- Case Details

- Case Intro 1

- Case Intro 2

» Operations Case Studies » Case Studies Collection » ICMR HOME » Operations Short Case Studies » View Detailed Pricing Info » How To Order This Case » Business Case Studies » Case Studies by Area » Case Studies by Industry » Case Studies by Company  | | | | Case Code | : | OPEA003 | For delivery in electronic format: Rs. 300;

For delivery through courier (within India): Rs. 300 +Shipping & Handling Charges extra - | | Case Length | : | 22 Pages | | Period | : | 2003 | | Organization | : | Tata Motors | | Pub Date | : | 2004 | | Teaching Note | : | Not Available | | Countries | : | India | | Industry | : | Automobile |

| Tata Motors, previously known as Tata Engineering and Locomotive Co Ltd (TELCO), is one of the largest companies in the Tata Group, and one of India's largest business houses. Tata Motors is India's leading commercial vehicle manufacturer and the third largest passenger car manufacturer. The company is the sixth largest truck manufacturer in the world. Tata Motors recently received the Balanced Scorecard Collaborative Hall of Fame Award for having achieved a significant turnaround of its overall performance. A comprehensive quality improvement and cost cutting initiative in September 2000, has played an important role in the company's turnaround, from a loss of Rs 500 crores in the year ended March 2001 to a profit of Rs 28 crores in the first quarter of 2002-2003. |

| Tata Motors has realised operational excellence will continue to be the critical determinant of success in the years to come. This case deals with the strategy adopted by Tata Motors for its turnaround and operational excellence. » Tata Motors, Operational Excellence | | Page No. | | | 1 | | | 2 | | | 4 | | | 6 | | | 11 | | | 13 | | | 16 | | | 18 | | | 19 | | | 2,6,14,21 | Tata Motors, Tata Engineering and Locomotive Co Ltd (TELCO), Operations management, Tata Group, Supply chain management, Cost reduction, Tata Indica, Tata Indigo, Vendor management, Six Sigma quality, Tata business excellence model Operations Management at Tata Motors - Next Page>> Case Studies Links:- Case Studies , Short Case Studies , Simplified Case Studies . Other Case Studies:- Multimedia Case Studies , Cases in Other Languages . Business Reports Link:- Business Reports . Books:- Text Books , Work Books , Case Study Volumes . Strategic Options for Automobile OEMs of Indian Origin to have Sustained Competitive Advantage: A Case of Tata Motors- Original Research

- Published: 02 August 2021

- Volume 16 , pages 139–152, ( 2021 )

Cite this article - Shivakumar S. Malagihal ORCID: orcid.org/0000-0002-5577-0040 1

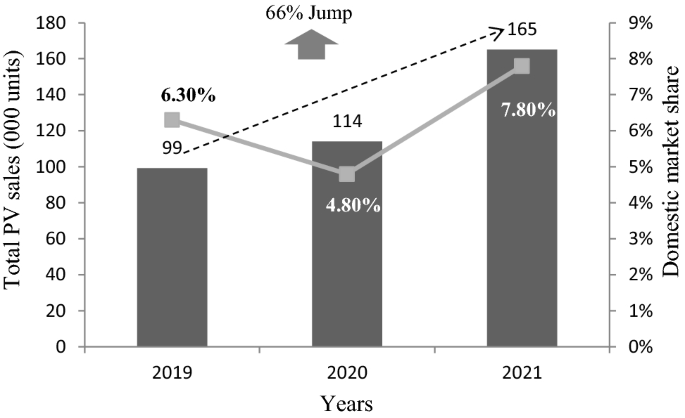

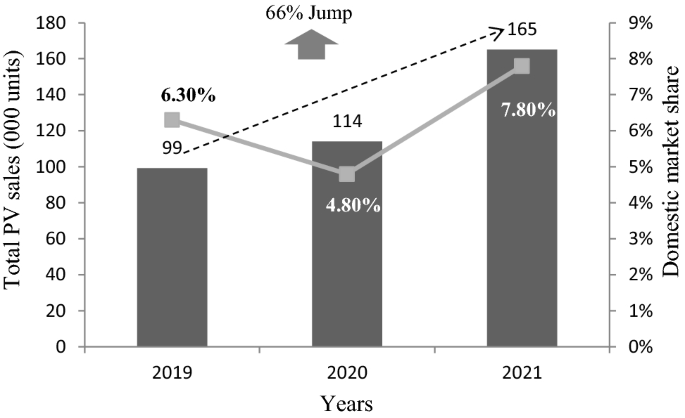

12k Accesses Explore all metrics The competitive landscape of automobile original equipment manufacturers around the globe is continuously changing, with new business models impacting the performance of automobile firms. The study uses benchmarking technique to benchmark Tata Motors passenger vehicle segment performance with a relevant foreign passenger vehicle manufacturer to explore the differences in core capabilities and platform strategies. The gaps reveal that there is tough competition among the firms in the automobile industry in India. The study also uses the problem structuring method to structure the key problem of Tata Motors' inadequate leverage of product platforms and identify the high potential root causes. The findings reveal that strategic options such as proper management of employees at top leadership positions, technologies, and strategic cooperation with partner firms may help Tata Motors better leverage new modular platforms. The new strategic options may also provide possibilities to scale internationally in niche vehicle product segments to achieve sustained competitive advantage. Among several potential capabilities and resources analyzed, only a few seem to be transferable to leverage advanced modular platforms and related digital technologies for Tata Motors. Similar content being viewed by others Internationalization of Tata Motors: Strategic Analysis Using Flowing Stream Strategy Process Internationalisation Process of Indian Auto Giants The Indian Automobile Industry: Technology Enablers Preparing for the FutureAvoid common mistakes on your manuscript. IntroductionThe automobile industry in India is an emerging and promising industry (Pillania, 2008 ; Sushil & Garg, 2019 ) that contributes 7.1% towards India's GDP and accounts for 4.3% of the total exports (Invest India, 2020 ). Due to the rapidly increasing demand, the automobile industry acts as an essential economic growth driver (MHIPE, 2012 ). Over the three decades, the Indian automobile industry has shown remarkable resilience to economic uncertainties; for example, Tata Motors Ltd has shown good recovery over the years and has registered impressive growth figures in the recent past. In India, the automobile industry, particularly the passenger vehicle business, was earlier dominated by local firms like Hindustan motors and Premier. However, after the liberalization in 1991, the Indian passenger vehicle market was flooded with foreign brands such as Suzuki, Hyundai, and Toyota, who set up their facilities in India and offered models at competitive prices. The foreign brands dominated the market and created an intensely competitive business environment for traditional firms of Indian origin, such as Tata Motors, Mahindra and Mahindra Limited, and Ashok Leyland. The growing economy and supportive demographic factors in India played an important role in making it an attractive automobile destination. According to the economic times auto ( 2018 ), only 22 people out of 1000 own a car in India, indicating a massive growth opportunity for India's automobile manufacturers. However, this opportunity to leverage domestic players' growth potential comes with the significant challenge of facing tough competition from multinational auto companies (Singh et al., 2007 ). These include Hyundai Motors, Maruti Suzuki, and others. This competition has increased pressure on firms of Indian origin (FIOs) to manufacture high-quality vehicles at a lower cost and manufacture different car models in a shorter lead duration (Scavarda et al., 2009 ; Singh et al., 2007 ). Today, FIOs have adequate reserves, but they seem to have inadequate technological capabilities and limited in-house expertise (Saad & Patel, 2006 ; Singh et al., 2007 ). To address these challenges, automobile FIOs have to improve their competitiveness and business performance by developing various sources of competitive advantage (Fig. 1 ), such as advanced technological capabilities with effective business strategies to avail the existing and future business opportunities.  Source: author’s compilation based on the adaptation of Momaya, ( 2001 ) and Ambastha and Momaya ( 2004 ) Indicative sources of competitiveness for PV automobile OEMs, their relevance and performance. The study intends to identify the potential sources of competitive advantage for the Tata Motors passenger vehicle segment in the digital economy. The sources are classified based on the Asset—Processes—Performance (APP) framework (Ambastha & Momaya, 2004 ), as shown in Fig. 1 . Among these three facets of competitiveness, the competitiveness process and performance facets are the prime focus of this study. The product platform strategy is common across several industries. A few examples of successful product platforms are Volkswagen's vehicle modular platform (Lampón et al., 2017 ), Intel's chip platform (Cusumano & Gawer, 2002 ), and HP's printer platform (Meyer & Lehnerd, 1997 ). In the long run, the product platform strategies seem to reduce production costs and increase product variety, helping firms gain a competitive advantage (Seyoum & Lian, 2018 ). Therefore, to investigate the potential capabilities of an already established automobile OEM, this research focuses on the following research questions: How do modular platforms act as a new strategic option to improve Tata Motors' domestic and international competitiveness? Which critical resources can help Tata Motors to sustain its competitive advantage in the digital economy? Literature and Conceptual BackgroundThis section presents brief literature on past studies related to the competitiveness of automobile firms in India. Appendix SA1 in the supplementary file highlights all the working definitions of key concepts used in this paper. The literature reviewed is summarized very briefly in two sub-sections below.  Competitiveness of Automobile Manufacturing Firms in IndiaWith globalization, automobile manufacturers have made numerous efforts to foster their competitiveness in the domestic and international markets. As a result, there is extensive research on multinational automobile manufacturers' competitive strategies from developed and developing nations (Freyssenet, 2009 ; Kalogerakis et al., 2017 ; Loganathan, 2013 ; Tambade et al., 2019 ). Most of the past studies have highlighted several findings on factors (Table 1 ) that impact the automobile industry's competitiveness. Scholars have also explicitly discussed the various priorities and factors contributing to car manufacturers' improved competitiveness in India. For example, in India, Nauhria et. al. ( 2011 ) listed the essential competitive priorities: consumer perspective, quality, and cost. Innovation and product technology as the following critical factors. However, the role of technology advancement (Umamaheswari & Momaya, 2008 ) and new platforms and digital technologies and platform capabilities to gain competitive advantage are less studied. Strategic Management of Technology as an Option to Improve Competitiveness and Business PerformanceTechnology is also considered an essential competitive factor at the firm level. Some scholars believe strategic technology management is a crucial practice to improve automobile OEMs (e.g., Maruti Suzuki) competitiveness (Sahoo et al., 2011 ), and techniques such as SAP-LAP (Sushil, 2009 ) were used to analyze the organization. Several researchers have studied the case of Tata Motors in recent times (Alagappan et al., 2013 ; Becker-Ritterspach & Bruche, 2012 ; Sushil & Garg, 2019 ). Becker-Ritterspach and Bruche ( 2012 ) focused on capability creation and internationalization of Tata Motors with the help of its business group; Alagappan et. al. ( 2013 ) highlight marketing strategy as one of the critical factors for competitive advantage. The study by Sushil and Garg ( 2019 ) attempts to list down and analyze some of the strategic options adopted by Tata Motors to manage the changing forces in the automobile industry. However, these studies focused very little on the progress of Tata Motors in leveraging technologies related to modular platforms as a strategic option for sustained competitive advantage (Bannasch et al., 2017 ). Methodologies and DataMethodologies. Among several frameworks of competitiveness, the ones that leverage benchmarking are considered better for exploratory studies. For example, the competitiveness Assets-Processes-Performance (Competitiveness APP) framework (Momaya, 2001 ; Ambastha & Momaya, 2004 ) allows extensive use of benchmarking (from quick benchmarking to detailed) at factor and criteria levels in phases such as diagnostics of problem, gap identification, and trend analysis. Another simple competitiveness framework ABCD tested in Indian contexts (e.g., Momaya, 2019 ; Moon et al., 2015 ) gives perspectives on benchmarking. So we have benchmarked TATA Motors passenger vehicle segment performance with leading passenger vehicle manufacturers in India and globally. The benchmarking approach enabled us to explore the differences in technological capabilities and platform strategies adopted by other leading firms in India. We conducted this study in three steps. First, we evaluate Tata Motors' performance by benchmarking its key strengths, market share, R&D spend, the number of patents filed, vehicle modular platform initiatives, and other financial parameters with global top-performing automobile OEM. In the second step, we attempt to structure the critical problem and determine the root causes using the problem structuring method (Momaya et al., 2016 ). The complete description of the problem structuring method is given in the supplementary file Appendix SA2. In the third and final step, the study attempts to identify and evaluate Tata Motors' critical resources and capabilities, including platform related, to explore how Tata Motors can engage in the platform economy to climb up the value curve (Umamaheswari & Momaya, 2008 ). The combination of benchmarking technique, problem structuring, and critical resource identification technique helped us analyze the performance gaps and platform capabilities among two plus one case organizations (the third case comparison can be seen in the supplementary file). This approach added strength to the research findings, although the nature of the data collected did not permit us to use any statistical technique. Despite several limitations, the study identified some exciting results that are different from previous studies' findings. Data Collection and AnalysisIn the first step, we collected data from secondary sources such as annual reports of select companies, literature, published articles, company websites, news media articles, and stories published by automobile associations (International council of clean transportation and the Society of Indian Automobile Manufacturers). In the second and third steps, we collected inputs through informal and structured interactions with the automobile industry to evolve better root causes and critical resource lists. Finally, we analyzed the qualitative and quantitative data collected from various sources and derived our findings and inferences based on the patterns and trends that emerged from the data. Case Study of Tata MotorsTata Motors is one of the leading international automobile manufacturers, part of the Tata group's multinational conglomerate. Tata Motors was incorporated on September 01, 1945, headquartered in Mumbai, India (Tata Motors Website, 2021 ). Tata Motors is listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Tata Motors is part of the Fortune Global 500 list. It has come a long way on a sustained international competitiveness journey by launching new innovative products and expanding into international markets, e.g., through Jaguar Land Rover's acquisition (JLR). Its product variants include passenger vehicles, commercial vehicles, and defence vehicles. Tata Motors' success in select segments is mainly supported by its ability to leverage technology and well-managed cooperative relationship to develop innovation capabilities (Bruche, 2010 ). Tata Motors, a market leader in the commercial vehicle segment, also managed to 'Leapfrog' to the passenger vehicle segment (Becker-Ritterspach & Bruche, 2012 ). Tata Motors leads the domestic market commercial vehicle segment with a 37% market share in 2019–2020 (Bloomberg, 2021 ). It has its manufacturing units in Lucknow, Dharwad, Pune Jamshedpur, Pantnagar, and Sanand in India. It also has marked its global presence by establishing manufacturing plants in the U.K., South Korea, Thailand, South Africa, Indonesia, Austria, and Slovakia. Tata Motors also has been in the passenger car market for over two and half decades. Over the years, it has launched classic indigenous vehicles such as the Tata Indica, Tata Sumo, Tata Safari, and the Tata Nano. However, TML's business in the passenger vehicle segment has remained relatively weak for many years due to increasing domestic competition from international auto manufacturing firms such as Hyundai Motors, Volkswagen, and Maruti Suzuki (Bodhanwala & Bodhanwala, 2020 ). TML's passenger vehicles (PV) business dropped to 5.7% in 2018 from its 15% share in 2008, as shown in Figs. 2 , 3 . Tata Motors is also not present in every car segment (refer to Table SA3.7 in supplementary file) and has limited product variants indicating its growth opportunities in many other categories .  Source: SIAM, India Brand Equity Foundation ( 2008 ); International council on clean transportation (2020). Passenger vehicle market size (2018): Approx. 4 Million; Source: SIAM Market Share of automobile companies in the passenger car segment in India (FY 2008 and 2018).  Source: created by Author based on the data from Tata Motors Investors Resources—Investing in Tata Motors ( https://www.tatamotors.com/investors/download-library/ ) Tata Motors market share in the passenger vehicle segment, FY 2010—FY Q1 2019. In 2017, the Chairman of Tata Sons, Natarajan Chandrasekaran, expressed his concern over the losses in Tata Motors' passenger car segment and its cost structures are out of whack. Every car and model at Tata Motors was losing money, and the chairman highlighted the importance of picking up volumes to become profitable (Taumar, 2017 ). Emerging Findings from the Comparative Analysis StudyIndicative findings from quick benchmarking tata motors with hyundai motors company. While Maruti Suzuki India limited holds the maximum share in the Indian passenger segment (India Brand Equity Foundation, 2021 ), Hyundai Motors Company (HMC), which has entered India in 1996, has progressed well in a short period. An initial literature review and a quick benchmarking with Hyundai Motors provided brief insights into Tata Motors Limited's (TML) gaps; Table 2 provides a glimpse. TML's inadequate leverage platforms (e.g., modular platforms and digital platforms) to enhance its domestic and international competitiveness is a significant problem to be studied. In addition, TML's considerable loss in the passenger vehicle segment's domestic market share over the years, as discussed earlier, and its slow strategic decision-making ability to address the problem seems to be a significant competitiveness dilemma. Appendix A Tables 6 , 7 , 8 exhibit the quick benchmarking between Tata Motors and Hyundai Motors India (India market). The overall financial condition of Tata Motors has underperformed (e.g., Net income, EBITDA) compared to Hyundai Motors India and has relatively low ROIC (return on invested capital) growth (Appendix A Table 8 ). In the last 5 years, Hyundai's better performance (domestic and international markets) can be attributed to its increasing employee productivity, as shown in Fig. 4 .  Source: Refinitve database Employee productivity (domestic and international markets) of TML and HMC. Indicative Findings from a Detailed Comparison of Select Companies—Passenger Vehicle SegmentHyundai's capabilities include having superior physical and digital infrastructure with high availability and excellent customer interfaces well-established standards to build good relationships with consumers on new digital channels such as online sales and social media platforms. On the other hand, Tata Motors has come a long way in the Indian automobile industry since 1945 and is still experiencing slow growth in its product portfolio in the domestic market. As shown in Fig. 5 , Tata Motors' PV business focus has remained domestic, and the domestic market is smaller (4 million, SIAM) than other western markets. Tata Motors has focused significantly less on exports and has diminishing export values than Hyundai Motors India, as shown in Fig. 6 . Tata Motors has 60% market coverage in various segments, focusing on positioning itself in the growing SUV segments. Tata Motors has not shown interest to cater its vehicles in all the available passenger vehicle segments (refer to Table SA3.7 in supplementary file).  Source: TML and HMI sales webpage. Note: HMI—Hyundai Motors India; TML: Tata Motors Limited Passenger vehicles (cars) domestic sales as % of total sales (domestic and export).  Passenger vehicles (cars) exports numbers as % of total sales (domestic and export). The Indian automobile major Tata Motors is years behind when it comes to using advanced technologies compared with leading international automobile manufacturers. This section also addresses Tata Motors' inadequate leverage of new platform approaches to improve its domestic and international competitiveness in the passenger vehicle segment. Hyundai's ability to leverage platforms (Table 3 ) and other advanced automobile digital technologies (Table 4 ) may have helped HMC to achieve a sustainable competitive advantage in the Indian automobile market. For cost innovation, HMC also plans to adopt new global modular electric vehicle architecture to enhance the efficiency and scalability of product development. For example, Hyundai has a new E-GMP platform that will underpin future Hyundai, Kia, and Genesis models. On the other hand, Tata Motors' current passenger vehicles are built on four platforms Tata X1, Super Ace, Modular platforms (Alfa and Omega), and it plans to make all its vehicles on Alfa and Omega. Moreover, in response to the COVID-19 pandemic, car OEMs have launched their online sales platforms. For example, 'ClicktoDrive' by Tata Motors and 'Clicktobuy' by Hyundai Motors India. The new online sales platforms have integrated more than 600 dealer outlets across India (Tata Motors news, 2020 ; Hyundai Motors press, 2020 ). How may new Platforms help Tata Motors in Gaining a Sustained Competitive Advantage?Although the strategic investment decision to reduce the number of vehicle platforms was taken in 2013, Tata Motors took more than seven years to launch their first modular platform (e.g., advanced modular platform in 2020). Post the modular platform release, Tata Motors is able to climb up to the third position in passenger vehicle sales for the financial year 2020–21 (Tata Motors annual analyst engagement report, 2021 ). The company posted sales of 1.65 lakh units of PVs in FY20-21, a growth of 66% from the 2019 financial year sale values as shown in Fig. 7 , but the company is still making losses on its passenger segment (Appendix A Table 6 ).  Source: Tata Motors annual analyst engagement report 2021 Tata Motors PV volumes launched on new platforms (launched from 2019). Summary Findings from Problem StructuringThe initial benchmarking exercise with Hyundai Motors Company provided an idea about Tata Motors Limited's passenger vehicle segment gaps. Inadequate leverage of new platform approaches to improve its competitiveness in the passenger vehicle segment is a significant problem for Tata Motors. Some critical competitiveness dilemmas are decreasing passenger vehicle market share in India and the low ability to leverage its long legacy brand value in India. While its commercial vehicle segment is a leader in the domestic market, its passenger vehicle segment's contribution to achieving a sustainable competitive advantage is questionable. The study attempts to structure the relatively less addressed Tata Motors passenger vehicle segment's inadequate leverage of new platform approaches to enhance its overall competitiveness. The actor-based root cause analysis (Momaya et al., 2016 ) helped us identify the potential actor-based root causes for the problem identified. The study revealed that all the identified five actors (refer to blue line box in Fig. 8 ) contribute equally to the problem identified.  Indicative Root Cause Analysis (RCA) Diagram. Note: Red doted boxes are high potential causes identified (scored above seven). Refer to Table SA3.11 in the supplementary file The reasons associated with Tata Motors' top management team of the passenger vehicle segment, more specifically the frequent exit of top leaders in the PV segment and unwillingness to adopt new business models, emerged as the primary root cause for the problem identified. Followed by this, the decision of the government of India to implement BS-VI by skipping the BS-V increased the spending of Tata Motors to adhere to BS-VI norms. Overall, top leaders' strategic investment decision ability and the production and design capabilities of Tata Motors are causing the inadequate leverage of the product platform approach as a new strategic option to improve domestic and international competitiveness. The study indicates that Tata Motors may need to focus on agility and its cultural change to adapt new models and efficiently leverage the modular platform approach to create more growth opportunities. Evaluation of Tata Motor's Critical Resources and CapabilitiesIn this section, the study attempts to leverage the resource-based view (Barney, 1991 ) to analyze Tata Motors Limited's resources (Table 5 ) that are valuable, rare, inimitable, and organizational-oriented. We have established a list of approximate resources and capabilities based on our interaction with the highly experienced experts (Castanias & Helfat, 1991 ) from academia and the automobile industry. Tata Motor's decision to focus on developing the advanced modular platforms and product sequencing capabilities seems to provide an opportunity to improve its economies of scale and scope, reduce development timelines, and improve sustainability. Tata Motors can strengthen its technological capabilities with its advanced modular platforms, such as connected vehicle technology and digital platforms. Tata Motor's sister firms, such as Tata Consultancy Services, Tata Communications, and Tata Technologies, can help develop cloud-based IoT platforms, connectivity technologies, and data management (Tata review, 2020 ). Focus on standardization and decentralization of its operations may help the firm reduce operating costs and improve its production efficiency. Utilizing its existing research and technology capabilities may also help the firm develop future-ready innovative products (Sushil & Garg, 2019 ). Another critical resource that can provide high value to customers is its online sales digital platform called 'Click to Drive.' The online digital sales platform helps automobile OEMs and dealers to improve customer engagement even after sales (Tata Motors Press, 2020 ). Conclusions and ImplicationsAutomobile OEMs worldwide, such as Volkswagen, Volvo, and BMW, are early adapters to modular platforms (Lampón et al., 2019 ). However, OEMs from Asia are slow in leveraging modular platforms and their associated digital technology advantages. Asian automobile OEMs seem to have started developing modular platforms, particularly for passenger vehicles launched on electric vehicle (EV) platforms (e.g., Hyundai Motors E-GMP and Tata Motors' electric vehicle modular platform). These electric vehicle platforms have better engine and transmission sub-platform, where electronics content is much higher, and there is potential for data collection. For automobile manufacturers OEMs, achieving economies of scale enhances their competitiveness in new product development and production systems (Haugh et al., 2010 ). In addition, standardizing the components and having a more significant number of standard units per automobile platform leads to economies of scale (Becker & Zirpoli, 2003 ). Hence, modular platforms can be considered an option among automobile OEMs to achieve a competitive advantage. Effective utilization of reserves, efficient management of digital technologies, and better leverage of its research and development capabilities can help Tata Motors to sustain its competitive advantage in the digital economy. Among several potential capabilities and resources analyzed, only a few seem to be transferable to leverage advanced modular platforms and related digital technologies for Tata Motors. Accordingly, the sustainability of competitive advantages of Tata Motors in segments related to new modular platforms and digital platforms seems low. Tata Motors has been in the Indian passenger vehicle market for over two and half decades. It seems to have started focusing on leveraging the modular platform approach. Tata Motors currently has developed two modular platforms: Alfa and Omega modular platforms. The firm plans to place all its new car models on these two platforms to improve its economies of scale. Still, the pace of adopting new modular platforms to gain economies of scale and scope is languid as compared to Hyundai Motors and western automobile OEMs. Moreover, adopting modular platforms demands more capital investments to develop new production facilities (Lampón et al., 2019 ). Still, Tata Motor may explore ingenious adaptation and technology absorption for specific new product development to reduce risks (Momaya, 2018 ). Hence, Tata Motors may have to make crucial strategic investment decisions before it is too late. Key questions that emerged in the problem structuring method areas follows: What are the possible opportunities in the electric car segment for TATA Motors in the domestic and international market? What segments of a passenger vehicle or mobility platform shall Tata Motors focus on for profitable growth in India and select international markets? The proximate implications for automobile firms of Indian origin in passenger vehicle manufacturing seem to be precise. The platform modular approach and leveraging digital platforms can be a valuable option to consider. New platform options may help OEMs of Indian origin to catch up fast with other international OEMs. Cooperative strategies with matching partners (e.g., Momaya, 2009 ) can become important for such catch-up. Firms of Indian origin (FIOs) have strategic choices about cooperating with start-ups, ventures, or large firms in India, Asia, or the West. Careful decisions based on strategic insights can shape their future. The paper's contribution is in using a detailed benchmarking technique that highlights the importance of leveraging capital-intensive modular platforms adequately by automobile firms in India to attain sustained competitive advantage. The study also contributes to 'characterizing the modular platform phenomenon' using the problem structuring' approach (Momaya et al., 2016 ). After multiple interactions with automobile industry experts (details provided in the supplementary file Table SA3.8), we identified the potential root causes for the problem statement ('EYE' of the root cause diagram). Finally, the study also contributes to theory by considering modular platforms as distinct strategic resource thinking in the competitive advantage research using tools such as VRIO. Limitation and Future ResearchFinally, this study has several limitations. First, the number of cases compared is small, and OEMs in India are still in their early stages of leveraging new platform approaches. Once Indian OEMs advance further, it would be advisable to confirm the findings of this study. Although some firms such as Hyundai seem to be shifting towards modular platforms in later generations, creating a competitive advantage for FIO can be difficult in modular platforms (particularly against Chinese firms with more significant economies). Understanding what balances between modular vs. integrated, physical vs. digital platforms that help FIOs gain competitive advantage can be a valuable topic to study. Management of Technology (MoT; see Momaya, 2018 ) can be another high potential research area for international competitiveness. It can involve technology foresight to identify and invest in high-potential segments of greener mobility. Key Questions Reflecting Applicability in Real LifeHow do you connect your functional area (e.g., operations, finance, technology management, or HR) with the international competitiveness of the firm of your choice? How can the problem structuring method be used to structure the critical problems in real-life organizations? How can firms with limited platform capabilities sustain competitive advantage? What balances between modular vs. integrated, physical vs. digital platforms can help FIOs gain international competitive advantage? Alagappan, B. C., Sahu, S., & Sahney, S. (2013). Marketing competitiveness: a case on launch of TATA nano. International Journal of Global Business and Competitiveness, 8 (1), 39–51. Google Scholar Ambastha, A., & Momaya, K. (2004). Framework for competitiveness. Singapore Management Review, 26 (1), 45–61. Bannasch, F., Rossi, G., Thaidigsmann, B. (2017). Push toward platforms and modularity: Choosing the right product development organization design. 1–7. Available at https://www.mckinsey.com/business-functions/operations/our-insights/platforms-and-modularity-setup-for-success . Accessed 18 Feb 2021. Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17 (1), 99–120. https://doi.org/10.1177/014920639101700108 . Article Google Scholar Becker, M. C., & Zirpoli, F. (2003). Organizing new product development: knowledge hollowing-out and knowledge integration - the FIAT auto case. International Journal of Operations & Production Management, 23 (9), 1033–1061. https://doi.org/10.1108/01443570310491765 . Becker-Ritterspach, F., & Bruche, G. (2012). Capability creation and internationalization with business group embeddedness - the case of Tata Motors in passenger cars. European Management Journal, 30 (3), 232–247. https://doi.org/10.1016/j.emj.2012.03.009 . Bloomberg, Q. (2021). Auto sales in december 2020: eicher sales rise 37%, Tata Motors' passenger vehicle sales nearly double. Bodhanwala, S., & Bodhanwala, R. (2020). Tata Motors: Can the turnaround plan improve performance? https://www.iveycases.com/ProductView.aspx?id=107468 . Accessed 8 Mar 2021. Bruche, G. (2010). Tata Motor's transformational resource acquisition path: A case study of latecomer catch-up in a business group context (No. 55). Working Papers of the Institute of Management Berlin at the Berlin School of Economics and Law (HWR Berlin). Castanias, R. P., & Helfat, C. E. (1991). Managerial resources and rents. Journal of Management, 17 (1), 155–171. https://doi.org/10.1177/014920639101700110 . Cusumano, M. A., & Gawer, A. (2002). The elements of platform leadership. MIT Sloan Management Review, 43 , 51–58. D’Cruz, J., & Rugman, A. (1992). New Concepts for Canadian Competitiveness . Kodak. Dhingra, M. (2020). Over 1,900 bookings made via Hyundai's Click to Buy. https://www.autocarindia.com/car-news/over-1900-bookings-made-via-hyundais-click-to-buy-417893 . Accessed 12 Feb 2021. E.T. Auto. (2018). India has 22 cars per 1,000 individuals: Amitabh Kant. E.T. Auto. Available at https://auto.economictimes.indiatimes.com/news/passenger-vehicle/cars/india-has-22-cars-per-1000-individuals-amitabh-kant/67059021 . Accessed 18 Feb 2021. Freyssenet, M. (2009). The Second Automobile Revolution, Trajectories of the World Car makers in the 21st Century . Palgrave Macmillan. Haugh, D., Mourougane, A., & Chatal, O. (2010). The Automobile Industry in and beyond the Crisis. OECD Economics Department Working Papers . OECD Publishing. Hyundai Motors. (2018). Investor presentation. https://www.hyundai.com/content/hyundai/ww/data/ir/calendar/2018/0000000203/files/hmc-ir-pt-may-2018.pdf . Accessed 20 Feb 2021. Hyundai Motors press (2020). Available at https://www.hyundai.com/in/en/hyundai-story/media-center/india-news.html#itemView . Accessed 12 Apr 2021. ICCT. (2020). https://theicct.org/publications/fuel-consumption-pv-india-052020 . Accessed 10 Mar 2021. India Brand Equity Foundation. (2021). Automobile Industry in India. Available at https://www.ibef.org/industry/india-automobiles.aspx . Accessed 10 Mar 2021. India Brand Equity Foundation. (2008). Available at https://www.ibef.org/download/Automotive_010709.pdf . Accessed 10 Mar 2021. Invest India. (2020). Running in the top gear. https://www.investindia.gov.in/sector/automobile . Accessed 12 Feb 2021. Kalogerakis, K., Fischer, L., & Tiwari, R. (2017). A Comparison of German and Indian innovation pathways in the auto component industry. Working paper, Institute for Technology and Innovation Management, Hamburg University of Technology, Hamburg, October. https://doi.org/10.15480/882.1633 . Kumar, S. R., & Bala Subrahmanya, M. H. (2010). Influence of subcontracting on innovation and economic performance of SMEs in Indian automobile industry. Technovation, 30 (11–12), 558–569. https://doi.org/10.1016/j.technovation.2010.06.005 . Lampón, J. F., Cabanelas, P., & González-Benito, J. (2017). The impact of modular platforms on automobile manufacturing networks. Production Planning and Control, 28 (4), 335–348. https://doi.org/10.1080/09537287.2017.1287442 . Lampón, J. F., Frigant, V., & Cabanelas, P. (2019). Determinants in the adoption of new automobile modular platforms: What lies behind their success? Journal of Manufacturing Technology Management, 30 (4), 707–728. https://doi.org/10.1108/JMTM-07-2018-0214 . Loganathan, Y. D. (2013). Contemporary tools and approach for project management sustainability in Indian automotive industry Nos 01–1278 (pp. 1–12). SAE International. https://doi.org/10.4271/2013-01-1278 . Book Google Scholar Meyer, M. H., & Lehnerd, A. P. (1997). The Power of Product Platforms . The Free Press. MHIPE. (2012). Report of Working Group on Automotive Sector for the 12th Five Year Plan. Ministry of Heavy Industries & Public Enterprises, Government of India, available at: https://dhi.nic.in/writereaddata/Auto%20report%20final.pdf . Accessed 14 Feb 2021. Momaya, K. S. (2001). International Competitiveness: Evaluation and Enhancement . Hindustan Publishing Corporation. Momaya (2008). Management of Technology and Innovation (MoT) for Competitiveness: Diagnosing Problems at Vonda Motors, ET Cases, No. STG-1-0058, pp. 1-9; Reference no. 318-0001-1, last accessed on March 2, 2021 at https://www.thecasecentre.org . Momaya, K. (2009). Exploring cooperative strategies for innovation: case of biopharmaceutical firms from India and Japan. The Journal of Science Policy and Research Management, 23 (4), 327–338. https://doi.org/10.20801/jsrpim.23.4_327 . Momaya, K. S. (2018). Management of Technology and Innovation (MoT) for Competitiveness: Diagnosing Problems at Vonda Motors, Case Reference no. 318-0001-1. https://www.thecasecentre.org/main/products/view?id=149299 . Accessed May 31. Momaya, K. S. (2019). The past and the future of competitiveness research: a review in an emerging context of innovation and EMNEs. International Journal of Global Business and Competitiveness, 14 (1), 1–10. https://doi.org/10.1007/s42943-019-00002-3 . Momaya, K. S., Bhat, S., & Lalwani, L. (2016). Institutional growth and industrial competitiveness: exploring the role of strategic flexibility taking the case of select institutes in India. Global Journal of Flexible Systems Management, 11 (2), 111–122. https://doi.org/10.1007/s40171-016-0144-2 . Moon, H. C., Lee, Y. W., & Yin, W. (2015). A new approach to analysing the growth strategy of business groups in developing countries: the case study of India’s Tata Group. International Journal of Global Business and Competitiveness, 10 (1), 1–15. Nauhria, Y., Kulkarni, M. S., & Pandey, S. (2018). Development of strategic value chain framework for Indian car manufacturing industry. Global Journal of Flexible Systems Management, 19 (1), 21–40. https://doi.org/10.1007/s40171-017-0179-z . Nauhria, Y., Pandey, S., & Kulkarni, M. S. (2011). Competitive priorities for Indian car manufacturing industry (2011–2020) for global competitiveness. Global Journal of Flexible Systems Management, 12 (3 & 4), 21–32. https://doi.org/10.1007/BF03396603 . Pahurkar, R. N., & Metha, P. (2017). Developing sustainable marketing strategy for electric vehicle (EV) – automotif. International Journal of Emerging Research in Management & Technology, 6 (11), 115–129. https://doi.org/10.23956/ijermt.v6i11.54 . Pillania, R. K. (2008). Creation and categorization of knowledge in automotive components SMEs in India. Management Decisions, 46 (10), 1452–1464. https://doi.org/10.1108/00251740810919986 . Rugraff, E. (2012). The new competitive advantage of automobile manufacturers. Journal of Strategy and Management, 5 (4), 407–419. https://doi.org/10.1108/17554251211276371 . Saad, M., & Patel, B. (2006). An investigation of supply chain performance measurement in the Indian automotive sector. Benchmarking an International Journal, 13 (1/2), 36–53. https://doi.org/10.1108/14635770610644565 . Sahoo, T., Banwet, D. K., & Momaya, K. (2011). Strategic technology management in practice: SAP-LAP hills analysis of an automobile manufacturer in India. International Journal of Business Excellence, 4 (5), 519–543. https://doi.org/10.1504/IJBEX.2011.042156 . Scavarda, L. F., Schaffer, J., Scavarda, A. J., Reia, A. C., & Schleich, H. (2009). Product variety: an auto industry analysis and a benchmarking study. Benchmarking an International Journal, 16 (3), 387–400. https://doi.org/10.1108/14635770910961399 . Seyoum, B., & Lian, Y. (2018). Market performance implications of modularization: evidence from global auto firms operating in China. International Business Review, 27 (1), 852–866. https://doi.org/10.1016/j.ibusrev.2018.01.008 . Singh, R. K., Garg, S. K., & Deshmukh, G. S. (2007). Strategy development for competitiveness: a study on Indian auto component sector. International Journal of Productivity and Performance Management, 56 (4), 285–304. https://doi.org/10.1108/17410400710745315 . Sushil, S. (2009). SAP-LAP linkages – a generic interpretive framework for analyzing managerial contexts. Global Journal of Flexible Systems Management, 10 (2), 11–20. https://doi.org/10.1007/BF03396558 . Sushil, S., & Garg, S. (2019). Internationalization of Tata Motors: strategic analysis using flowing stream strategy process. International Journal of Global Business and Competitiveness, 14 (1), 54–70. https://doi.org/10.1007/s42943-019-00006-z . Tambade, H., Singh, R. K., & Modgil, S. (2019). Identification and evaluation of determinants of competitiveness in the Indian auto- component industry. Benchmarking an International Journal, 26 (3), 922–950. https://doi.org/10.1108/BIJ-09-2017-0260 . Tata Motors Annual report. (2020). Tata Motors Limited. Accessed 20 Mar 2021. Tata Review. (2020). Report available at https://www.tatamotors.com/wp-content/uploads/2020/11/05114223/media-01oct20.pdf . Accessed 25 Feb 2021. Tata Motors Website (2021). Available at https://www.tatamotors.com/about-us/company-profile/ . Accessed 15 Mar 2021. Tata Motors annual analyst engagement report. (2021). Available at https://www.tatamotors.com/wp-content/uploads/2021/02/22133316/Tata-Motors-Group-Investor-Day_India-Business-2021.pdf . Accessed 24 Apr 2021. Tata Motors Press. (2020). Tata Motors launches' Click to Drive' – a contactless sales platform. Available at https://www.tatamotors.com/press/tata-motors-launches-click-to-drive-a-contactless-sales-platform/ . Accessed 20 Feb 2021. Taumar, D. (2017). Every car made by Tata Motors is losing money: N Chandrasekaran. https://auto.economictimes.indiatimes.com/news/industry/every-single-car-is-losing-money-at-tata-motors-n-chandrasekaran/61004017. Accessed 25 Mar 2021. Umamaheswari, R., & Momaya, K. (2008). Role of creative marketing in 10X journey: case of I.T. Firms from India. IIMB Management Review, 20 (1), 113–130. Download references AcknowledgementsI am thankful to all the automobile industry experts for sharing their valuable inputs through informal and structured interactions, which helped in building up the case effectively. I want to acknowledge and thank all the anonymous reviewers, the editors of JGBC, and the Editor-in-Chief, Dr. Kirankumar S. Momaya, for their valuable comments and suggestions that significantly improved this article. I would also like to thank the members and associates of the Group on Competitiveness, IIT Bombay, especially Dr. Ajitabh Ambastha and Padmanav Adhikari, for their support and guidance. Thanks to all the faculty members and fellow researchers of Shailesh J. Mehta School of Management, IIT Bombay, and TA and fellow learners of Competitiveness courses, particularly Resham Khade, for their support and help during the research based on the course project. The author did not receive any funding support from any organization for the submitted work. Author informationAuthors and affiliations. Shailesh J. Mehta School of Management, IIT Bombay, Powai, 400076, Mumbai, India Shivakumar S. Malagihal You can also search for this author in PubMed Google Scholar Corresponding authorCorrespondence to Shivakumar S. Malagihal . Ethics declarationsConflict of interest. The author declared no potential conflicts of interest concerning the research, authorship, and publication of this article. Supplementary InformationBelow is the link to the electronic supplementary material. Supplementary file1 (PDF 631 kb)Additional tables related to quick benchmarking Rights and permissionsReprints and permissions About this articleMalagihal, S.S. Strategic Options for Automobile OEMs of Indian Origin to have Sustained Competitive Advantage: A Case of Tata Motors. JGBC 16 , 139–152 (2021). https://doi.org/10.1007/s42943-021-00029-5 Download citation Received : 25 March 2021 Accepted : 02 July 2021 Published : 02 August 2021 Issue Date : December 2021 DOI : https://doi.org/10.1007/s42943-021-00029-5 Share this articleAnyone you share the following link with will be able to read this content: Sorry, a shareable link is not currently available for this article. Provided by the Springer Nature SharedIt content-sharing initiative - Automobile OEMs

- Passenger vehicle segment

- Strategic options

- Platform approach

- Sustained competitive advantage

- Find a journal

- Publish with us

- Track your research

- Relationship with Supply Chain Partners

- Corporate Overview

Initiatives on building sustainable relationships with our supply chain partners Automobile companies have a complex supply chain. The automobile supply chains can be broadly classified into - Direct Material Suppliers (auto components fitted on vehicle) and Indirect Material Suppliers (consumables such as paint, pre-treatment chemicals gases, etc. used in the manufacturing process as well as other materials required for supporting processes). The other key component of the automobile value chain includes sales & marketing and after sales service to ensure a superior customer experience through dealers and service touch points. We engage with our channel partners as well as suppliers very closely. We believe partnering with our suppliers and dealers for sharing knowledge and developing capacity, will add to our cost efficiency and ensure an enhanced customer experience.  Our 'Project Sankalp' benefits bottom-of-the pyramid supplier partners in the areas of quality, productivity and profitability through capability building, elimination of waste (rework, rejections, transit damages, etc.) conservation of resources and a better work environment thereby ensuring business continuity.  Jaguar Land Rover's supply chain is complex and growing in line with our international expansion Around 72% of JLR's suppliers participated in the CDP Supply Chain survey in 2015-16, which compares well with the CDP average of 51%. The Carbon Disclosure Project (CDP) Supply Chain programme is an important global platform for engaging with suppliers to help businesses decarbonise and strengthen their own resilience. JLR's UK supply chain has grown strongly, matching its growth story. UK-sourced components have increased to 50%, creating GBP 3.5 billion per annum of additional UK contracts, supporting 200,000 jobs and taking its total annual manufacturing spend with UK suppliers to more than GBP 6.5 billion. In the last five years, JLR's investment has generated more than 60,000 new jobs in the UK supply chain. In FY 2017, TML has engaged with 105 top suppliers who have reported on their environmental, social and governance performance. In addition, we conducted site assessment of 52 suppliers and the combined performance is given below: ISO 14001 compliant OHSAS 18001 compliant ISO 14001- In process OHSAS 18001 - In process 540322.54 GJ Total energy consumption 95315.82 tCO 2 e Scope 1 & Scope 2 emission Lost Time Injury (LTI) Suppliers using renewable energy 288980.26 m 3 Water consumption 83086.31 MT 7.5% female workers Gender diversity Incidents of non-compliance (Legal compliance) Employee unions at suppliers 25 suppliers with near-miss monitoring Internationalization of Tata Motors: Strategic Analysis Using Flowing Stream Strategy Process- January 2020

- International Journal of Global Business and Competitiveness 14(1)

- Indian Institute of Technology Delhi

- Indian Institute of Management Shillong

Abstract and Figures Discover the world's research - 25+ million members

- 160+ million publication pages

- 2.3+ billion citations

- A. V. Shishkin

- Benchmark Int J

- Louis Turner

- Michael E. Porter

- Recruit researchers

- Join for free

- Login Email Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google Welcome back! Please log in. Email · Hint Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google No account? Sign up

- Entertainment

- Life & Style

To enjoy additional benefits CONNECT WITH US  Tata Motors confident of sustaining growth amid supply chain concernsUpdated - February 22, 2021 10:51 pm IST Published - February 22, 2021 10:32 pm IST - NEW DELHI Tata Motors logo outside the company’s showroom in Mumbai. File Even as shortage of semiconductors, steel prices and muted macroeconomic indicators pose a challenge for the auto industry as it recovers from the impact of COVID-19, Tata Motors said growth momentum in its passenger vehicles was sustainable, as it was driven by latent demand and its ‘new forever’ range of products, a senior company executive said. Speaking to The Hindu , Shailesh Chandra, president, Passenger Vehicles Business Unit, Tata Motors, said that he expected the passenger vehicle segment to close the current fiscal year with a decline of about 5%. This, he said, was an improvement given an earlier expectation of a 20% decline. For the coming financial year he expects a double-digit growth for the entire segment. The company on Monday unveiled the all-new Safari SUV with introductory prices ranging from ₹14.69 lakh to ₹21.45 lakh. Steep ramp-upCompared with the 12% decline in PVs for the industry year-to date, Tata Motors has seen a 46% growth. The backbone of the success is the company’s ‘new forever’ range of models, he added. “... but we have taken certain very transformative steps in the front-end as well as some very stupendous effort on the back-end also, which has led to a very steep ramp up from sales of 11,000 units per month to nearly 27,000 units per month.” “It is easy for us to sustain this because there is still a gap in terms of what is the booking rate that we are getting and what we are able to supply even with the five products that we have. Now, on top of that we are adding Safari and we plan to bring Hornbill in the current calendar year. So therefore, it is not only about sustaining this growth; we are actually very confident of growing from where we are,” Mr. Chandra said. He noted that the industry perspective had been seeing recovery since Q2 over the previous financial year which was a low base year. “... the silver lining is that the last five-six months have been double-digit growth for the industry. Also, typically after Diwali, there is a 35% drop in the demand which has not happened this year…,” he said. Mr Chandra added that this showed there was sustenance of demand which the supply side is not able to meet and therefore there is a lot of latent demand remaining still. “...Given that the industry is at possibly the lowest level of inventory levels at channel partners and there is a need to replenish that, is showing that the demand is going to sustain for a while. Of course, it remains uncertain because the macroindicators are not that great. When you talk in terms of the whole economy, when you talk about the fuel prices, It’s not that good, but still it is sustaining because of a few factors,” he said. Mr. Chandra said that while the shortage of semiconductor as well as steel prices were going to be a ‘real issue’, currently there was ‘no reason to panic’. Shortage restricts potential“We are pretty much in a similar situation as the industry from a supply side perspective...this is going to be a challenge for us also. There are a series of actions that we have taken to overcome that...and so far we have been able to manage. It’s an uncertain situation but there’s nothing to panic as of now,” he said, adding that this definitely restricted the entire industry from fully unleashing the potential in the demand that they were currently seeing. He said the firm’s product strategy would depend on which segments that showed propensity for growing faster than the rest of the industry, and which ones were going to balloon in size going forward...within those segments we analyse the customer segment and the price points and see what is the best value proposition we can bring rather than showing a me-too product.” “There is a significant growth one is seeing in the SUVs. From a 9% share of SUVs about 10 years agp, it is now 33%. So it is gaining importance, there is a greater disposable income that you’re seeing...people are upgrading also from a lower segment to the higher segment and a big opportunity that one is seeing in the mid-size SUV space. And from our perspective it was important for us to tap this growth and be in that sweet spot where the future is headed towards,” he said. Related TopicsTop news today. - Access 10 free stories every month

- Save stories to read later

- Access to comment on every story

- Sign-up/manage your newsletter subscriptions with a single click

- Get notified by email for early access to discounts & offers on our products

Terms & conditions | Institutional Subscriber Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments. We have migrated to a new commenting platform. If you are already a registered user of The Hindu and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.  |

IMAGES

VIDEO

COMMENTS

This document discusses supply chain management at Tata Motors Limited, a leading automobile manufacturer in India. It begins with an overview of the automobile industry in India, noting its importance to the economy and factors influencing demand. It then provides background on Tata Motors and describes key aspects of its supply chain management approach, including relationships with ...

Supply Chain Management Case Study: Tata Motors. 937 Words4 Pages. Threats : MUL recently faced a decline in market share from its 50.09% to 48.09 % in the previous year (2011) • Major players like MARUTI Suzuki, HYUNDAI, Tata has lost its market share due to many small players like Volkswagen- polo. Ford has shown a considerable increase in ...

the same time facing sustainable challenges. Tata Motors is one of India's most well-known vehicle manufacturers. This case study examines how the company handles sustainable supply chain management and analyses sustainable supply chain management in the Indian automotive industry by specifically focusing on Tata Motors.

Abstract: Supply/Distribution Chain Management includes the planning and. management of all activities involved in sourcing and procurement, conversion and all. logistics management activities. It ...

Blog Home » Tata Motors Case Study: History, Business Model, Products, Financials, Peers, and SWOT Analysis. ... Tata Motors signed a deal to supply 3,500 EVs to BluSmart Mobility, India's first electric and shared smart mobility company, expanding Delhi NCR electric fleet and offering customers more environment-friendly travel options ...

Design & Tools and Managing Supplier Quality. In this paper, we pres ent a case study of how Tata Motors. Ltd (TML), an Automotive OEM giant in India, has successfully implemented Supplier Quality ...

Operations Management at Tata Motors. This case study was compiled from published sources, and is intended to be used as a basis for class discussion. It is not intended to illustrate either effective or ineffective handling of a management situation. Nor is it a primary information source. Tata Motors, previously known as Tata Engineering and ...

Supplier Quality Management Case Study - Tata Motors Ltd. (An Automotive OEM in India) ... In this phase, TML ensures that suppliers form integral part of supply chain for the OEM, and,

INTRODUCTION: WE would be understanding the crucial Business Operations and Supply Chain Management with the help of the case study of Tata motors by understanding the management concepts and models it uses for its successful operations. Tata Motors is among the world's leading manufacturers of automobiles. They are India's largest automobile manufacturer and continue to take the lead in ...

The document discusses Tata Motors' supply chain. It provides background on Tata Motors, founded in 1945 in India. It then describes the key aspects of Tata Motors' supply chain, including procurement, inventory, transportation, facilities, information management, and sustainability strategies. It also presents a case study using a gravity model to determine the optimal location for a ...

261535033-Supply-Chain-Management-Tata-Motor.pdf - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Tata Motors Limited is India's leading automobile manufacturer. It relies on third-party suppliers for raw materials, parts, and components used in vehicle production. The company monitors supplier performance but faces risks from disruptions in the supply chain ...

Tata Motors Limited Strategic Case Study. MGMT 4020: Strategic Management Ferguson, Jade Garcia, Orlando Giusti, Jefferey Smith, Konnor. ... Supply Chain Management Supply chain oversees the logistics of the supply and delivery of parts for its vendors while Production and Planning Management oversees execution of new projects. Tata Motors has ...

in the supply chain management is its ability to forecast demand accurately. The objective of the current study was to find out the level of customer satisfaction on supply chain management practices of Toyota and Tata motors in KSA. A total of 250 randomly drawn respondents were taken for the survey using questionnaire method.

Tata Motors buys Nissan facility in South Africa. Tata Motors has got a prestigious order from the Delhi Transport Corporation (DTC) for 500 non-ac, CNG-propelled buses. Tata motors Ltd has appointed Mr. P M Telegang as Executive Director (Commercial Vehicles). OBJECTIVE OF THE STUDY The study of the Inventory Management is done in TATA MOTORS LTD.

The competitive landscape of automobile original equipment manufacturers around the globe is continuously changing, with new business models impacting the performance of automobile firms. The study uses benchmarking technique to benchmark Tata Motors passenger vehicle segment performance with a relevant foreign passenger vehicle manufacturer to explore the differences in core capabilities and ...

In conclusion, Tata Motors' strategic transformation has had a positive impact on the. company's stocks and shares. Through restructuring, cost optimization, a focus on electric. vehicles, a ...

The concept of supply chain applies to the internal relationship between processes as well as the outside relationship between operations. Overall it is a management of activities and relationship which intends to achieve maximum customer value and sustainable competitive advantage. (Cowe, 2008). First-tier supplier.

SCM of tata motors - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Tata Motors is India's largest automobile company and a leader in commercial and passenger vehicles. The document discusses Tata Motors' supply chain management. It provides background on Tata Motors, noting it has operations across India and in other countries through subsidiaries.

CASE STUDY: TATA MOTORS negatively or positively for Tata depending on where the price is today, but since India's economic struggles is putting a damper on the automotive industry, then this would be a negative outcome for Tata. 1.2 Consumers spending less: Another external factor that the car manufacturing company has been facing is global per

JLR's UK supply chain has grown strongly, matching its growth story. UK-sourced components have increased to 50%, creating GBP 3.5 billion per annum of additional UK contracts, supporting 200,000 jobs and taking its total annual manufacturing spend with UK suppliers to more than GBP 6.5 billion. In the last five years, JLR's investment has ...

Here a case study of Tata Motors has been taken to e xamine . ... • The firm has reorganized its supply chain and expands its . ... nal of Management Studies, 47 (6), 1020-1047.

Tata Motors confident of sustaining growth amid supply chain concerns Updated - February 22, 2021 10:51 pm IST Published - February 22, 2021 10:32 pm IST - NEW DELHI