a sense of some of the history, let’s look at some of the strategic pillars that make Walmart the success it is.

The Walmart Cheer

In 1975, Sam Walton traveled to Korea and Japan to visit some of his suppliers and to see what the mass production facilities looked like that were feeding the rapid growth of his organization. One of the visits was to a Korean tennis ball manufacturer, where he came across the idea of what would become the Walmart Cheer .

The factory was not that inspiring aesthetically, but Walton was taken aback by how enthusiastic and happy the staff was. It was clear that they had something special about them, even in the rather dingy circumstances that they worked in. And when he saw the reason why he knew he had to bring a similar idea to Walmart.

The employees at this factory would get together at the beginning of every day and perform a cheer together. As silly as this sounds, they would do this choreographed war cry of sorts that was designed to unite them and reinforce the values and ideals that they were aiming for that day. On a once-off, this might seem like just a gimmick, but repeated day after day, and it turned into a mantra for that factory that kept the workers going and helped them to feel like they were a part of something larger than themselves.

Walton loved this idea and adapted it into what is known today as the Walmart Cheer. Every day before the staff opens their doors to the public, they will gather together to perform this ritual. The sales numbers for the day before would be read out, as well as any goals that are being set for that particular day, and then the employees will go back and forth spelling out Walmart in the same enthusiastic way that you might have during your high school war cries.

Walton recognized that while this seemed inconsequential to some, a little ritual like this acted as a moment for the staff to come together and set their intentions for each day. It gave the store managers an opportunity to share some words of inspiration or motivation to help fire up the employees. And it got the employees to get into their bodies a bit and set themselves up to be in a good state for what was to come.

By the time that the doors were opened for that day, there was an energy and vitality in that workforce that was contagious. This would help them serve the customers with as much verve as possible, which was what Walmart was all about.

Now, whether this is still done at every store is anyone’s guess, but it points to an important strategic insight that comes from Walmart. They understand that the energy put forth by their retail staff has a significant impact on the overall buying experience. While we tend to place a lot of focus on product ranges, pricing, distribution, marketing, and all those components the truth still remains that people buy from people. The ritual of the Walmart Cheer was a simple piece of what made those employees feel like they were all on the same team. And through the age-old tool of group song and dance, they could set their intentions and build the energy that they would need to give to their customers.

This shows an attention to detail that most retailers don’t get right. We’ve all been in situations where the apathy shown by retail employees creates a sour experience for us as customers, and it leads to us ignoring that brand as a result. Walmart understood this and sought to create practical ways for employees to come together and deliver that exceptional buying experience that the customers were looking for.

Always Low Prices

One of the more common oversimplifications that you’ll hear in the business strategy canon is that your pricing model must fall into one of two camps- high volumes at low prices or low volumes at high prices. While the reality is much more nuanced than that, the choice remains one that all companies must make if they are to create something sustainable.

Walmart has always been focused on low prices. They will do everything they can to slash their prices as low as possible because that is the value that they aim to provide to their customers. They want to beat the competition by convincing their audience that you won’t find these goods for cheaper than anywhere else. All across their supply chain, they are doing everything they can to keep the costs as low as possible.

You can see that most clearly in their margins. For the vast majority of their existence, they’ve kept their net profit margin in the 1-5% range , which is quite staggering when you think about the size and scale that they’ve managed to achieve. This is certainly doing things the hard way when it comes to building a business. Leaving yourself this little operational wiggle room is something that a lot of strategists might advise you against. But Walmart has made it work incredibly well.

The reason that this is so interesting is that in our modern context, the biggest companies in the world have insanely high margins that business experts across the gamut celebrate. The digital businesses that leverage the internet to deliver their offerings can find their margins being in the range of 60% and upwards in most cases, which is in stark contrast to the Walmart model.

But that’s a feature of brick-and-mortar retail. Your overheads and your rent make up a sizable chunk of your cost, and then you add on top of that the complex supply chain that brings a wide variety of products onto your shelves. Before you know it, your margins are under serious pressure and you require a significant investment in infrastructure to get the economies of scale you need.

This is compounded when you consider the types of goods that Walmart sells. The core of the offering is essentials, which are the bread and butter of daily life. Customers only really care about price and convenience in these verticals, so Walmart set itself up to match those desires. Through innovative supply chain optimizations and radical cost-cutting philosophy, they made themselves known as the discount retailer where you get the best prices.

It’s difficult to understate how valuable this branding is. If you can convince your customers that you’ll always have the lowest prices on the market, there’s no reason for them even to consider your competitors. Instead, they trust your product curation and become loyal customers of Walmart. At this point, you transcend the competition, and all you’re working on is delivering a consistently high quality of service to your existing base. This is the core proposition that the entire empire is built on.

That’s not to say that a low-price strategy is easy to execute, of course. There are some serious minefields you must navigate when you are trying to compete solely on price. It’s certainly not well suited for every business. But if you can carve out that space in the mind of the customer, you can build a sustainable following that will continue to bring you the volumes you need to make the business work.

Your business promise manifests itself and drowns out the competition.

Decentralized Logistics

To operate at the scale that Walmart does, you rely on a logistics system that must perform incredibly efficiently and reliably in rain or shine to supply stores with the items they need. In fact, you wouldn’t be out of order to suggest that at this point, Walmart is essentially a logistics company. In much the same way that Amazon relies on its distribution center, Walmart relies on always having its products in stock to fulfill the customer promise that they’ve made. And to do this with thousands of stores across the world is not an easy thing to get right.

The key strategic decision that the company made when it comes to its logistics was to decentralize its distribution centers and focus on getting the best possible location for each one. Instead of focusing on how they could achieve economies of scale in each distribution center, by building massive warehouses that would then distribute goods, they wanted more centers that could service the surrounding stores in a reasonable period of time. The objective that they set was that every Walmart store should be able to receive a delivery within 24 hours from a distribution center. This meant that as long as the distribution centers were well stocked, you could rectify stock shortages in any store within a day – helping to ease the pressure that comes with being known as the shop that has everything.

The placement of these distribution centers thus became very important to get right. You weren’t optimizing for low rent, high traffic, good infrastructure, or any of that. You were doing a geographic calculation to identify which stores needed to be serviced and therefore, where should the center be placed. These centers became the nodes of the network that would enable Walmart to spread its wings across the whole of the USA. They potentially could have saved money by optimizing for different criteria, but the specific choice to have a decentralized system meant that they could always ensure that their inventory levels were well managed and controlled.

Another interesting piece of this strategy was that once they had a new distribution center up and running, they would start by building the furthest store away from that center and then move closer and closer towards it, building stores as they went. This meant that the distribution center was prepared, right from the beginning, to handle its most challenging deliveries. Every subsequent store that was built could leverage that early work, and things got easier and easier as a result.

This prioritization also meant that Walmart could be much more selective as to where their actual retail locations were. Using the distribution center as the centerpiece, they could identify the key customer locations that mattered most and set up shop there, creating the spokes of their wheel. It was small details like this that allowed them to ramp up their retail capacity in ways that other chains just couldn’t match.

These logistical decisions have, of course, become part and parcel of our modern conversation because of the shift towards online shopping. Led by the giant that is Amazon, the world of logistics management has radically advanced since Walmart’s early days. But in their time, they really were one of the first companies who were very thoughtful about how they set up their distribution networks and used those pillars as the foundation on which they would expand their empire.

Bargaining Power

It would be impossible to discuss Walmart’s strategy without talking about the incredible level of bargaining power they enjoy over their suppliers. As one of the first retailers that went on an aggressive land grab strategy, they were determined to expand their offering as widely as possible to every town in America. They hoped to bring their consumer promise of low prices to everywhere you could imagine so that the brand became synonymous with saving.

Their success with this rapid expansion meant that they ate up market share in every region that they entered. And after a while, they became the dominant retailer in the country, controlling a significant portion of the goods market. This early domination gave them the leverage that they needed to negotiate the best possible terms with their suppliers.

When Walmart came knocking, suppliers knew that the order sizes were so big that they had to do anything to win that business. Manufacturers around the world would compete to have their goods on Walmart shelves because the scale was just unfathomable. This competition drove prices down and improved payment terms for Walmart itself. They could sit back and let companies eat into their own margins – helping Walmart to provide even lower prices to customers.

This is one of those advantages that gets locked in early and is very difficult to dislodge. If you look back at Walmart’s competitors over the years, this is one of the reasons why they have struggled to make a dent. Walmart’s bargaining power in these negotiations is second to none because a lot of suppliers would reconfigure their entire operation to manage the Walmart order. It was so big in size that it would subsume your manufacturing capacity and while some were able to expand beyond it, a lot of companies were comfortable just servicing the growing Walmart empire.

An example like this shows just how important a first-mover advantage can be in markets like this. When you’re competing on price and convenience, the way that you build scale is by being everywhere. And even though your margins are low in the beginning, if you can capture the market early, you can then put pressure on your suppliers to improve the financial situation over the long term.

You have to have enough cash to wait it out, of course, but this is the same model that we’ve seen from numerous venture-backed companies from the past two decades who chase customer growth first, knowing that once they have the lion’s share of the market, they will have the opportunity to squeeze all the other stakeholders because of the power that you wield. Uber is one modern example that comes to mind here.

And it’s not only on price that you benefit. The improved payment terms that you can negotiate have a significant influence on your cash flow cycle and therefore your ability to scale. Essentially, Walmart created an opportunity for themselves to borrow money for next to nothing which could then subsidize their long-term plans. It’s one of those lesser celebrated pieces of the business that actually has had an outsized impact on their success. And it shows the virtues of a high-volume, low-priced business.

In-House Drivers and Route Optimization

Another part of the Walmart strategy that has paid off for them is the decision to insource their transport across the board. Currently, the company boasts one of the largest truck fleets in the world, and their drivers are some of the highest-skilled drivers in the industry. They made it a priority from very early on to invest in this because they knew that it was crucial to managing a vast landscape of stores. They could have very easily subcontracted this work out to a courier service directly but decided that bringing it in-house would provide synergies that would be valuable.

They spend a lot of time and resources training and upskilling their drivers so that they can maintain the safest possible distribution network in the business. The drivers clock in over 700 million miles every year but still have one of the best safety records on a global scale. This speaks to the attention to detail and care taken to strengthen this part of their business, where a lot of companies might try to cut corners.

Having the best drivers isn’t everything though, you then have to figure out how to utilize them most effectively. Walmart does this expertly through complex route optimization processes that plan out all the travel that these trucks must go through to meet the demands of the various stores.

The main thing that they focus on is minimizing empty miles. Every time a truck is travelling without goods inside it, that opportunity cost is eating into the bottom line. So, everything that the company can do to optimize how they use their available space is going to pay dividends over the long run.

To this end, they employ sophisticated logistics management software that tracks current inventory levels, store purchases, incoming supplies, and truck positioning – to craft routes and distribution schedules that can deliver as efficiently as possible. This technology undergoes a complex weighting of various criteria including fuel consumption, environmental impact, traffic conditions, and more – ensuring that all the transport resources are used to their full potential. This has been tweaked over time and continues to learn from ongoing data that consistently compounds its value.

None of this optimization would be possible though without the right data behind it , and that’s another area where Walmart has invested a lot of money into. The technological infrastructure that sits behind these thousands of stores is monumental. It allows the distribution nodes to understand the exact situation in real-time for any store they work with. As conditions change or consumer behavior adjusts, they can take that into account and adapt the transportation planning accordingly.

It’s difficult to appreciate just how transformational this is until you’ve spent some time working on inventory management solutions. This part of business has changed dramatically in the last few years with the Internet of Things, machine learning, and advanced algorithmic decision-making starting to make its mark in the world of logistics. Walmart has shown itself to be a leader in this regard, which continues to push them forward as a company.

Of course, the shift towards online shopping is going to disrupt the typical way they do things, but the principles of logistics remain the same. As Walmart begins to compete on last-mile delivery to the houses of their individual customers, they are going to rely on many of the same technologies to manage inventory, track deliveries, and optimize routes so that they can sweat their assets as efficiently as possible.

The big competitor here is Amazon, who have built a distribution network unlike anything we have ever seen, but Walmart still holds its own because of the infrastructure it has in place. Some are talking about how we may see Walmart converting some stores into further distribution centers for online orders and if so, they would have some of the best-located nodes that anyone could imagine. We’ll have to wait and see.

Walmart is an American institution and through the years it has become a key staple for millions of families across the country. Through thick and thin, Walmart is relied upon to provide the essentials that customers need to survive and thrive. As such, they’ve transcended a mere grocery store and have taken on a certain social responsibility to continue to supply the American people with what they need.

In times of natural disasters that have devastated American towns, we’ve seen Walmart get on the front lines to help supply the recovery efforts and help to rebuild communities that are getting back onto their feet. But the only way they’ve been able to do that is by having their own disaster recovery strategies in place – policies that stand out when you compare them to the rest of the industry.

At great cost, Walmart has built six dedicated disaster recovery centers which are well-stocked at all times and ready to serve if something goes wrong in any of their regions. These centers are specifically designed to be a backup and so they hope that they never have to use them, but over the past few decades they have played a very important role in the Walmart story.

Having this redundancy in place as a business allows them to react much quicker to adverse conditions than might be possible otherwise. At the very moment where stores are incapacitated, they can have their distribution center ready to replenish the supplies that are needed in that community. This means that customers can rely on Walmart to get them the goods that they need even in the very worst of times.

Doing this has significant financial implications of course because those centers are just sitting attracting cost without delivering any tangible ROI for the company. Some might say that it’s a waste of resources. But Walmart sees the power in being the retailer that never runs out of stock and is more than happy to pay those costs. Because the branding that comes with it more than pays for those idle distribution centers. Customers can trust that Walmart will look after them in every circumstance, good or bad, and that continues to entrench their competitive advantage in every market they enter.

We can all learn from this – and it’s certainly very topical right now as we deal with a global pandemic. Having redundancy in your organization to prepare for those rainy days helps you to be much more agile than you would have been. And when you consider the branding tailwinds you receive when you are in a position to help people, it makes all that investment worth it.

This is not a corner that you should cut lightly. Redundancy matters.

Acquisitions and Joint Ventures

Let's look at how Walmart approached its international expansion. We can see a very clear strategic preference for acquiring existing retail chains or partnering with existing brands instead of trying to build their own from scratch. This principle is at the heart of their entries into Mexico, China, India, South Africa, and everywhere else where they have a presence. And it’s worth discussing why they went this route.

Walmart understood that the cultural context of their branding and their product offering is what enabled their success in each local area that they went. Customers trusted the chain with their business because it was delivering exactly what they wanted at the best price possible.

The organization knew that if they were to go into a new territory where they had limited cultural understanding, they risked creating a retail experience that didn’t serve those people in the way that it should. And that was an expensive mistake to make if you were entering a new company for the first time.

Instead, if they could leverage the knowledge and experience of local brands who understood the market, they could fast-track all of those learnings and get up to speed in next to no time – because they were standing on the shoulders of giants. So, that’s what they did. They would go into these new markets and look for acquisition targets that made sense for the growing empire.

They were looking for great locations, high customer foot traffic, and a certain penchant for discount shopping. Not only that, they were also looking for operations that weren’t operating as smoothly as they could be. That’s where the Walmart machine could add value.

When the company found a target like this, they could offer a premium price to acquire those brands because they had the confidence in their own technology, systems, and global supply networks that they could drastically improve the efficiency of those stores and drive prices even further down as a result. Riding on the success of the American stores, they could afford to take their time reconfiguring the internal operations and turning those brands into the sophisticated operations that were in place back home.

This is not to say that every acquisition worked, far from it . International expansion is notoriously difficult. But the key insight is that they realized that they didn’t need to reinvent the wheel. The existing brands had loyal customers, good locations, and a cultural understanding of what was required to serve that particular area. If Walmart could bring its technology and operational excellence to the table, it could turn the dial up on success and grow internationally in a much more streamlined way.

The lore of internal expansion is littered with stories about high-powered brands walking into new countries and expecting to just build exactly the same business in the new place. Walmart wasn’t that naïve. They knew that they had to be smarter than that. And you should be too.

That brings us to the end of this strategy breakdown for Walmart, one of America’s biggest retail success stories. It’s rare that you see a company carry forward the ethos and values of its founder as it scales to this size, but that’s exactly what Walmart has done. Even though it is now a giant commercial conglomerate, it hasn’t lost that special sauce that the Waltons imbued in the company DNA.

It hasn’t tried to become what it’s not. The company has stayed true to its original brand promise that it will give you the widest range of goods at the best prices, wherever you happen to be. We’ve pulled out some key strategic pieces in this study, and those are certainly important in how they’ve got to where they are, but the purity of the offering is what really stands out.

Behind the simplicity of the brand image, lies a sophisticated logistics network, cutting-edge real-time data analysis, thoughtful HR strategy, planned redundancy, strong supplier negotiation, and a land grab strategy rivaled only by perhaps McDonald’s. These components all come together to make Walmart what it is and the scale they’ve achieved is testament to making this a winning formula.

What lies in the future for the company remains to be seen. They face stiff competition from Amazon and a myriad of other online retailers who are stealing customers from right under their noses. But we wouldn’t want to doubt their ability to adjust just yet. They’ve shown time and time again that they can remain relevant, and it’s hard to see them giving that up now.

It’s a story of diligence, perseverance, and a customer focus that bordered on obsession. And when we look back at some of the greatest retailers the world has ever seen, you can bet that Walmart is going to be very near the top of that list.

Sam Walton, we salute you.

Contemporary Strategy Analysis, 10th Edition by Robert M. Grant

Get full access to Contemporary Strategy Analysis, 10th Edition and 60K+ other titles, with a free 10-day trial of O'Reilly.

There are also live events, courses curated by job role, and more.

Case 6 Walmart, Inc. in 2018: The World's Biggest Retailer Faces New Challenges *

In 2018, Walmart was not only the world's biggest retailer, it was also the world's biggest company in terms of revenue—a position it had first attained in 2000 and had held for most of the intervening years.

Since going public in 1972, Walmart's record of growth and profitability was remarkable. Between 1972 and 2009, its average annual sales growth was 22% and its return on equity had not fallen below 20%.

Yet, sustaining Walmart's phenomenal record of growth and profitability was proving to be an ever more daunting challenge. As Walmart continued to expand its range of goods and services—into groceries, fashion clothing, music downloads, online prescription drugs, financial services, and health clinics—it was forced to compete on a broader front. While Walmart could seldom be beaten on price, it faced competitors that were more stylish (T.J.Maxx), more quality‐focused (Whole Foods), more service‐oriented (Lowe's, Best Buy), and more focused in terms of product range. In its traditional area of discount retailing, Target was an increasingly formidable competitor, while in warehouse clubs, its Sam's Clubs ran a poor second to Costco.

However, all these competitive threats were trivial compared to that posed by online retailing—and, specifically that posed by the world's emerging retail colossus: Amazon. During 2017, the turf battle between the two became increasingly acute: while Walmart expanded ...

Get Contemporary Strategy Analysis, 10th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

Don’t leave empty-handed

Get Mark Richards’s Software Architecture Patterns ebook to better understand how to design components—and how they should interact.

It’s yours, free.

Check it out now on O’Reilly

Dive in for free with a 10-day trial of the O’Reilly learning platform—then explore all the other resources our members count on to build skills and solve problems every day.

Künstliche Intelligenz in Unternehmen: Innovative Anwendungen in 50 erfolgreichen Firmen

Der Bestsellerautor und Geschäfts renommierter KI-Experte Bernard zeigt, wie sterben Technologie des maschinellen Lernens das von Unternehmen verändert. Das Buch bietet einen Überblick über einzelne Unternehmen, beschreibt das spezifische Problem und erklärt, wie KI die Lösung erleichtert. Jede Fallstudie bietet einen umfassenden Einblick, der einige technische Details wichtige Lernzusammenfassungen enthält. Marrs Buch ist eine aufschlussreiche und informative Untersuchung der transformativen Kraft der Technologie in der Wirtschaft des 21. Jahrhunderts.

Bernard Marr

Bernard Marr is a world-renowned futurist, influencer and thought leader in the fields of business and technology, with a passion for using technology for the good of humanity. He is a best-selling author of over 20 books, writes a regular column for Forbes and advises and coaches many of the world’s best-known organisations. He has a combined following of 4 million people across his social media channels and newsletters and was ranked by LinkedIn as one of the top 5 business influencers in the world.

Bernard’s latest books are ‘Future Skills’, ‘The Future Internet’, ‘Business Trends in Practice’ and ‘ Generative AI in Practice ’.

Bernard Marr ist ein weltbekannter Futurist, Influencer und Vordenker in den Bereichen Wirtschaft und Technologie mit einer Leidenschaft für den Einsatz von Technologie zum Wohle der Menschheit. Er ist Bestsellerautor von 20 Büchern, schreibt eine regelmäßige Kolumne für Forbes und berät und coacht viele der weltweit bekanntesten Organisationen. Er hat über 2 Millionen Social-Media-Follower, 1 Million Newsletter-Abonnenten und wurde von LinkedIn als einer der Top-5-Business-Influencer der Welt und von Xing als Top Mind 2021 ausgezeichnet.

Bernards neueste Bücher sind ‘Künstliche Intelligenz im Unternehmen: Innovative Anwendungen in 50 Erfolgreichen Unternehmen’

Walmart: Big Data analytics at the world’s biggest retailer

23 July 2021

With over 20,000 stores in 28 countries, Walmart is the largest retailer in the world. So it’s fitting then that the company is in the process of building the world’s largest private cloud, big enough to cope with 2.5 petabytes of data every hour. To make sense of all this information, Walmart has created what it calls its Data Café – a state-of-the-art analytics hub located within its Bentonville, Arkansas headquarters.

Walmart uses Big Data in practice

The Data Café allows huge volumes of internal and external data, including 40 petabytes of recent transactional data, to be rapidly modelled, manipulated and visualised. Speaking to me about the project, senior statistical analyst Naveen Peddamail said, “If you can’t get insights until you’ve analysed your sales for a week or a month, then you’ve lost sales within that time.”

Quick access to insights is therefore vital. For example, Peddamail told me about a grocery team who could not understand why sales had suddenly declined in a particular product category. By drilling into the data, they were quickly able to see that pricing miscalculations had led to the products being listed at a higher price than they should have been.

The system also provides automated alerts, so, when particular metrics fall below a set threshold in any department, the relevant team is alerted so that they can find a fast solution. In one example of this, during Halloween, sales analysts were able to see in real time that, although a particular novelty cookie was very popular in most stores, it wasn’t selling at all in two stores. The alert prompted a quick investigation, which showed that, due to a simple stocking oversight, the cookies hadn’t been put on the shelves. The store was then able to rectify the situation immediately.

The technical details

As well as 200 billion rows of transactional data (representing only the past few weeks!), the Café pulls in information from 200 sources, including meteorological data, economic data, Nielsen data, telecom data, social media data, gas prices, and local events databases. Anything within these vast and varied datasets could hold the key to the solution to a particular problem, and Walmart’s algorithms are designed to blaze through them in microseconds to come up with real-time solutions.

Ideas and insights you can steal

Clearly, Walmart has huge amounts of data at its fingertips – and the resources to tackle all that data. But what any company can borrow from Walmart’s example is their ability to react to data quickly. After all, there’s little point investing in data capabilities if your internal setup doesn’t allow you to quickly make decisions and changes based on what the data is telling you.

You can read more about how Walmart is using Big Data to drive success in Big Data in Practice: How 45 Successful Companies Used Big Data Analytics to Deliver Extraordinary Results .

Related Articles

AI Politicians: The Future Of Democracy Or A Threat To Freedom?

2024 is a big year for democracy, with over two billion of us voting in elections across the US, India, the EU, the UK and many other countries and territories.[...]

How Mailchimp Hopes To Build The End-To-End AI Solution For SMEs

I often write about AI's potential to transform any business. Yet, a question I frequently get from small businesses is, "Does that really include us?"[...]

Will AI Surpass Human Intelligence, Or Is It Just Hype?

Artificial intelligence is going to change the world—but there’s still a lot of hype and hot air around it.[...]

The Vital Difference Between Machine Learning And Generative AI

Artificial intelligence (AI) is transforming our world, but within this broad domain, two distinct technologies often confuse people: machine learning (ML) and generative AI.[...]

The Difference Between ChatGPT And Generative AI

As artificial intelligence continues to reshape industries, understanding which jobs remain secure is crucial.[...]

The New HR Playbook: Catalyze Innovation With Analytics And AI

Beneath the surface of every HR function, there lies a treasure trove of data. But if that[...]

Sign up to Stay in Touch!

Bernard Marr is a world-renowned futurist, influencer and thought leader in the fields of business and technology, with a passion for using technology for the good of humanity.

He is a best-selling author of over 20 books, writes a regular column for Forbes and advises and coaches many of the world’s best-known organisations.

He has a combined following of 4 million people across his social media channels and newsletters and was ranked by LinkedIn as one of the top 5 business influencers in the world.

Bernard’s latest book is ‘ Generative AI in Practice ’.

Social Media

- About / Contact

- Privacy Policy

- Alphabetical List of Companies

- Business Analysis Topics

Walmart SWOT Analysis & Recommendations

This SWOT analysis of Walmart Inc. presents the company’s strengths and weaknesses, as well as the business opportunities and threats relevant to the condition of the retail industry. As a leading retailer, the company has competitive advantages linked to its market position and organizational size. However, to fulfill Walmart’s mission statement and vision statement in the long term, the business needs to match its strategic decisions to the issues arising from the SWOT factors. For instance, the company must account for opportunities and threats that represent external forces in the retail market. Walmart optimizes its operations based on a variety of internal and external factors, including the ones examined in this SWOT analysis.

This SWOT analysis includes an internal analysis of Walmart’s strengths and weaknesses (internal strategic factors) and an external analysis of business opportunities and threats (external strategic factors). These strengths, weaknesses, opportunities, and threats provide a picture of the strategic planning options available to the retail corporation. The SWOT variables enumerated below affect the company, as well as its customers, business partners, suppliers, and competitors in the retail industry.

Strengths (Internal Strategic Factors)

Walmart’s strengths are business characteristics that enable growth, expansion, and profitability. In this part of the SWOT analysis, such characteristics strengthen the business against external forces, such as the threat of competition. The following internal factors are Walmart’s strengths:

- Dominant brick-and-mortar retail presence

- High-efficiency logistics and global supply chain

- Strong bargaining power against suppliers and manufacturers

Walmart’s industry position comes with a dominant brick-and-mortar retail presence, which is a business strength in this SWOT analysis. This strength enables the company to maintain a stable market share, despite aggressive competitors, like Amazon and Target. The large brick-and-mortar presence, along with the operations of the subsidiary, Sam’s Club, helps protect Walmart from competition, which includes Amazon’s relatively small brick-and-mortar operations. In addition, the high-efficiency logistics and global supply chain are a strength that this SWOT analysis links to the retail company’s growth potential. This internal strategic factor facilitates the ability to offer low prices, in support of Walmart’s generic competitive strategy and intensive growth strategies . This SWOT analysis also points to the retail company’s bargaining power as a strength for influencing suppliers and manufacturers. Based on the company’s large organizational size, this internal factor strengthens the business in imposing low prices on goods sold at its stores. This pricing strategy affects suppliers and manufacturers, while ensuring low selling prices at the company’s stores and e-commerce website. To support high efficiencies and large-scale operations, Walmart’s operations management involves advanced business information systems and related technologies. These technological applications help minimize costs, errors, and delays in retail business processes. Walmart’s inventory management is also a foundation that supports the strengths mentioned in this part of the SWOT analysis.

Walmart’s Weaknesses (Internal Strategic Factors)

Walmart’s weaknesses impose challenges in withstanding external forces, such as the threats identified in this SWOT analysis. Business weaknesses are internal factors related to the retail company’s ability for further business development, additional competencies, and higher profits. The following are Walmart’s weaknesses:

- Limited e-commerce operations

- Absent or insignificant operations in international shipping

- Competitive disadvantage relative to specialty sellers’ product quality