- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Actuarial Intern Cover Letter Example

Writing a cover letter for an actuarial internship can be a challenging process, but it is necessary to make a great first impression with a potential employer. With the proper guidance, you can easily craft a tailored and informative cover letter that grabs the attention of the hiring manager. This guide will provide you with helpful tips on how to write a cover letter for an actuarial internship, as well as a sample cover letter to get you started.

Download the Cover Letter Sample in Word Document – Click Below

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples .

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

Actuarial Intern Cover Letter Sample

Dear [Hiring Manager],

I am writing to apply for the position of Actuarial Intern at [Company Name]. With my strong academic background in mathematics and actuarial science, along with my practical experience in the field, I am confident that I can make a positive contribution to your company.

I am a recent graduate of [University/College] with a Bachelor’s Degree in Mathematics and a specialization in Actuarial Science. During my time in college, I was an active member of the college’s Actuarial Science Club and took part in several internships in the field. These experiences have given me a well- rounded understanding of the actuarial industry and have prepared me to take on the challenges of a professional role.

I have a strong aptitude for data and analytics, and I am comfortable working with sophisticated software. My strong analytical skills combined with my knowledge of financial theory have enabled me to work with large datasets, develop detailed reports and make informed decisions. During my internships, I had the opportunity to perform tasks such as pricing and validation of life and annuity policies, risk analysis and assessment and portfolio analysis. I am confident that I could bring similar value to [Company Name].

I am also a quick learner, who can adapt quickly to new environments. I am eager to learn more about the insurance industry, and I believe that my enthusiasm and commitment to the field will be an asset to the team.

Thank you for taking the time to consider my application. I look forward to hearing from you soon.

[Your Name]

Create My Cover Letter

Build a profession cover letter in just minutes for free.

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Actuarial Intern cover letter include?

A successful actuarial intern cover letter should include a few key elements to demonstrate your qualifications and interest in the position.

First, your cover letter should include an introduction that effectively summarizes your qualifications and experience in the actuarial field. This should be followed by specific examples of how your skills and experience fit the requirements of the internship. This could include any relevant courses you have taken, internships you have participated in, or research projects you have worked on.

Additionally, it is important to include information about why you are interested in the position and why you believe you are a good fit. This should be tailored to the specific job description and focus on the qualities and skills that make you the ideal candidate for the role.

Finally, your cover letter should include a professional closing statement that reiterates your interest in the role and encourages the hiring manager to reach out with further questions or to schedule an interview.

Actuarial Intern Cover Letter Writing Tips

Writing a successful cover letter is an essential part of applying for an actuarial intern position. A good cover letter will demonstrate your knowledge of the industry and your enthusiasm for the role. Here are some tips to help you craft an effective actuarial intern cover letter:

- Highlight your qualifications. In your cover letter, make sure to emphasize any qualifications you have for the job, such as a degree in mathematics, statistics, or actuarial science. Be sure to include any relevant coursework and work experience.

- Explain how you can contribute. Your cover letter should be a persuasive argument for why you are the best person for the job. Explain why you would be a great addition to the team, and what skills and qualifications you can bring to the position.

- Demonstrate your enthusiasm. Show that you are passionate about the role and the industry by giving examples of why you are excited to be an actuarial intern.

- Keep it professional. A cover letter should be written in a professional tone and free of slang or overly casual language. Make sure you review and proofread your letter for any spelling or grammar errors.

- Personalize your letter. Every cover letter should be tailored to the specific job and company you are applying for. Research the company and use the information you find to personalize your letter and demonstrate your understanding of the organization.

Following these tips will help you create an effective cover letter for an actuarial intern position. With a focused and thoughtfully written letter, you can increase your chances of getting an interview and potentially landing the job.

Common mistakes to avoid when writing Actuarial Intern Cover letter

Writing an Actuarial Intern cover letter can be a daunting task. It’s important to stand out among the competition, but you must also be careful not to make any mistakes. Here are some of the most common mistakes to avoid when writing an Actuarial Intern cover letter:

- Not tailoring the content to the specific employer: A generic cover letter will not help you stand out from the competition. Make sure to tailor the content to the specific employer and position you are applying for.

- Not highlighting your relevant skills: An Actuarial Intern cover letter should highlight your relevant skills and experiences that make you an ideal candidate. Make sure to list any experience in the field, any special skills you may have, and any certifications you may have obtained.

- Not proofreading: Typos and spelling mistakes can be a quick way to turn off a potential employer. Make sure to proofread your cover letter multiple times before submitting it.

- Not using the proper format: Your cover letter should be formatted correctly, including using a professional font, margins, and spacing. Make sure to use a standard cover letter format that allows your content to stand out.

- Not including a call to action: Always include a call to action in your cover letter. This can be an invitation to contact you, an offer to provide more information, or an invitation to discuss further.

Key takeaways

Writing a cover letter for actuarial internships can be a daunting task. Writing an impressive cover letter requires you to showcase your knowledge and skills in a concise and organized way. Here are key takeaways to help you create an impressive actuarial intern cover letter:

- Identify the key skills and experiences that you have that can be transferable to the role. Highlight what you have done that is relevant to the internship and how you can be an asset to the organization.

- Showcase your technical knowledge and writing skills. Actuarial internships require a deep knowledge of math and statistics, so demonstrating your analytical and problem- solving skills is essential. Additionally, make sure your writing skills are on full display by drafting a well- written and professional cover letter.

- Demonstrate your interest in the actuarial field and the specific organization. Show your enthusiasm by highlighting the experiences you have had that have made you passionate about the field and how working with the particular organization will contribute to your career goals.

- Make sure to proofread your cover letter. No matter how strong your qualifications are, an error- filled cover letter will not create a great impression. Proofread your cover letter and have someone else review it for you.

By following these key takeaways, you can create an excellent cover letter for an actuarial internship and make a great impression on potential employers.

Frequently Asked Questions

1. how do i write a cover letter for an actuarial intern job with no experience.

Writing a cover letter for an actuarial intern job with no experience can feel like an uphill battle. However, with the right approach, you can make your qualifications stand out. First, focus on emphasizing your knowledge and skills that are relevant to the role. Highlight any classes you have taken in finance, mathematics, or statistics, as well as any extracurricular activities that have honed your analytical and problem- solving skills. Also, include any relevant volunteer experience you have had, such as helping to facilitate a financial literacy program or organizing a charity event. Showcase your enthusiasm and dedication to the insurance and financial services industry, and explain why you feel this position is a great fit for you.

2. How do I write a cover letter for an Actuarial Intern job experience?

If you have prior experience as an actuarial intern, use it to your advantage in writing your cover letter. Start off by briefly describing your experience and the duties you handled. Then, focus on how you have grown since then, showing tangible evidence of your progress. Highlight any additional courses you have taken in finance, mathematics, or statistics, and mention any awards or recognition you have received. Demonstrate how your knowledge, skills, and experience make you an ideal candidate for this position. Finally, explain why you are excited to join the company and the role you want to play in the team.

3. How can I highlight my accomplishments in Actuarial Intern cover letter?

When writing your cover letter for an actuarial intern job, you should aim to demonstrate how you are an asset to the team. Focus on highlighting any awards or recognition you have won, and showcase any projects or initiatives you have been part of. For example, you could mention any research papers you have written or any financial models you have built. Discuss any learning opportunities you have created, or any industry events you have organized. Above all, emphasize how your accomplishments can help the company reach its goals and objectives.

4. What is a good cover letter for an Actuarial Intern job?

A good cover letter for an actuarial intern job should be both informative and persuasive. Begin with a strong introduction that outlines why you are the right candidate for the job. Then, provide evidence of your qualifications, emphasizing any relevant experience, internships, coursework, or certifications. Showcase your knowledge of the actuarial field, and explain why you are excited to join the team. Finally, close with a powerful concluding statement that will leave the reader with a lasting impression of your qualifications. With the right approach, you can create a cover letter that will help you stand out from the competition.

In addition to this, be sure to check out our cover letter templates , cover letter formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

Let us help you build your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder

Actuarial Intern Cover Letter Examples & Writing Tips

Use these Actuarial Intern cover letter examples and writing tips to help you write a powerful cover letter that will separate you from the competition.

Table Of Contents

- Actuarial Intern Example 1

- Actuarial Intern Example 2

- Actuarial Intern Example 3

- Cover Letter Writing Tips

Actuaries use mathematical and statistical methods to assess the risk of potential events, such as death, sickness, injury, or loss of property. They work in the insurance industry, but their skills are also in high demand in other industries.

To land an actuarial internship, you need a well-written cover letter. Follow these examples and tips to learn how to write an actuarial internship cover letter that will get you noticed.

Actuarial Intern Cover Letter Example 1

I am excited to be applying for the Actuarial Internship at Topdown Insurance. I believe that my skills and experience make me the perfect candidate for this position.

I have experience working in the insurance industry, and I have a strong understanding of the actuarial process. I am proficient in Excel and have experience using actuarial software. I am also comfortable working with data and am able to analyze and interpret information quickly.

I am a motivated and hardworking individual who is able to work independently as well as part of a team. I am eager to learn and am committed to developing my skills. I am confident that I have the potential to be a valuable asset to Topdown Insurance.

Thank you for your time and consideration. I look forward to hearing from you soon.

Actuarial Intern Cover Letter Example 2

I am writing in regards to the Actuarial Intern opening that I saw on your website. I am confident that I have the skills and qualifications that would make me the perfect candidate for the job.

I have been working in the actuarial industry for the past three years and have gained a great deal of experience and knowledge in the field. I have a strong understanding of the actuarial process and the various calculations that are involved. I am also familiar with the software used in the industry, including MLC, Prophet, and R.

I am a hard-working and motivated individual who is always looking for new challenges and opportunities. I am confident that I would be a valuable asset to your team and would be able to contribute to your company’s success.

If you would like to discuss this position further, or if you have any questions, please do not hesitate to contact me at your earliest convenience. I look forward to hearing from you.

Actuarial Intern Cover Letter Example 3

I am writing to express my interest in the actuarial internship position that you have posted. I believe that this position would be a great fit for me, and I would like to explain why I feel that way.

I am currently a senior at the University of Michigan, where I am pursuing a degree in Actuarial Science. My concentration is in Risk Management, and I am also minoring in Statistics. I have been working as an intern at XYZ Insurance Company since January of this year, and I will be graduating next month.

My time at XYZ has given me the opportunity to work on a variety of projects, including property and casualty insurance pricing models, life insurance policy analysis, and long-term care insurance underwriting. I have also had the chance to work with some of the best actuaries in the industry, and they have taught me so much about what it means to be an actuary.

I am very interested in pursuing a career as an actuary, and I know that there are many different paths that I could take. However, I do not want to become just another number cruncher; I want to make a difference in people’s lives by helping them understand their risk exposure. That is why I am so interested in your company’s focus on customer service.

I know that you are looking for someone who is hardworking, intelligent, and willing to learn. I believe that these qualities describe me well, and I hope that you will agree after reading my resume.

Actuarial Intern Cover Letter Writing Tips

1. show your skills.

When applying for an actuarial internship, it’s important to show employers that you have the skills they’re looking for. The best way to do this is by providing specific examples from past work experiences.

For example, if you’ve completed an actuarial science degree, mention any coursework or projects you’ve done that are related to the job you’re applying for. You can also highlight any skills you’ve developed that are relevant to the actuarial field, such as strong math skills or experience using Excel.

2. Tailor your cover letter to the job description

One of the best ways to make sure your cover letter is tailored for a specific job is by paying close attention to the details of the position. For example, if you see that an actuarial internship opening requires experience with a specific software, mention any experience you have with that software.

If there are any additional requirements or skills mentioned for that job, also list them on your application; this will help make it clear how you can meet their needs.

3. Demonstrate your passion for the actuarial field

Employers want to hire interns who are passionate about the actuarial field and are excited to learn new things. Show your passion by using phrases like “I’m eager” and “I’m looking forward” in your cover letter.

You can also talk about why you decided to pursue an actuarial science degree, and explain how you’ve developed a strong interest in the field. For example, you might have volunteered with an organization that helps seniors plan for their retirement, or you might have read a book about actuarial science that really interested you.

4. Proofread your cover letter

Proofreading your cover letter is the first step to landing an interview for an actuarial internship. As with any position, it’s important to spell-check and double-check that there are no errors in your resume or cover letter. Otherwise, you risk being disqualified before the employer even sees your qualifications.

Vehicle Inspector Cover Letter Examples & Writing Tips

Funeral assistant cover letter examples & writing tips, you may also be interested in..., sleep technician cover letter examples & writing tips, compliance analyst cover letter examples, box office manager cover letter examples, ekg technician cover letter examples & writing tips.

An Actuarial Internship Guide for Aspiring Actuaries

Gain invaluable insights into launching your actuarial career with a comprehensive guide to actuarial internships, where practical experience merges with academic learning to enhance employability and industry expertise.

“My year-long actuarial placement prepared me for the workplace better than any university module could ever dream of doing”

Those are the thoughts of one of my colleagues who, much like myself, undertook an actuarial placement at the UK’s largest pensions consultancy. A year-long work placement is the most important year of any students’ studies. A survey conducted by reed.co.uk in 2011 found that almost three-quarters of graduates considered their work experience to be an invaluable part of their degree. Nowadays there is an ever-increasing importance of having practical work experience under your belt before entering the working world for good.

I took away more benefit from my placement year than I could ever have imagined. Most of all, a placement year is an opportunity to learn. I entered it with hesitation and trepidation but 14 months on I have finetuned an abundance of interpersonal and professional skills, which leads me to definitively state a placement year is the most invaluable experience any student could avail of.

Understanding Actuarial Placements

Good question. A placement is effectively a free trial; a ‘try before you buy’. It allows employers the benefit of building relationships with universities in order to assess potential future graduates by employing them on a temporary basis.

As for students, it is an incredible opportunity to learn about their future industry, build a professional network and boost their employability with practical on-the-job experience.

Ultimately, you are still a student. A placement year is a compulsory part of many undergraduate degrees and carries academic credit . Typically, the university works closely with employers, awarding you a wide support network, and it plays a key role in helping you to secure a placement in the first place. There are dedicated placement coordinators that help students build relationships with employers, offer interview practice and help to finetune your CV to the nth degree.

Students also have the opportunity to work further afield . I wanted to remain in Belfast so I was limited to the pensions industry. However there is an abundance of opportunities in the Republic of Ireland and across the UK in other sectors such as insurance, reinsurance and banking. The most adventurous of students can even jet across the Atlantic to work in the likes of Toronto and Vancouver.

It is much more of an experience than simply working 9 ‘til 5. Many students will live away from home for the first time, experience an office environment, and hone countless skills that are yet to be unearthed.

Notwithstanding that, the goal of a placement is of course to gain practical experience within the industry and to develop a professional network to give students a head start as a graduate. The benefits of a work placement are perfectly summarised by former chief executive of careers website, Prospects , Mike Hill, who believes “a placement year shows you have a work ethos and makes you far more employable” .

Comparing Actuarial Placements and Summer Internships

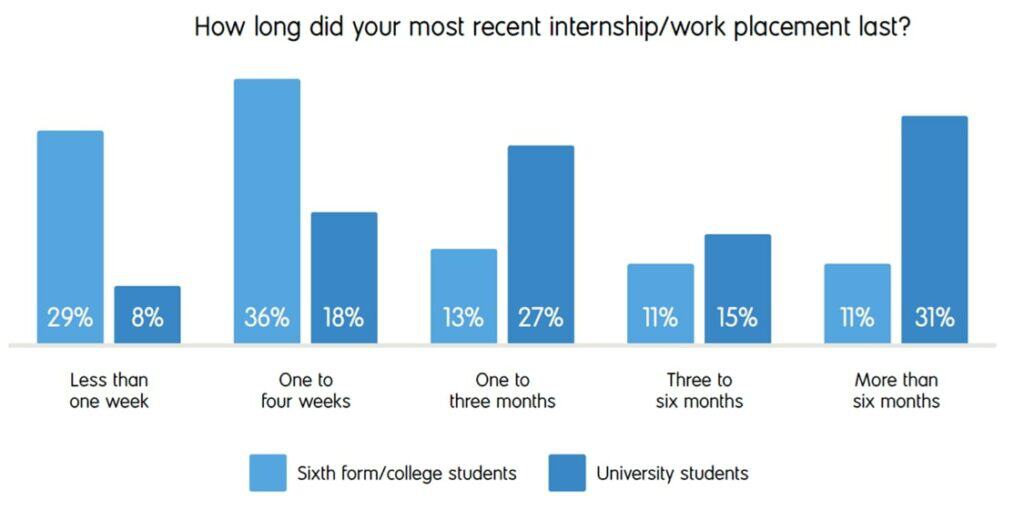

A placement year differs greatly from a summer internship. Internships are typically undertaken during the summer to gain experience and enhance your employability. Whereas a work placement typically lasts for the best part of a year – for instance, a placement year is a compulsory part of my actuarial undergraduate degree and is required to last between nine and 15 months. That is not to understate the usefulness of a summer internship.

The short-term nature of an internship can in fact be a positive. It grants a student an insight into the industry and can greatly enhance your CV. It demonstrates:

- A willingness to learn about the career path

- A genuine interest in the industry

- A proactive attitude to obtain work experience (generally unpaid)

- Commitment to sacrifice your summer holiday in order to amplify your career prospects

And perhaps most importantly of all, it gives a student something material to talk about in a job interview.

On the flip side, I would argue an internship just isn’t long enough to really learn about the job role. If an internship is the equivalent of dipping your toes into the shallow end, a placement year is diving straight into the deep end. Some will sink and some will swim.

My placement year changed (for the better) six months in. It is at this stage that I began to put my learning into practice, and really felt at home on-the-job. I started my placement two months early, and it was the best decision I made as it gave me an invaluable head start. I had the opportunity to drain as much knowledge and help out of my new colleagues before the remaining placement students joined the company.

I had two more months of asking countless questions, two more months of making mistakes, and two more months of learning from them. Figure 1 shows that just 31% of work placements undertaken by university students last more than six months. That isn’t enough time to fully engage in your new industry as, from my experience, the second half of a placement year is the most useful as this is when you start to put your learning into practice.

Key Lessons from an Actuarial Internship Experience

I completed a 14-month work placement at the largest pure pensions consultancy in the UK. The company has won numerous awards at the UK Pensions Awards and the UK Employee Experience Awards in recent years, so I was enthused by the prospect of working for such a highly-esteemed company that clearly values its employees.

I entered the world of GMP equalisation , which is tricky to explain briefly but I will try. Essentially it is a legal requirement, arising from the Lloyds Judgement in 2018 , to equalise pensions that were accrued in the 1990s to ensure that a member is not treated less favourably on the grounds of sex (as there were different rules for males and females for this specific type of pension). I encountered an awful lot of technical jargon throughout my placement, much of which took me a lot of practice to truly understand.

My primary role as an actuarial associate was to analyse and check bulk member data, carry out bulk ‘equalisation’ calculations and produce advice reports that were presented to the Trustee(s) of the pension scheme.

I was entrusted with overseeing the progress of numerous schemes through this process which involved liaising with senior actuaries and juggling multiple deadlines to ensure client satisfaction.

Towards the end of my placement, having earned the trust of my peers, I was challenged with collating data for 200+ schemes and to produce a report summarising the results for marketing purposes. This exposed me to another aspect of a multi-faceted business in terms of the importance of flexible marketing material to maintain current and attract new clients.

Gaining Essential Skills from Actuarial Internships

One of the key takeaways from my placement was the stark increase in confidence I experienced over the year. I became a much more-rounded person, both from a professional and personal point of view.

Given the backdrop of the COVID pandemic, much of my placement was completed virtually which initially challenged, but ultimately enhanced, my communication skills. It forced me to communicate with colleagues and pick up the phone to them when I encountered an issue, as I couldn’t just turn around to the person at the next desk and discretely ask for their help.

The key skills and benefits I acquired from my work placement include:

- Establishing numerous working relationships with key members of the team through asking for help and offering support in ad hoc projects

- Advancing my technical skillset through a daily use of Excel and its endless functions

- Independently reviewing the work of other colleagues and providing constructive feedback

- Training less experienced members of the team which required the ability to communicate technical concepts in a non-technical manner

- Vast exposure to member data and the complexities of pension schemes, enhancing my knowledge of the pensions industry as a whole

- A conviction to offer my own solutions to modelling complexities and discuss these with experienced, qualified actuaries

One thing that became clear in hindsight was the substantial change to my placement experience after the first six months. By this stage I had made the rookie mistakes and was now developing an aptitude for my work. I began putting my learning into practice and started to take the initiative by communicating technical concepts with senior members of the team and invited open debate.

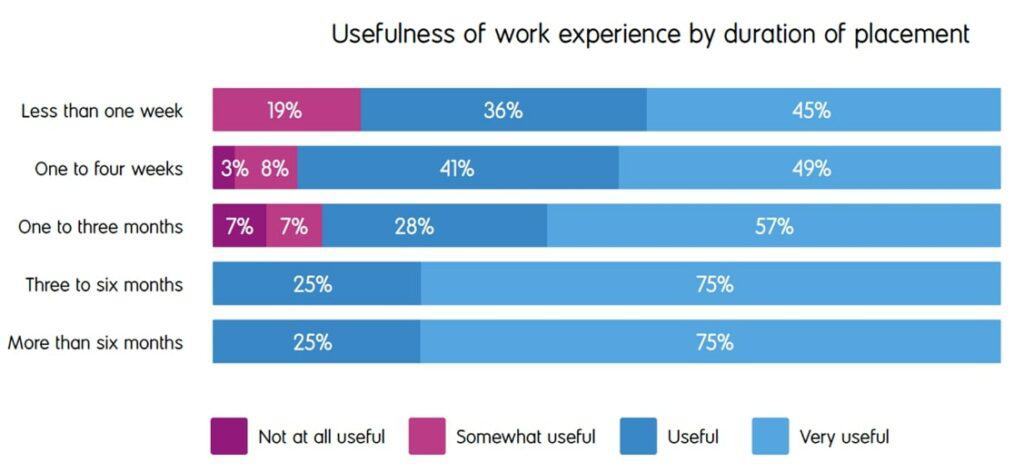

Figure 2 mirrors my experience – the longer your work placement, the more valuable it is. In 2020, 100% of students found their work placement to be at least ‘useful’ having spent more than six months in the workplace. This is when the real learning and development starts.

Overcoming Challenges in Actuarial Internships

It’s about time I address the elephant in the room: the worldwide pandemic which meant that the vast majority of my placement year was completed from the comfort of my own home.

For the first 12 months of my placement, I visited the office just four times, two of which were due to IT issues. Thankfully, I was able to work in the office once a week during the final two months of my placement as the company rolled out a new flexible working model.

The main challenges associated with working from home were keeping myself accountable for fulfilling my duties during the day despite not being in a purpose-built office environment. It was easy to feel disenchanted working from home, especially in the latter months of my placement as I required less support to complete my work and fulfill my responsibilities.

The experience of working in the office was an alien one at first but I quickly grew to really enjoy it. The ability to socialise with members of the team and ask for their help in person was much more engaging than via a message over MS Teams.

Working from home was a challenge at first. Nonetheless it was a necessary challenge given that hybrid working models will likely be the backbone of any future career in the actuarial industry . In fact, 67% of work placements in 2021/22 were expected to be a hybrid of working from home and face-to-face interactions, according to the Prospects Early Careers Survey 2022 .

The findings of this survey are in keeping with my experience. Respondents found hybrid placements the most useful and online placements ranked last in respect of the various working models. I felt re-energised being able to work in the office during the last two months of my placement and would actively seek a company that follows a hybrid working model when securing a graduate job . The benefits of face-to-face interactions cannot be underestimated.

Actuarial Internships: A Journey of Learning and Growth

You learn too many lessons whilst on placement to recall one-by-one. However, one key piece of advice I would give to anyone embarking on an industrial placement is to say yes to every opportunity . Why? Because you will either succeed or you will learn.

“I have not failed. I’ve just found 10,000 ways that won’t work.” – Thomas Edison

A placement year is littered with learning curves. Sometimes you place too much trust in your initiative and make a rookie mistake, and whilst it would be easy to dwell on your mistakes, you have to use them as a learning opportunity. It is important to remember that you are still a student; you are there to learn. It’s unrealistic to get 100% in your university modules. Therefore it is equally as unrealistic to expect to never to make a mistake on placement. What you must do however is ask for help and learn from your misjudgements.

Another useful tip I would give to fellow students is to record all the tasks/projects you complete whilst on placement and to make note of any highlights/milestones. This way, you have some concrete evidence of achievements within the workplace. It also allows you to quantify the progress you have made from day one, which can be helpful not only in relaying to a future interviewer, but also in reassuring yourself that you have made significant strides when you reach a stumbling block.

Securing Your Actuarial Internship: Tips and Strategies

There are multiple things you can do to boost your chances of securing an industrial placement at the company of your choice. These are my seven most important tips when seeking to land a placement role.

- Contact past placement students to learn about the company and demonstrate this proactive approach in your interview

- Use flashcards to mimic interview-style questions. Remember: the employer is just as interested in you as a person than as a student, so be prepared to talk about yourself!

- Arrange a mock interview with your placement coordinator to finetune your interview technique and make use of their feedback

- Don’t get too bogged down on the industry, instead focus your efforts on where you would like to work. If you don’t like the industry you work in, e.g. pensions, then at least you can rule it out as a future career path

- Research extensively into the company. The company website should be your first port of call for company background, recent news and highlights

- Know your industry. Read articles about recent developments in the industry and find a way to bring this up in the interview. For example, in my interview, I discussed the role of the Pension Protection Fund after Toys R Us fell into administration

- Always ask a question at the end of the interview. What you say isn’t that important, what is important is that you show an interest in the company you are applying for. For example, you may ask what their working model is, or how they support graduates through professional exams

Navigating Your Actuarial Career Path Through Internships

There is no doubting that completing an industrial work placement as part of your academic studies puts you ahead of the curve. You become instantly more employable. In fact, 88% of employers agree that students with work experience under their belt arrive to the workplace with better skills.

There are numerous benefits to your future career prospects as a direct result of completing an industrial placement year. Practical work experience is one of the first things employers will look for in a graduate. Given only 7% of students completed a placement year as part of their degree in the past 12 months, this practical experience gives you a unique selling point and ensures your CV will stand out .

The experience of the office environment during a placement year can help to alleviate the nerves associated with starting a graduate role and entering the office for the first time. And if you are lucky enough to secure a graduate role with the same company in which you completed your placement year, you will just be picking up where you left off.

The impression I made on my employer during my placement year led to me securing a graduate role without having to negotiate the rigmarole of applying for jobs and preparing for interviews. This eliminates the stress of having to balance your studies alongside securing a graduate job in your final year, which in turn boosts your chances of scoring highly in your course. Of course, as an actuarial student, this is of paramount importance given the exemptions from the actuarial exams that are available through accredited degree programmes.

Final Reflections on Actuarial Internships

A year-long industrial placement prepares you for the workplace in a way that no university module can replicate. There will undoubtedly be challenges throughout a placement year, each of which should be viewed as a learning opportunity as opposed to a failure. There are numerous benefits to completing a year in industry. However, the overarching positive is the boost to your employability and your CV. There are lessons to be learned in your introduction to the workplace, none of which will do your future career prospects any harm.

Actuarial Internship FAQs

Actuarial interns typically assist in the daily tasks of professional actuaries, gaining exposure to real-world applications of actuarial science. Tasks may include:

- Data analysis : Helping to compile and analyze data for risk assessment.

- Report preparation : Assisting in the preparation of reports on findings.

- Modeling : Supporting the development of financial models using software tools.

- Research : Conducting research on specific topics under the guidance of senior actuaries.

- Participating in meetings : Attending meetings to understand how actuaries communicate with clients and team members.

The benefits of an actuarial internship include:

- Practical experience : Applying academic knowledge in a professional setting.

- Networking opportunities : Connecting with professionals in the industry, which can be valuable for future job prospects.

- Skill development : Enhancing technical skills like software proficiency, as well as soft skills such as communication and teamwork.

- Understanding the profession : Gaining a clearer idea of what actuaries do daily and what career paths are available.

To find actuarial internships , you can:

- Visit your university’s career center : They often have resources and contacts with companies that offer internships.

- Use job boards and websites : Websites like Indeed, Glassdoor, and LinkedIn frequently list internship opportunities.

- Network : Attend industry conferences, seminars, and local actuarial club meetings to meet professionals and learn about internship opportunities .

- Company websites : Visit the careers section of insurance companies, consulting firms, and other businesses that employ actuaries to find internship listings .

Your application should typically include:

- Resume : Highlight your education, relevant coursework, any previous internships, and technical skills (such as software proficiency).

- Cover letter : Tailor your cover letter to each internship, explaining why you are interested in the position and how your skills and goals align with the company’s needs.

- References : Have a list of references ready, ideally including professors or previous employers who can vouch for your skills and work ethic.

Qualifications for an actuarial internship typically include:

- Educational background : Most positions require that you are pursuing a degree in actuarial science, mathematics, statistics, or a related field.

- Technical skills : Knowledge of statistical software programs, programming languages, and Excel.

- Passed exams : Having passed one or more actuarial exams can significantly enhance your candidacy.

- Analytical skills : Ability to work with large data sets and perform detailed analysis.

Actuarial internships can be quite competitive, especially those offered by well-known companies. To stand out, it’s beneficial to have strong academic records, passed actuarial exams, relevant coursework, and extracurricular involvement in related fields.

To increase your chances, focus on:

- Passing actuarial exams : The more exams you’ve passed, the more attractive you are as a candidate.

- Building technical skills : Proficiency in relevant software and programming languages.

- Networking : Building relationships in the industry can often lead to internship opportunities.

- Being proactive : Reach out to companies with inquiries about potential internships and express your interest.

“ Ryan Boyd is an Actuarial Assistant at XPS Pensions Group . Prior to that he was an Actuarial Associate at XPS Pensions. Ryan graduated from Queen’s University Belfast in 2023 with a BSc degree in Actuarial Science and Risk Management. You can connect with him on LinkedIn .”

The Weekly TOP 10 Actuary Jobs

Get the top 10 actuary jobs delivered to your inbox every friday..

- Upload your Resume/CV

- Advanced Search

- Actuary Career Advice

- Top 10 Best Actuary Jobs

- Browse Actuary Jobs

- Advertise an Actuarial Job

- Search Resumes/CVs

- Actuarial Recruiter Advice

About ProActuary

- ProActuary Blog

Popular Jobs

- Actuary Jobs

- Management Jobs

- Consultant Jobs

- Senior Analyst Jobs

- Actuarial Analyst Jobs

- Data/Analytics Jobs

- Remote Jobs

- Associate Actuary Jobs

- Pricing Actuary Jobs

- P&C/General Insurance Actuary Jobs

- Actuarial intern Jobs

- Underwriting Jobs

- Retirement/Pensions Jobs

- Life Actuary Jobs

- Director Jobs

- Product Jobs

- Reserving/Valuation Jobs

- Reporting Actuary Jobs

- Modeling Jobs

- Health Actuary Jobs

- Audit/Compliance Jobs

- Climate/Sustainability Jobs

- Reinsurance Actuary Jobs

- Data Scientist Jobs

- Graduate Jobs

- Claims Jobs

- Vice President/Assistant VP Jobs

- Banking Jobs

- Junior Actuary Jobs

- Portfolio Jobs

Actuarial Intern Cover Letter Example

An Actuarial Intern is a temporary role in the field of Actuarial Science. This position typically involves assisting Actuaries with their day-to-day work and gaining related experience.

Writing a cover letter for your dream job is a difficult task. Luckily, writing an Actuarial Intern Cover Letter is super easy with our sample cover letter. Our Proprietary easy-to-use generator makes short work of all your cover letter needs and will aid you to accomplish your goals. An actuarial intern is responsible for providing support to the actuarial team in the areas of pricing, reserving, and capital modeling. This includes researching and analyzing data, developing actuarial models and reports, and preparing presentations.

- Cover Letters

- Accounting & Finance

The intern will also provide support to senior actuarial staff in the development of advanced actuarial models. They will review and analyze existing actuarial models and recommend changes as needed. They may also be asked to review internal and external documents to ensure accuracy.

What to Include in a Actuarial Intern Cover Letter?

Roles and responsibilities.

- Researching and analyzing data related to various actuarial topics.

- Developing financial models and using software programs to evaluate and analyze actuarial data.

- Assisting in the development of actuarial pricing models and other financial models.

- Assisting with the development of actuarial marketing materials and presentations.

- Assisting with the development of actuarial reports and studies.

- Gathering and organizing actuarial data and information.

- Developing actuarial projections and calculations.

- Participating in team meetings and strategy sessions.

- Helping to develop and implement actuarial strategies.

- Assisting in the development of actuarial processes and procedures.

- Assisting in the development and review of actuarial policies and procedures.

- Attending industry conferences and seminars as necessary.

Education & Skills

Actuarial intern skills:.

- Strong analytical and problem-solving skills.

- Excellent mathematical and statistical abilities.

- Ability to work independently and as part of a team.

- Ability to interpret and explain complex data.

- Proficiency in software such as Excel and Access.

- Knowledge of actuarial science and actuarial principles.

Actuarial Intern Education Requirements:

- Bachelor’s degree in actuarial science, mathematics, statistics, or a related field.

- Working towards professional accreditation or certification in the field of actuarial science.

- Working knowledge of financial and risk management principles.

- Previous experience in the insurance or financial services industry.

- Previous internship or work experience in actuarial science.

- Familiarity with actuarial software applications such as PolySystems, GGY-AXIS, or Prophet.

Actuarial Intern Cover Letter Example (Text Version)

Dear Mr./Ms.

I am writing to express my interest in the Actuarial Intern position at [Company Name]. I am confident that my education, experience, and enthusiasm for the actuarial profession make me an ideal fit for this role.

I am currently completing a Bachelor of Science in Mathematics with a major in Actuarial Science at [University Name]. I have successfully completed coursework in financial mathematics, probability, and statistics, as well as insurance and risk management. My coursework and academic accomplishments have prepared me to be successful in an actuarial environment.

My background includes:

- Obtaining Associate of the Society of Actuaries (ASA) designation in 2020.

- Participating in a summer actuarial internship with [Company Name] where I successfully managed and completed projects on time.

- Achieving and maintaining a 3.9 GPA throughout college.

- Demonstrating strong analytical and problem-solving skills.

- Possessing strong attention to detail and excellent communication skills.

I am knowledgeable in actuarial software including [software name] and have considerable experience with Excel and Microsoft Office. I am eager to contribute to the success of your organization through my research, analysis, and problem-solving skills.

I am confident that my enthusiasm and commitment to the actuarial profession would be a great asset to [Company Name].I would welcome the opportunity to discuss my qualifications in further detail. Thank you for your time and consideration.

Sincerely, [Your Name]

When writing a cover letter for an actuarial intern position, be sure to emphasize your relevant skills, education, and experience. Highlight any internships or other professional experiences that have prepared you for the role. Additionally, make sure to express your enthusiasm and interest in the position and demonstrate why you would be a great fit for the job. Refer to our extensive range of Actuarial Intern Resume Samples for help with your resume writing.

Customize Actuarial Intern Cover Letter

Get hired faster with our free cover letter template designed to land you the perfect position.

Related Accounting & Finance Cover Letters

How to get an actuarial internship

Finding an actuarial internship can really be one of the most crucial steps in your actuarial career. The experience that you can get will really improve your (actuarial) employability in the future and it gives you a ton of valuable experience.

I was fortunate enough to get my first actuarial internship without even having any exams passed, so I know that these steps can work if they’re followed closely and correctly.

Step 1 – Fix up your resume

This is actually the most important part. You have to make sure your resume stands out among all the other resumes the employer gets. In my opinion, one of the top reasons great candidates aren’t able to find a job is because they’re resume just isn’t very good.

The good news is that this means you can stand out even if your experience and achievements aren’t way better than everyone else’s. What you really need to do is just make sure that your resume makes your true value show. Your resume has to sell employers on YOU and why they should want to hire you for that actuarial internship and not someone else.

So it’s super important that you spend lots of time fixing up your resume and making it the best it can be. You can get tons of job search tips & resume advice by signing up for my regular emails ( you can sign up to get those here or at the bottom of this page).

Those emails will give you lots of insight into how to make an awesome actuarial resume that really stands out.

Step 2 – Look for openings

There are lots of places to look for actuarial internship positions. The problem is that many of them aren’t even advertised.

The first place to start looking is online using Google search. Some schools have internal postings too. If you can’t find them, you should ask a career advisor where they are. That same career advisor may even be able to help you fix up your resume.

In those situations, there will likely be a lot of competition since the postings are made available to everyone. That’s OK though – it’s a good place to start and you may as well try for them.

Next, you can look for actuarial firms and insurance companies that don’t have postings up. They often have the option to submit your resume even if they’re not a specific posting that you’re interested in. The worst case is that you apply and they can’t use you right now, so really there’s no harm in doing that and it may just land you an internship.

Next it’s time to get in touch with your own personal network. Do you know anyone that works at an insurance company? Many people are willing to help others in getting a job within their company and it really gives you a ‘leg up’ on the competition.

If you do have some contacts, connect with them and see if they would mind passing your resume onto a manager in the actuarial department. If that doesn’t work, maybe they’ll at least be OK with you mentioning them on your cover letter when you submit a resume.

It’s important that you be open to opportunities outside of your comfort zone. Try not to limit yourself in any way. Look for internships in other cities, other states or provinces, maybe even other countries! Be open to positions that are closely related to the actuarial field too, like underwriting, data analysis, investments or risk management.

You need to be flexible in the type of work too – consulting, life insurance, P&C, health – anything!

By applying to more places, you’ll significantly open up your options and ideally you’ll have internship offers at more than one company and you can choose the one that works best for you.

Step 3 – Apply to openings

Now that you’ve found a bunch of places to submit your resume to, it’s time to apply to all of them.

This process is pretty time consuming, but tends to go the smoothest if you have all your cover letters and resumes ready before you apply to the postings. This way, you can just zip through the application process with each company without having to stop to work on your resume and cover letter between each application.

Personally, I don’t think you should send a cover letter unless it’s asked for in the posting or if there is something on your resume that really needs to be addressed. But if you do submit one, the cover letter should always be personalized and reviewed/edited by someone other than yourself.

Step 4 – Following up

This is an important step that shouldn’t be skipped. It could get you an interview that you wouldn’t have got otherwise.

I understand why some people don’t feel that following up is a good idea, but my logic is that if you haven’t heard back after a certain amount of time, there’s almost no harm in doing so.

Employers are busy. Maybe they didn’t see your internship application for some reason. Or maybe they thought they found someone but it didn’t work out. Following up may just get you the opportunity that you need to get that actuarial internship!

So how long should you wait?

There’s no right or wrong amount of time to wait, but I think that waiting a minimum of 2 weeks before following up is fair. But really, it’s going to depend on several factors such as when the application deadline was and your method of applying.

For positions posted online where an application deadline was specified, you should wait until a week or 2 after the deadline before following up. But if the deadline is more than 4 weeks away, I think it’s safe to assume that this is an ongoing posting and you should follow up a couple weeks after applying.

Of course, use your own judgement on this… there is no right and wrong.

Step 5 – Prepare for the interview

OK so great! Now hopefully you got an interview… now what? You need to do some preparation!

If you’re anything like me, interviews make you nervous. I’ve learned a few tricks over time though that really seem to help calm my nerves. Hopefully they’ll help you too.

First – you have to do some research. Go to the company’s website, look around, and get to know them a bit better. You don’t need to know a whole bunch of facts and statistics, but pick up on a few things that truly stand out to you. You may be able to mention them (casually) during your interview.

But more important in your interview preparation is to review some common actuarial interview questions and prepare some good responses for them. I don’t recommend that you memorize word-for-word what you’d say if any specific question arises. Instead, just have some bullet points in your mind about things that you could talk about.

I like to go through tons of practice interview questions, and naturally build up a collection of possible experiences that I could talk about when they ask “Tell me about a time when…” or “how would you handle this…”.

It’s best to practice answering these questions out loud too, not just in your head. That can make a huge difference!

Step 6 – At the interview

The easy part here is to make sure you’re not late. Being about 10 minutes early is ideal. If you’re earlier than that, it might be a bit “too early” so just wait in your car or somewhere (if possible and not awkward) until you’re 10 minutes early.

Try to stay calm and relax. I know that’s easier said than done. But interviewers know that this process is nerve wracking and I’m sure they’ll understand. If they don’t, maybe they’re not the type of people you’d want to work for during your internship anyway.

The best situation is if your interview is more like a conversation rather that just a question and answer session. But depending on your interviewer, that’s not always possible.

Interviewers for actuarial internship positions are typically more likely to hire someone that they feel they can relate to and connection with. That’s why a conversation is better. You can show them, first-hand, that relatable and likable.

Hopefully, they’d be able to see that your personality and character would fit in well with others that already work at the company. If they see that, then things look good for you! Hopefully you’ll get the job.

Step 7 – Follow up after the internship interview

Again, everyone has different opinions on this interview follow-up, just like the resume application follow up I talked about earlier.

If you do follow up after the interview, you need to be extremely confident in your ability to write a good follow-up email. It should be professional, summarize some of the key points that you talked about during the interview, and your include your contact information.

Personally, I usually skip over this step. I’m never sure about the best timing, and I don’t want to accidentally ruin any ‘good feelings’ the interviewer may have. You may feel differently though, so I’ve added this step for completeness.

So those are my 7 steps to getting your first actuarial internship. If you want more resume tips and job search advice just sign up for my regular email tips by entering your email address below.

Get an actuarial job even in today's competitive market!

Get all my best tips on how to become a TOP actuarial candidate so that you can get your actuarial dream job. Just add your email below.

Get our FREE Entry-Level Actuarial Resume & + Job Hunting Tips!

Learn things like… – How to set up your resume to get noticed. – Why you’re not getting any interviews. – When to start looking for your first actuarial job. – How many exams you really need before you apply.

5+ Actuary Cover Letter Examples and Templates

Home » Cover Letter Examples » 5+ Actuary Cover Letter Examples and Templates

Create the simple Actuary cover letter with our top examples and expert guidance. Use our sample customizable templates to craft a cover letter that’ll impress recruiters and get you that interview today. Start now and make your dream job come true!

Are you looking to kickstart your career as an Actuary? A well-crafted cover letter is an essential tool to showcase your skills, passion, and suitability for the role. By effectively highlighting your qualifications, achievements, and enthusiasm, you can grab the attention of potential employers and increase your chances of landing an interview.

In this comprehensive guide, we will provide you with examples and templates for writing a captivating cover letter specifically tailored for an Actuary position. Whether you are an experienced professional or a recent graduate, our tips and techniques will help you create a persuasive cover letter that stands out.

Actuary Cover Letter Examples and Templates

1. Actuary Cover Letter Example

Dear Hiring Manager,

I am writing to apply for the Actuary position at [Company Name]. With a strong background in mathematics and a passion for data analysis, I believe I am a perfect fit for this role.

During my previous role as an Actuarial Analyst at [Previous Company], I was responsible for conducting risk assessments, analyzing data to determine insurance premiums, and developing pricing models. I also have experience in using statistical software such as SAS and R to analyze large datasets and develop predictive models.

I am highly skilled in problem-solving and critical thinking, which are essential skills for actuaries. Additionally, my strong communication skills allow me to effectively present complex actuarial concepts in a clear and concise manner.

I am confident that my analytical skills, attention to detail, and ability to interpret complex data will greatly contribute to the success of [Company Name]. I am eager to leverage my expertise to assess risks accurately, develop pricing strategies, and support strategic decision-making.

Thank you for considering my application. I am eager to discuss how my qualifications align with your needs further. Please find attached my resume for your review. I look forward to the opportunity to interview with you and further demonstrate my suitability for the Actuary role.

Sincerely, [Your Name]

2. Short Actuary Cover Letter Sample

I am writing to express my interest in the Actuary position. With a solid background in mathematics and a passion for data analysis, I am confident in my ability to contribute to the success of [Company Name].

As an Actuarial Analyst at [Previous Company], I honed my skills in risk assessment, data analysis, and predictive modeling. I have experience using statistical software such as SAS and R to analyze complex datasets and develop pricing strategies. I am highly organized and detail-oriented, ensuring accurate and comprehensive actuarial reports.

I am confident that my analytical mindset and expertise in data analysis will enable me to provide valuable insights to support strategic decision-making at [Company Name]. Attached is my resume for your review. I look forward to the opportunity to discuss how my skills align with your needs in more detail.

Thank you for considering my application.

3. Actuary Cover Letter for Job Application

Dear [Recipient’s Name],

I am writing to apply for the Actuary position at [Company Name] as advertised on [Job Board/Company Website]. With a strong background in mathematics and a passion for data analysis, I am confident in my ability to contribute to [Company Name]’s success.

In my previous role as an Actuarial Analyst at [Previous Company], I successfully conducted risk assessments, developed pricing models, and analyzed complex data sets to support strategic decision-making. I have experience in using statistical software such as SAS and R to analyze large datasets and develop predictive models.

I am confident in my ability to analyze complex data, identify trends, and provide actionable recommendations. Furthermore, my strong communication and presentation skills enable me to effectively communicate actuarial findings to stakeholders.

I am excited about the opportunity to contribute to [Company Name]’s growth and success as an Actuary. Attached is my resume for your consideration. I would welcome the opportunity to discuss how my skills and qualifications align with your needs in more detail.

Thank you for considering my application. I look forward to the opportunity to interview with you.

4. Actuary Cover Letter for a Candidate with no Experience

I am writing to express my interest in the Actuary position at [Company Name]. Although I have recently graduated with a degree in Mathematics, I am eager to apply my knowledge and skills to contribute to [Company Name]’s success.

During my academic studies, I developed a strong foundation in mathematics, statistics, and data analysis. My coursework and projects provided me with hands-on experience in using statistical software such as SAS and R to analyze complex datasets. I am a quick learner with a strong analytical mindset and attention to detail.

I am confident that my ability to analyze data, along with my excellent problem-solving skills, make me a strong candidate for the Actuary role. Additionally, my internship experience in a different field has equipped me with valuable transferable skills such as teamwork, time management, and effective communication.

I am eager to contribute to [Company Name]’s success as an Actuary. Attached is my resume for your consideration. I would welcome the opportunity to discuss how my skills and qualifications align with your needs in more detail.

5. Sample Application Letter for Actuary with Experience

I am excited to apply for the Actuary position at [Company Name]. With over [Number of Years] years of experience in risk assessment, data analysis, and predictive modeling, I bring a wealth of knowledge and expertise to support [Company Name]’s growth.

In my current role as an Actuarial Analyst at [Current Company], I have successfully provided strategic insights and supported decision-making through data analysis. I am well-versed in using statistical software such as SAS and R to analyze complex datasets and develop pricing models. Moreover, I have a proven track record of developing comprehensive actuarial reports to drive business performance and optimize risk management.

I am highly skilled in analyzing data, conducting risk assessments, and developing pricing strategies. My strong communication and presentation skills have enabled me to effectively communicate complex actuarial information to stakeholders at various levels.

I am confident that my extensive experience, analytical mindset, and attention to detail make me an ideal candidate for the Actuary role. Attached is my resume for your review. I would welcome the opportunity to discuss how my skills and qualifications align with your needs in more detail.

How to Write an Actuary Cover Letter

Writing an effective Actuary cover letter involves following a clear structure and including relevant information that showcases your qualifications and demonstrates your commitment to the field. Let’s explore the step-by-step guide to help you craft a compelling cover letter that captures the attention of potential employers.

Objective of an Actuary Cover letter:

- Introduce yourself and express your interest in the position.

- Highlight your relevant skills, experiences, and achievements.

- Demonstrate your knowledge of actuarial concepts and methodologies.

- Show your passion for analyzing data, assessing risks, and making informed decisions.

- Thank the employer for considering your application.

Key Components For Actuary Cover Letters:

- Contact Information: Include your name, address, phone number, and email address at the top of the cover letter.

- Salutation: Begin the cover letter with a professional greeting, such as “Dear Hiring Manager” or “Dear [Company Name] Recruiting Team.”

- Introduction Paragraph: In a concise and engaging manner, introduce yourself, mention the position you are applying for, and briefly indicate your motivation for applying.

- Body Paragraphs:

- Skills and Qualifications: Highlight your relevant technical skills, such as proficiency in statistical analysis, data modeling, programming languages, and actuarial software.

- Experience and Achievements: Discuss your experience in the field of actuarial science, including internships, projects, or any relevant work experience. Highlight any achievements or recognition you have received.

- Knowledge of Actuarial Concepts: Demonstrate your understanding of actuarial concepts, methodologies, and regulations. Discuss your ability to apply these concepts to real-world scenarios.

- Passion for the Field: Express your enthusiasm for working as an Actuary and your dedication to continuous learning and professional development.

- Closing Paragraph: Conclude your cover letter by restating your interest in the position and expressing your availability for an interview or further discussion. Mention any further enclosed documents, like your resume or references.

- Formal Closing: End the letter with a professional closing, such as “Sincerely” or “Best Regards,” followed by your full name.

- Signature: Sign your name between the closing and your printed name. If the cover letter will be sent electronically, you can type your name instead.

Formatting Tips for an Actuary Cover Letter:

- Keep the cover letter length to one page.

- Use a professional and well-structured format, using bullets or paragraphs to highlight key information.

- Use consistent font sizing and alignment throughout the letter.

- Proofread your letter carefully for spelling, grammar, and formatting errors.

Tips for Writing Your Actuary Cover Letter:

- Customize the cover letter to the specific job requirements and company information.

- Highlight your technical skills and expertise in statistical analysis, data modeling, and actuarial software.

- Emphasize your ability to work with complex data sets and analyze risks accurately.

- Showcase your experience in applying actuarial concepts and methodologies to solve real-world problems.

- Mention any certifications or professional memberships you hold, such as the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

- Provide evidence of your success in previous actuarial roles, such as cost savings, improved risk management, or accurate forecasting.

- Use industry-related keywords throughout the cover letter to demonstrate your familiarity with key concepts.

- Maintain a professional tone and language throughout the letter, while injecting your personality and enthusiasm.

- End the cover letter on a positive and hopeful note, expressing gratitude for the opportunity to apply.

How long should a cover letter be for an Actuary?

Ideally, an Actuary cover letter should be concise but impactful, usually not exceeding one page. Aim for 3-4 paragraphs that cover your key qualifications and leave the hiring manager eager to learn more about you. Remember to be specific, concise, and emphasize your most relevant experiences and accomplishments.

How do I write a cover letter for an Actuary with no experience?

If you are a recent graduate or have limited experience in the field of actuarial science, focus on transferable skills and demonstrate your passion for the industry. Here are a few tips to help you compose a cover letter without direct actuarial experience:

- Highlight transferable skills, such as strong analytical abilities, mathematical aptitude, attention to detail, and problem-solving skills.

- Emphasize your coursework or projects related to actuarial science, statistics, mathematics, or finance.

- Discuss any internships or part-time positions where you gained exposure to data analysis, risk assessment, or financial modeling.

- Showcase your ability to learn quickly and adapt to new concepts and methodologies.

- If possible, provide examples of personal qualities that make you well-suited for an actuarial role, such as being detail-oriented, meticulous, or a strong team player.

Remember, while experience is valuable, highlighting your skills, passion, and willingness to learn can be equally valuable when applying for an entry-level Actuary position.

Key Takeaways

A well-written and tailored cover letter is your opportunity to make a strong impression as an Actuary candidate. Remember the following:

- Customize the cover letter for each job application.

- Showcase your technical skills and expertise in actuarial science.

- Provide specific examples of accomplishments and experiences.

- Express your industry knowledge and passion.

In Conclusion

Writing an attention-grabbing and well-crafted cover letter as an Actuary can significantly increase your chances of securing an interview. Tailor your letter to portray your suitability for the role, highlight your skills and achievements, and demonstrate your passion for the field. By following the guidelines provided in this article, you’ll be equipped to create a standout cover letter that puts you a step ahead of the competition.

Now, put your skills into action and start crafting your tailor-made Actuary cover letter, tailored to the job and company you are applying to. Good luck!

Career Expert Tips:

- If you're stepping into the professional world, understanding the basics is crucial. Learn What is a cover letter and its role in the job application process.

- How to start a cover letter can be a challenging task. Get a comprehensive guide on how to kickstart your cover letter and make a strong first impression.

- Looking for inspiration to draft your own cover letter? Browse through these Cover letter examples to find a style that fits your profession.

- Why start from scratch? Use these Cover Letter Templates tailored for various professions to simplify your job application process.

- How long should a cover letter be : The length of a cover letter is vital in conveying your message concisely. Discover the optimal length to make sure your cover letter is not too short nor too long.

- Ensure that you know how to write a resume in a way that highlights your competencies.

- Check the expert curated popular good CV and resume examples

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Actuarial Intern Cover Letter Sample

Learn more about Actuarial Intern Cover Letter Example, Cover Letter Writing Tips, Cover Letter Formats and much more. Start editing this Actuarial Intern Cover Letter Sample with our Online Cover Letter Builder.

Actuarial Intern Cover Letter Templates

Hiring Managers expect information to appear in standard formats or close to it. Many companies and Job Portals use ATS (Applicant Tracking System), searches for keywords and don't recognize certain types of layouts, odd-shaped bullet points, columns, or creative fonts.

Why build with CV Owl?

ATS Compliant Templates

Templates designed in a way to pass any scanning test making sure your resume doesn't end up in the recruitment black hole.

AI Keyword Suggestion

Including keywords in your resume and cover letter increases your chances of landing a job interview. Get relevant keyword

Proof Reader

Typos and spelling errors on your resume can quickly undermine your chances of getting the job. Luckily, we’ve got it covered for you..

Achievements Highlighter

Listing achievements is what differentiates the top candidates from the rest. Our builder allows you to highlight your skills with solid-proofs in the resume itself.

Responsibilities Verification

Build trust in employers with verification of roles / responsibilities / accomplishments from your previous reporting managers.

Video Resume

Give yourself an edge with a video resume with studies finding that visuals are processed 60,000x faster than text.

Get Resume Score with our AI-powered Resume Checker

Get your resume scanned for free by our AI powered resume checker. Get a Resume score based on criterias recruiters & employers are looking for. Get actionables to optimize your resume, improve your score & land more interviews. The aim of our service is to help you maximize the impact of your CV, achieve your career goals and assist you create an interview winning resume.

Our Customers Love Us

“It was a pleasure to host CV Owl at our college campus for an interactive session on Resume building. The students benefited greatly as the company discussed the essential features of a CV, the main points to be covered herein, the difference between a CV and Resume and the importance of being aware of this difference while applying for jobs.”

“The Training and Development Centre of JMC in collaboration with CV Owl successfully conducted a workshop on CV & Resume Building. The students found the CV portal (designed free of cost for JMC students) to be exceptionally helpful both for creating the CV as well as reviewing it.”

Ridhima Gupta

“We sincerely thank CV Owl and Mr. Ankur for delivering such amazing and informative webinar for our students and gave us chance to improve our CV's. In all, the session remained instrumental in giving the aspirants a proper direction to work for their dream jobs and career goals.”

“We thank CV Owl for organising CV Building Webinar and CV clinics. The entire team worked exceptionally hard to review students resume within 48 hrs. The entire process was carried out in a very smooth manner and helped students to identify their mistake in their CVs.”

Table of Contents

Best Actuarial Intern Cover Letter

What is the Actuarial Intern cover letter?

Why do Actuarial Intern cover letters matter?

- Structure of the Product Manager cover letter

How to write a great Actuarial Intern cover letter?

Actuarial Intern Cover Letter Example Tips

Whenever a job seeker applies for a Actuarial Intern role in a new company, he/she must signal their value through multiple mediums. While the Actuarial Intern resume will be the most well-known part of the Actuarial Intern job application, but, do consider the Actuarial Intern cover letter equally important for landing a job. Writing a great Actuarial Intern cover letter plays an important role in your job search journey.

Many employers no longer ask for cover letters these days, whereas, many employers still ask for cover letters from job seekers. And if you are sending an email to the recruiting team to apply, your email itself acts as a cover letter.

An engaging Actuarial Intern cover letter can help you grab an employer's attention, which can lead to landing an interview for a job. Before creating a job-winning cover letter that really works for you, you need to know what content and format are to be used. Check out our perfect Actuarial Intern cover letter example and start creating one for you on our easy to use cover letter builder.

When writing a Actuarial Intern cover letter, always remember to refer to the requirements listed in the job description of the job you're applying for. Highlight your most relevant or exceptional qualifications to help employers see why you stand out from other candidates and are a perfect fit for the role.

CV Owl's Actuarial Intern cover letter example will guide you to write a cover letter that best highlights your experience and qualifications. If you're ready to apply for your next role, upload your document on CV Owl for a review service to make sure it doesn't land in the trash.

Here we will discuss what a cover letter is, how to write a cover letter, why it matters for your job search, and what its structure should look like.

Must Read: How to Write a Cover Letter & Cover Letter Writing Tips explained

A cover letter is a narrative about who you are and why the recruiter should invest time in evaluating you, rather investing in other candidates. You need to showcase that you're the right fit for that specific job opening. It's important to always remember that the role of the cover letter is to share a narrative which is completely different from a resume for your job application.

Whereas, the Actuarial Intern resume should highlight all your quantitative values where you need to prove your worth through concrete numbers. Your Actuarial Intern cover letter should be different from your resume where you need to demonstrate a story about yourself in a way that your resume will never be able to do so. Alternatively, students who study web development can ask for Python assignment help at AssignmentCore whose experts handle various projects in Python language.

Your resume acts as a demo video for employers, which includes quick hits and stats on why you are the best solution whereas your cover letter acts like a customer testimonial white paper. Make it sound like an in-depth discussion with a couple of concrete and impactful experiences that bring you to life as a human being.

Check out professional cover letter templates at CV Owl's cover letter directory and you can use those templates for free for creating your Actuarial Intern cover letter using our professional cover letter builder.

Must Read: How to Get Your Cover Letter Noticed by Employers

The cover letter is kind of a test for you. It tests to see whether you can craft a compelling narrative about yourself. By testing your cover letter writing abilities, the company is trying to assess whether or not you would be able to craft compelling narratives on behalf of that company in the future.

Many companies will let you optionally attach a cover letter along with your application. If you take this as a challenge for yourself and do so, it will showcase your firm commitment to the company, and allows you to tell a story about yourself as a leader and as a collaborator. A solid cover letter will leave a long-lasting impression in the recruiters mind and will help make you stand out from other candidates.